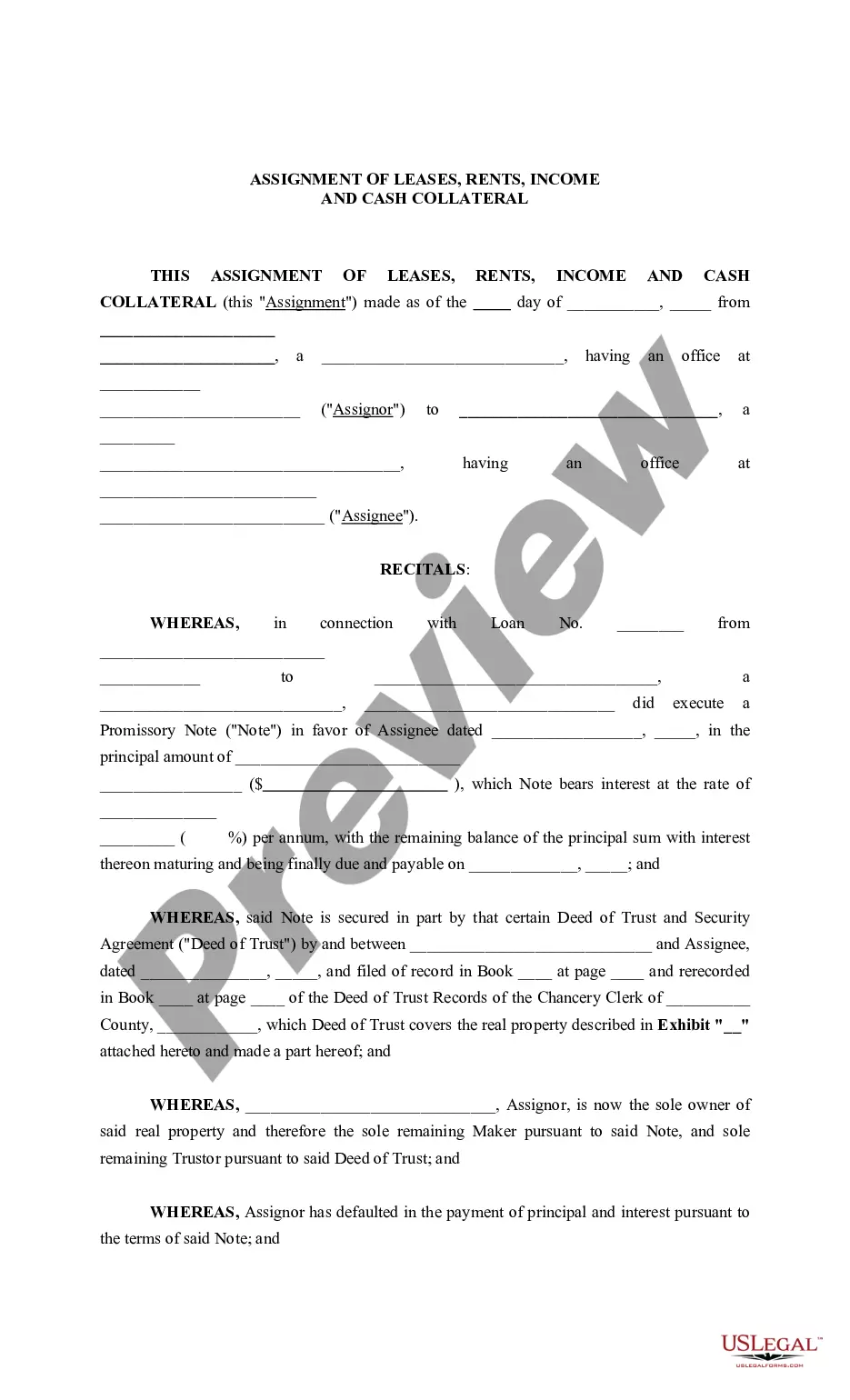

This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Personal Property Business Form For A Small Business In Houston

Description

Form popularity

FAQ

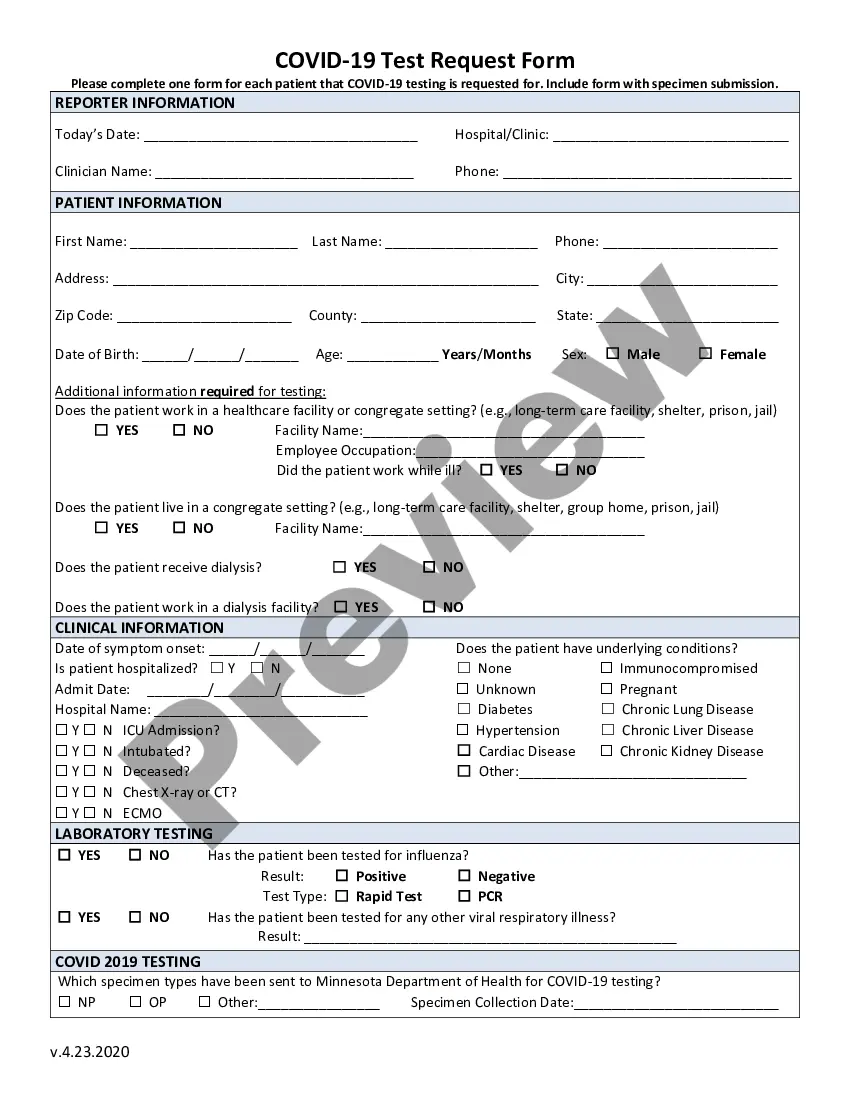

How to fill out the Business Personal Property Rendition Tax Form 50-144? Collect all necessary business and property details. Determine the market value of your property. Complete the required sections of the form. Review all information for accuracy. Submit the form to the appropriate appraisal district.

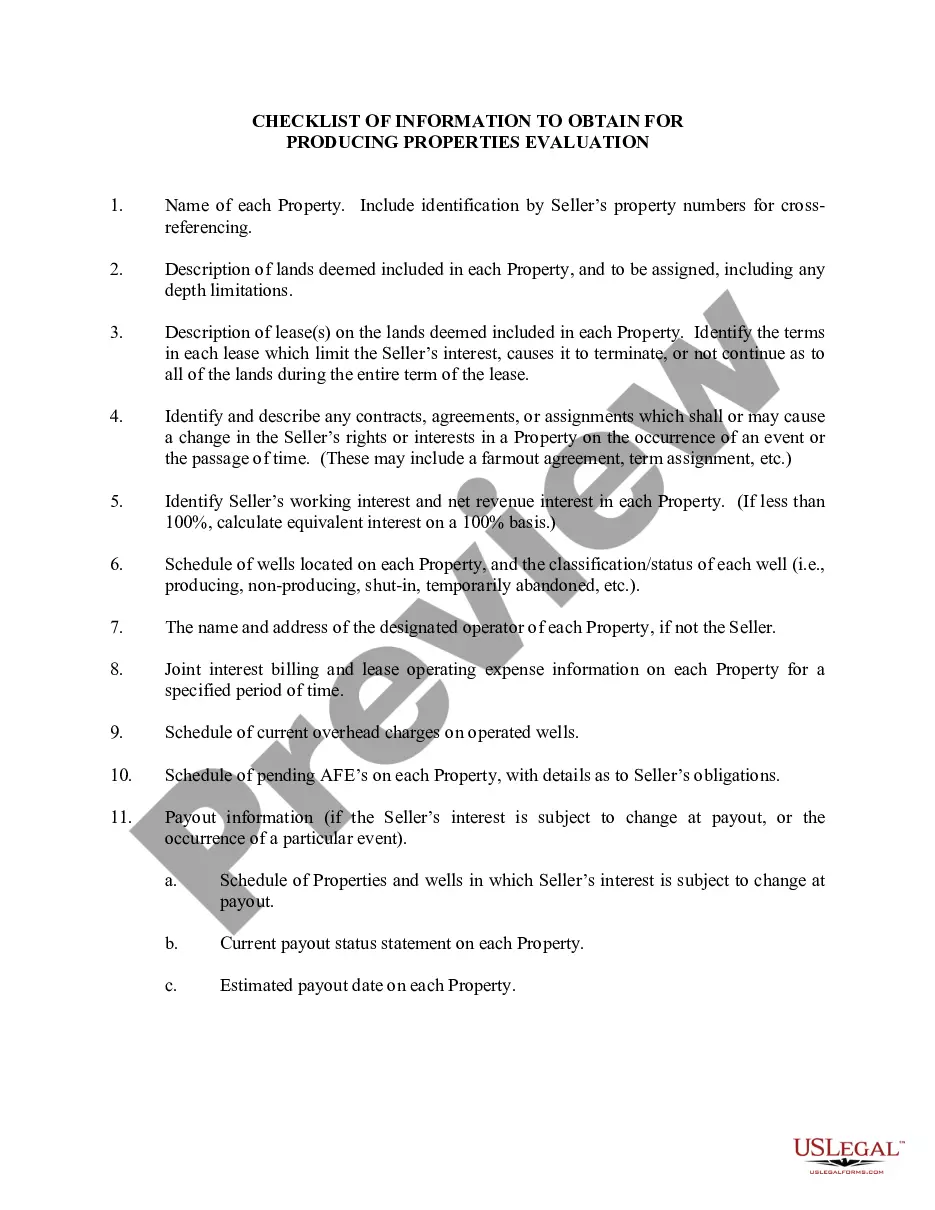

Business personal property accounts for 9.8 percent of the total market value of all property in the state, and 10.5 percent of all school taxable property in the state. exemption if they are in the state on a temporary basis.

Business owners are required by State law to render personal property that is used in a business or used to produce income. This property includes furniture and fixtures, equipment, machinery, computers, inventory held for sale or rental, raw materials, finished goods, and work in process.

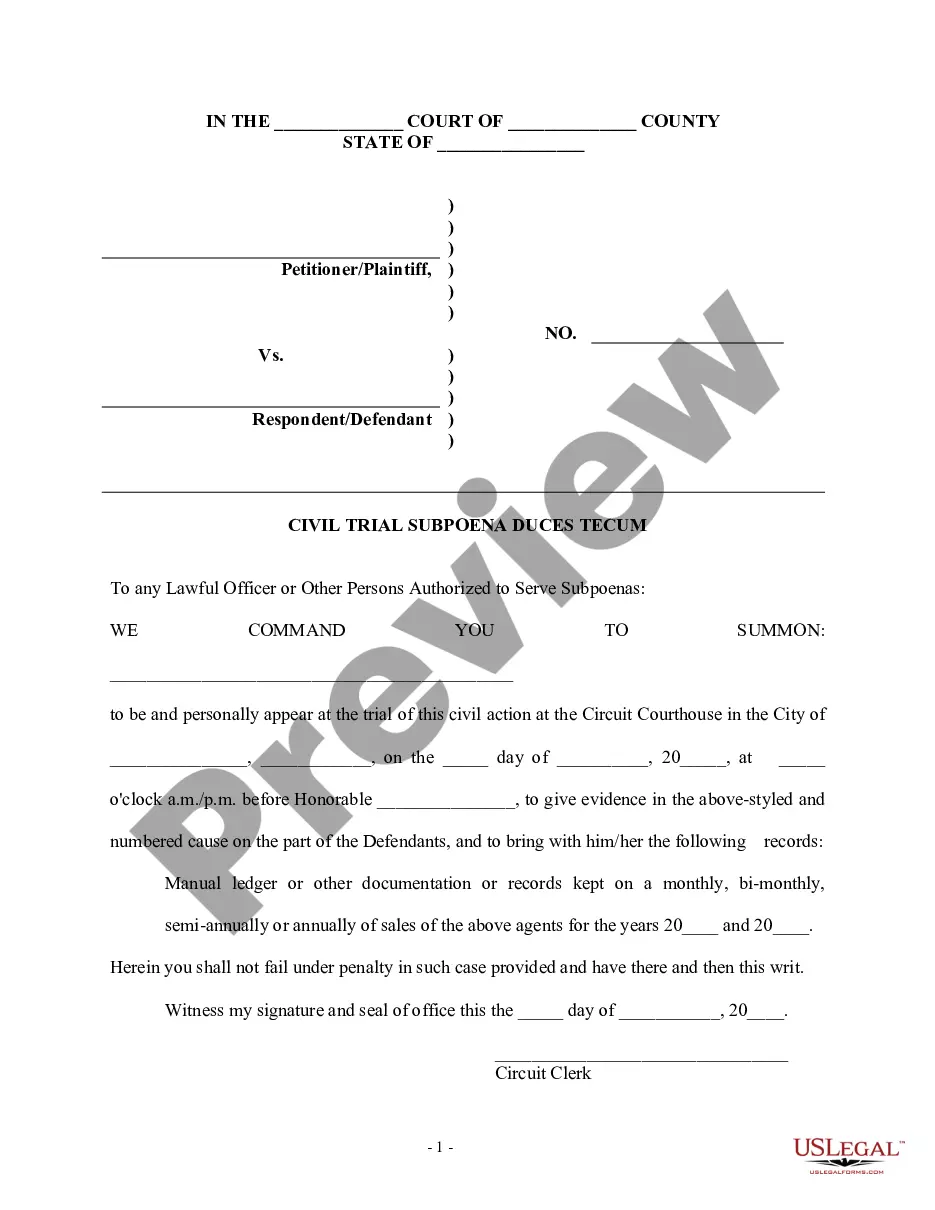

A personal property rendition is a report that lists all business assets (personal property) that are subject to personal property tax, which is typically all tangible personal property unless a specific exemption applies.

A rendition is a form that allows you to self-report your business personal property to the County Appraisal District. The County uses this information to help estimate the market value of your property for taxation purposes.

Business Personal Property Tax is a tax assessed on tangible personal property businesses own. This type of property includes equipment, furniture, computers, machinery, and inventory, among other items not permanently attached to a building or land.

You can write off property tax for your business. This turns a fact-of-life into a strategic deduction that lowers your overall taxable income. Commercial landlords, self-employed workers and small business owners who own property solely for commercial intent can qualify for this deduction.

Property taxes in Texas are the seventh-highest in the U.S., as the average effective property tax rate in the Lone Star State is 1.60%. Compare that to the national average, which currently stands at 0.99%. The typical Texas homeowner pays $3,797 annually in property taxes.

What is business personal property? Business personal property is all property owned or leased by a business except real property.