Property Personal Sale With Power Of Attorney In Middlesex

Description

Form popularity

FAQ

Disadvantages of a Power of Attorney Potential for Misuse: The most significant risk associated with a POA is the potential for misuse by the appointed agent. Lack of Oversight: A POA grants considerable control to the agent without requiring oversight or approval from third parties.

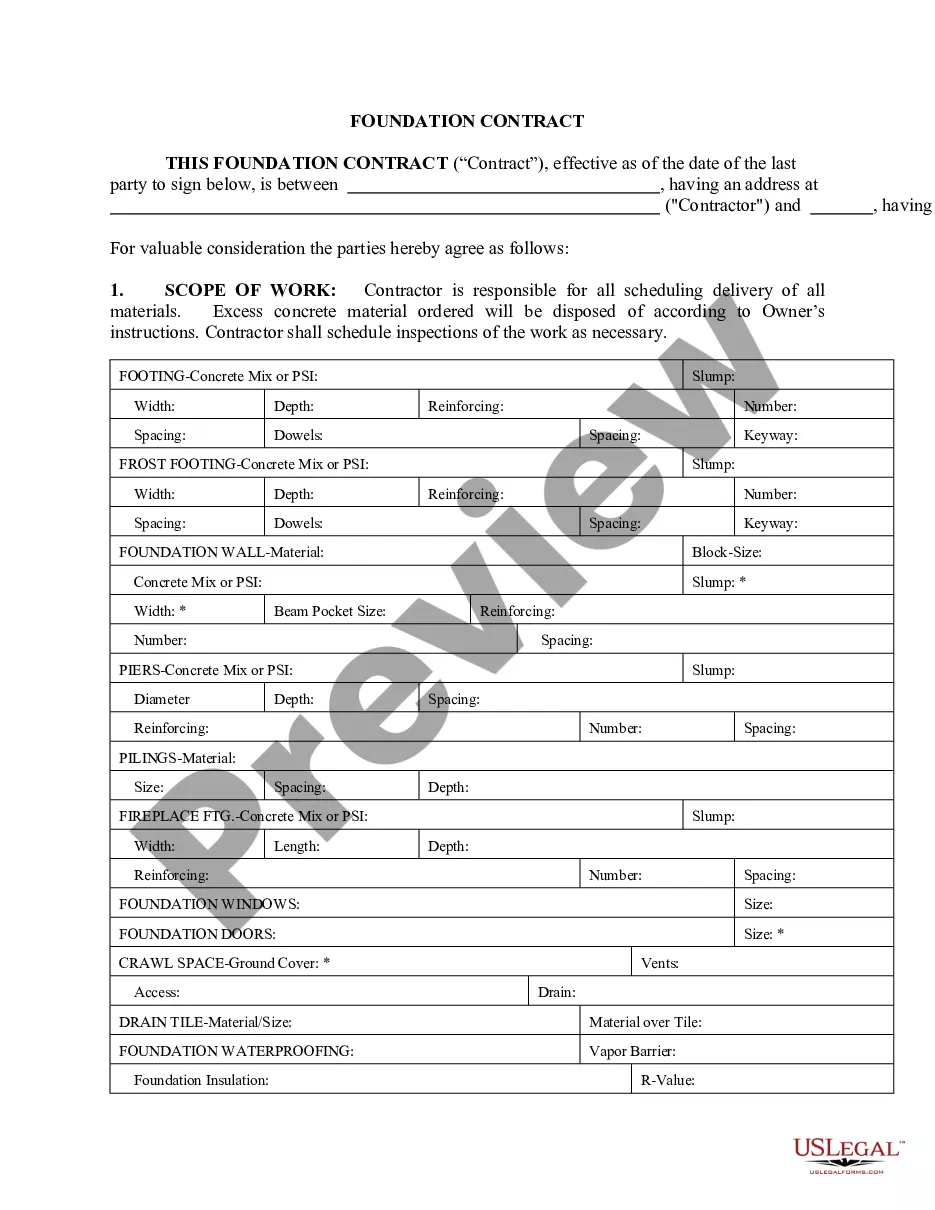

How to Write Step 1 – Begin With a Real Estate Power of Attorney Template. Step 2 – Enter the Parties' Names and Addresses. Step 3 – Add the Property Information. Step 4 – Identify the Successor Agent. Step 5 – Grant Powers and Authority. Step 6 – State Limitations on the Agent's Authority.

A power of attorney gives one or more persons the power to act on your behalf as your agent. The power may be limited to a particular activity, such as closing the sale of your home, or be general in its application. The power may give temporary or permanent authority to act on your behalf.

And a notary depending on the state's. Laws. If everything is in order the bank should accept theMoreAnd a notary depending on the state's. Laws. If everything is in order the bank should accept the document within the specified time frame.

Making financial and legal decisions on behalf of the principal. Hiring third-party professionals (such as lawyers and CPAs) to assist with power of attorney responsibilities. Litigating on the principal's behalf in court. Making safe investments of the principal's assets.

1. General Power of Attorney. A General Power of Attorney grants broad powers to an agent to conduct a variety of transactions. This capability becomes a critical tool in executing an estate plan or managing legal business and financial affairs.

What a power of attorney can't do Change a principal's will. Break their fiduciary duty to act in the principal's best interests. Make decisions on behalf of the principal after their death. (POA ends with the death of the principal. Change or transfer POA to someone else.

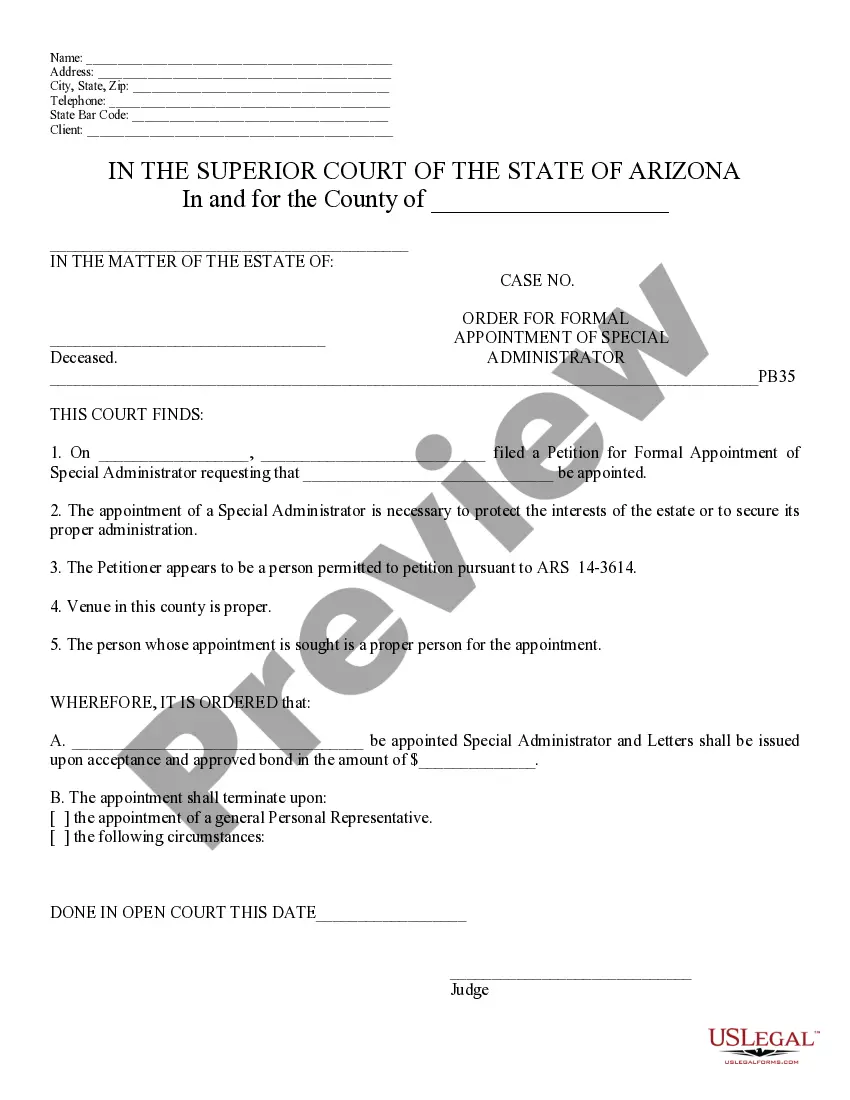

Steps for Making a Financial Power of Attorney in New Jersey Create the POA Using a Form, Software, or an Attorney. Sign the POA in the Presence of a Notary Public. Store the Original POA in a Safe Place. Give a Copy to Your Agent or Attorney-in-Fact. File a Copy With the County Clerk's Office.

In New Jersey, all power of attorney documents require that both the principal and the attorney-in-fact are competent and be of sound mind at the point at which they are executed. They must be signed in the presence of at least 2 witnesses and in the presence of a licensed Notary of the State of New Jersey.

Delegation of Authority Give a copy to your attorney-in-fact. Or, if your power of attorney won't be used right away, keep the form with your power of attorney document so your attorney-in-fact will have easy access to it later.