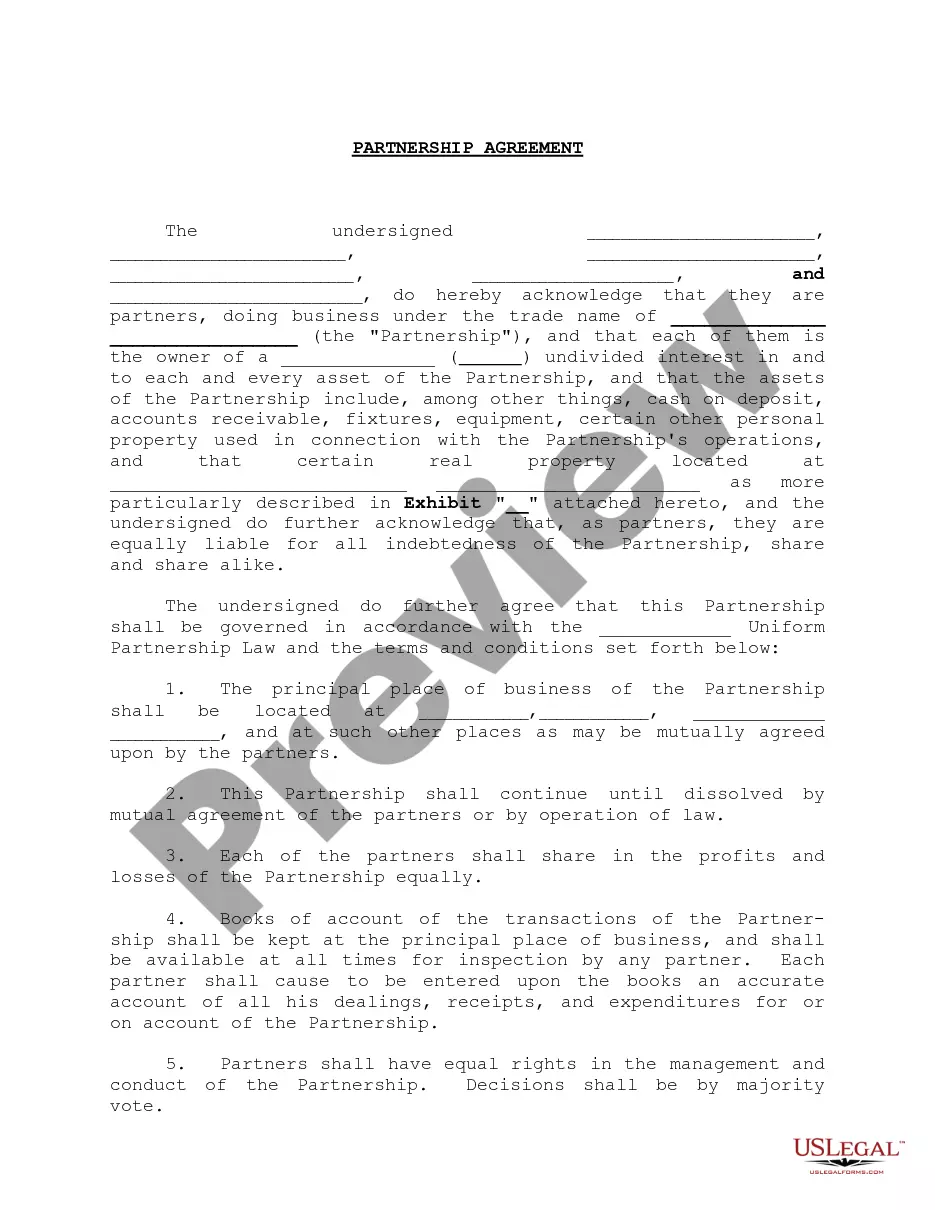

This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Business Personal Property Form 103 In Nevada

Description

Form popularity

FAQ

Ing to Nevada Revised Statutes, all property that is not defined or taxed as "real estate" or "real property" is considered to be "personal property." Taxable personal property includes manufactured homes, aircraft, and all property used in conjunction with a business.

How you file your business taxes with the IRS depends on your business's structure. Some structures, like corporations, must file their business taxes separately from their personal taxes. Other structures, like sole proprietorships, must report their business income on their personal taxes.

Business Personal Property Tax is a tax assessed on tangible personal property businesses own. This type of property includes equipment, furniture, computers, machinery, and inventory, among other items not permanently attached to a building or land.

The state of Georgia provides the following exemptions: All personal clothing and effects, household furniture, furnishings, equipment, appliances, and other personal property used within the home, if not held for sale, rental or other commercial use, shall be exempt from all ad valorem taxation.

File online at .nvsilverflume or return the completed form to the Secretary of State by fax to (775) 684-5725; by email to newfilings@sos.nv; or, by mail to 202 North Carson Street, Carson City, Nevada 89701-4201.

In order to close your sales tax permit in Nevada, you will need to complete the Nevada Sales/Use Tax Account Close Out Form.

Yes, you can cancel your DBA by filing a certificate of termination with the county clerk in the county/counties where you registered the name. Your certificate of termination will need to be notarized.

To close your Modified Business Tax (MBT), you must also contact the Employment Security Division (ESD) at (775) 684-6300 and provide the date of your last payroll to close your Unemployment Insurance (UI) account. Once your UI account is closed with ESD, your MBT account will be closed with the Department.

An MBT (Modified Business Tax) number is a unique identifier assigned to businesses in Nevada for the purpose of paying the Modified Business Tax. It is issued by the Nevada Department of Taxation. You'll receive your MBT account number with your “New Nevada Employer Welcome Package.”