Personal Property Business Form For Central Government Employees In Middlesex

Description

Form popularity

FAQ

Massachusetts levies an excise on each vehicle at the rate of $25 per $1,000 of valuation.

The tax is calculated by multiplying the assessed value of the property by the personal property tax rate of the city or town. Personal property is assessed separately from real estate where it is located.

Massachusetts General Laws Chapter 59, Section 18 It is assessed tax separately from real estate, but is taxed at the same rate. The tax rate for Fiscal Year 2025 was set at $11.15 per thousand dollars of value. Personal Property is taxable in the municipality where it is situated on January 1st of that year.

Deductible personal property taxes are those based only on the value of personal property such as a boat or car. The tax must be charged to you on a yearly basis, even if it's collected more than once a year or less than once a year.

For tax year 2023, Massachusetts has a 5.0% tax on both earned (salaries, wages, tips, commissions) and unearned (interest, dividends, and capital gains) income. Certain capital gains are taxed at 8.5%.

No - business corporations are subject to personal property tax on ma- chinery used in the conduct of business, with some limited exceptions detailed below. Corporations are also subject to local taxation on poles, underground conduits, wires & pipes (generally owned by utilities or manufacturers).

Recent Trends in Tangible Personal Property Taxation State2006 Personal Property2017 Personal Property California 4.11% 5.20% Colorado 12.06% 6.90% Connecticut 6.09% 13.28% Florida 7.43% 7.00%29 more rows •

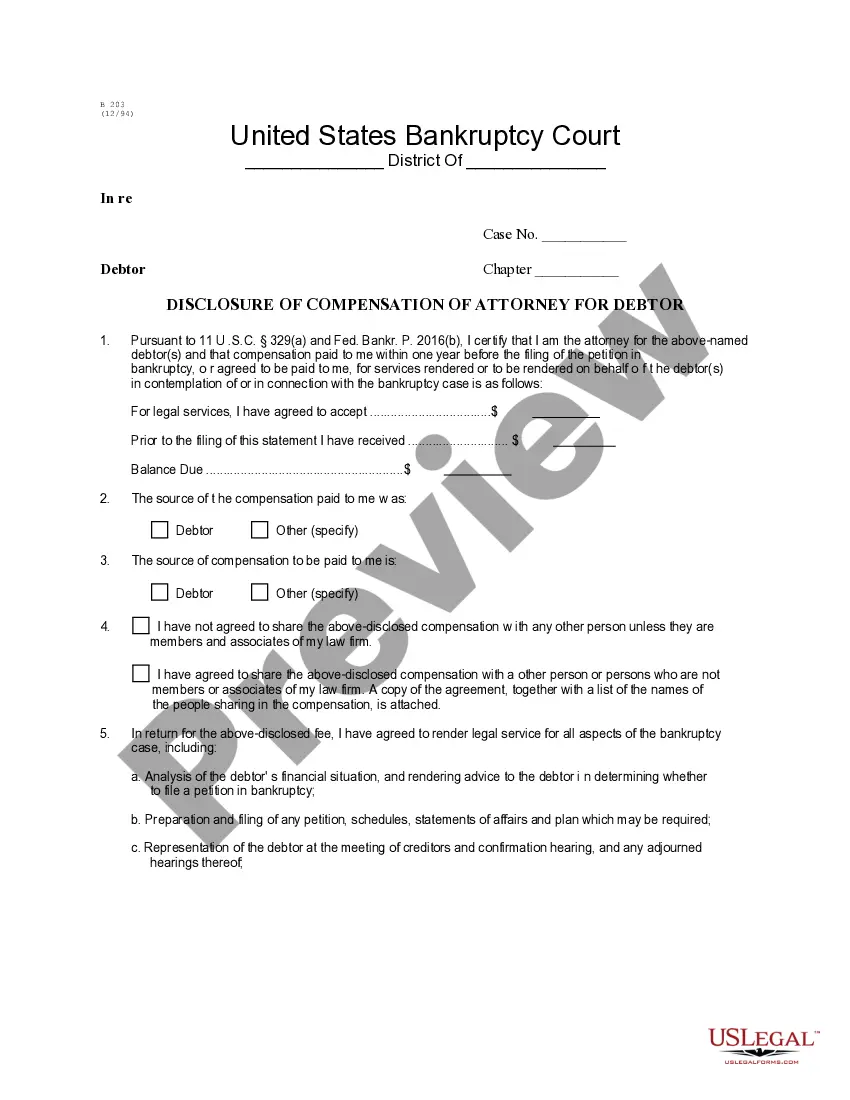

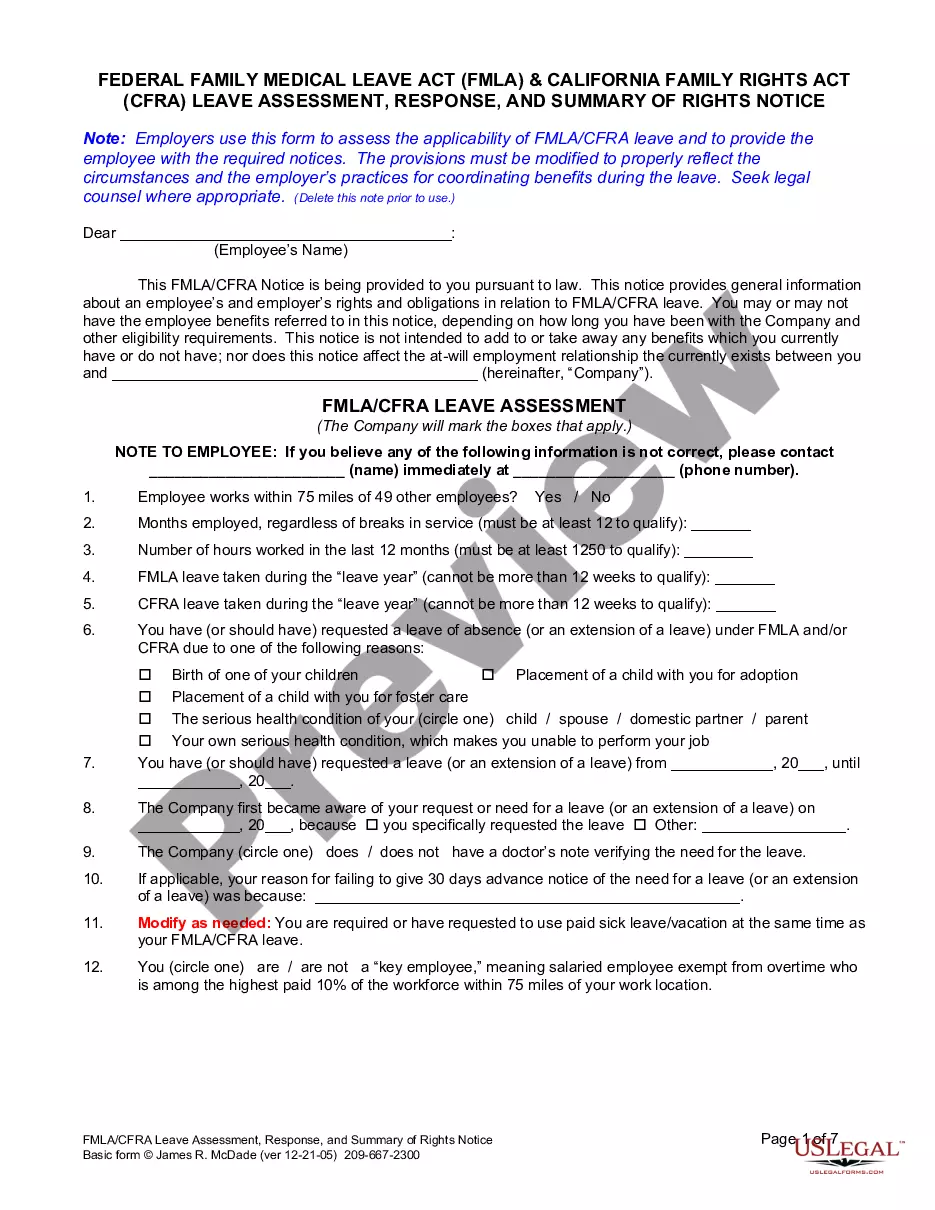

This Form of List (State Tax Form 2) must be filed each year by all individuals, partnerships, associations, trusts, corporations, limited liability companies and other legal entities that own or hold taxable personal property on January 1 unless required to file another local or central valuation personal property ...

Form ST-120, Resale Certificate, is a sales tax exemption certificate. This certificate is only for use by a purchaser who: A – is registered as a New York State sales tax vendor and has a valid. Certificate of Authority issued by the Tax Department and is making.