Bill Personal Property Form For Tax Purposes In Fulton

Description

Form popularity

FAQ

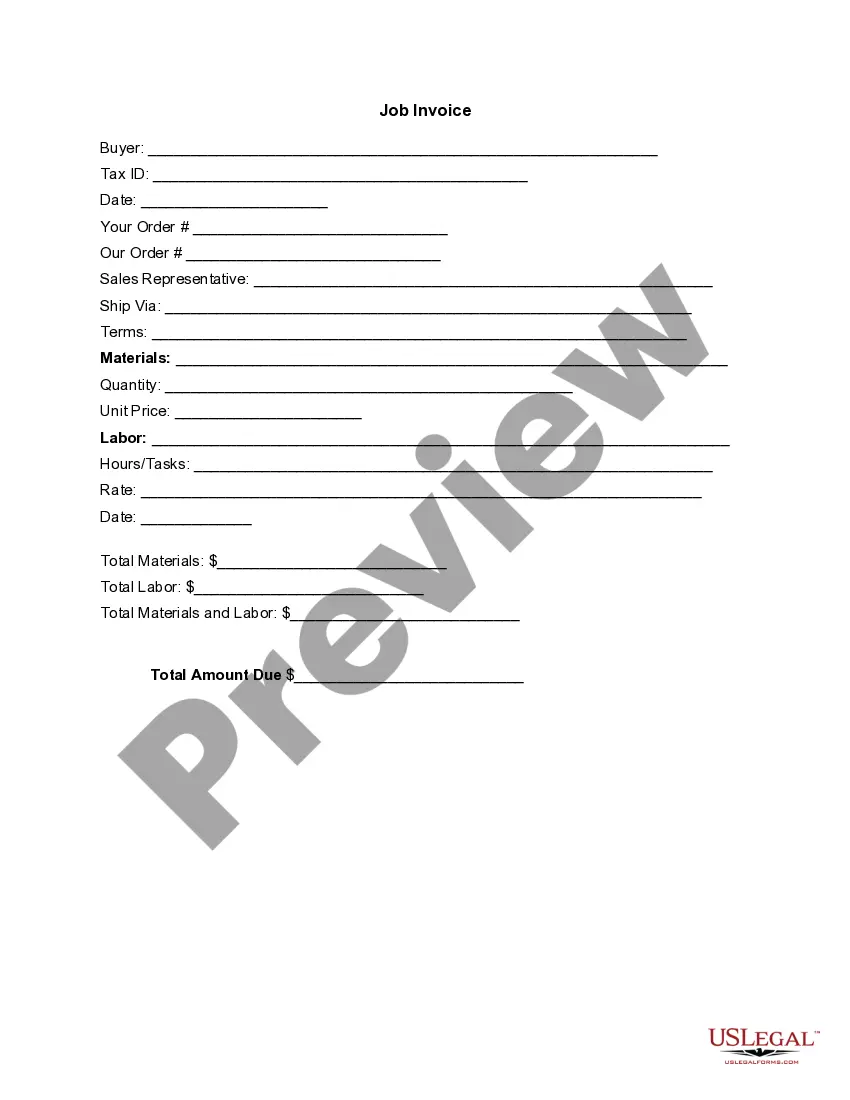

Where to Report Personal Property on Your Taxes. Claim the itemized deduction on Schedule A – State and local personal property taxes (Line 5c). Taxes you deduct elsewhere on your return — like for a home office or rental — don't qualify for this deduction.

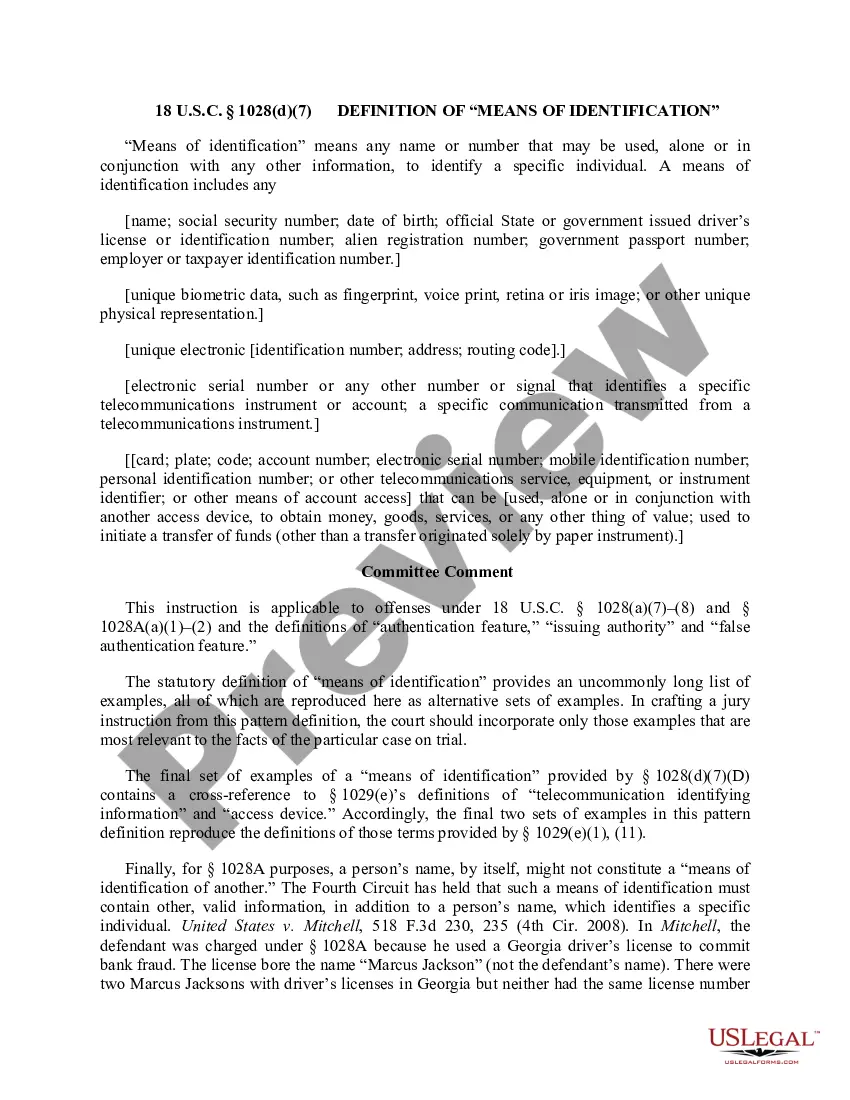

Recent Trends in Tangible Personal Property Taxation State2006 Personal Property2017 Personal Property California 4.11% 5.20% Colorado 12.06% 6.90% Connecticut 6.09% 13.28% Florida 7.43% 7.00%29 more rows •

You must be 65 years old or older. You must be living in the home to which the exemption applies on January 1 of the year for which the exemption applies. Your net income, or the combined net income of you and your spouse must not be greater than $10,000 for the preceding year.

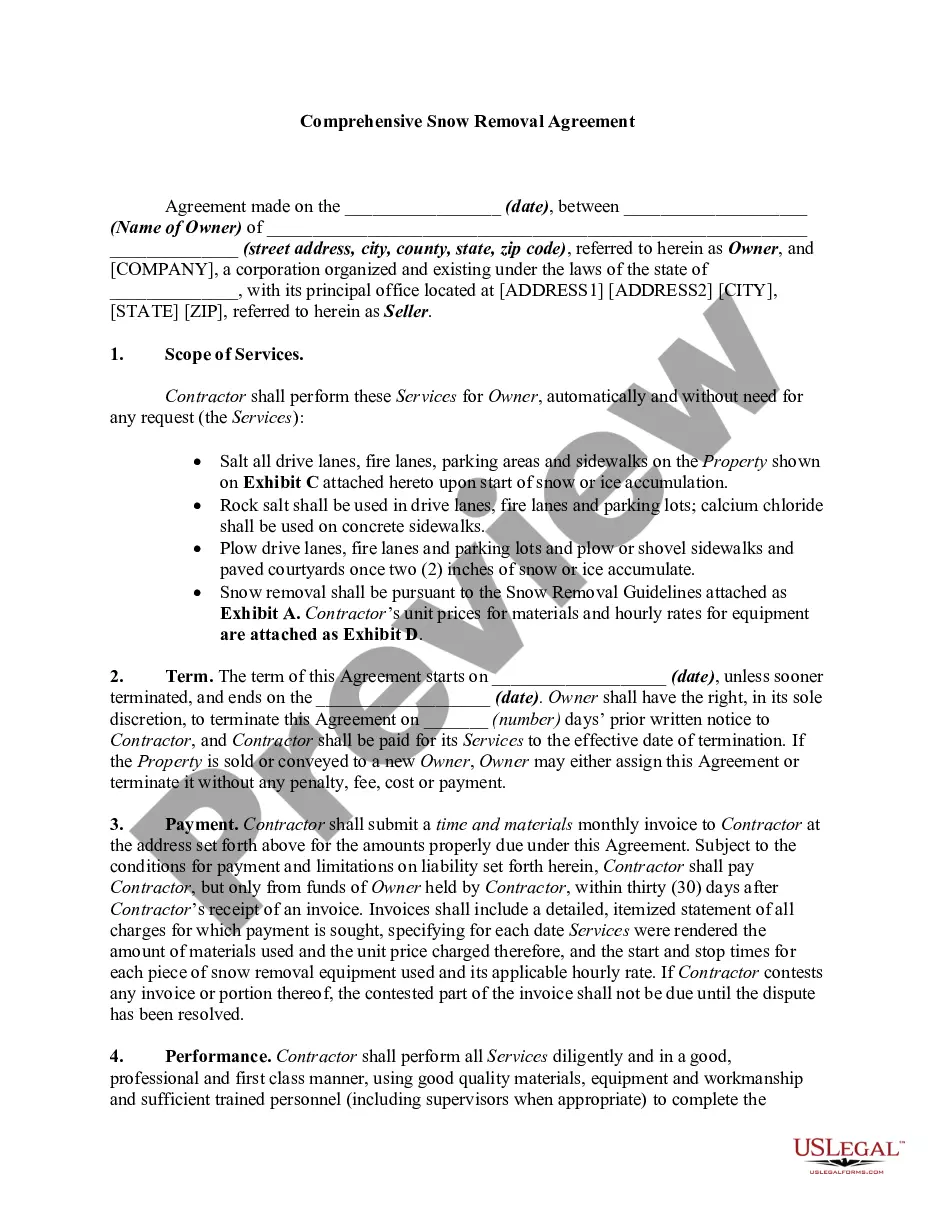

The property value is the full market value appraised by the Assessors. All property in Georgia is taxed at an assessment rate of 40% of its full market value. Exemptions, such as a homestead exemption, reduce the taxable value of your property. Let's say this homeowner qualifies for an exemption of $2,000.

Personal property is subject to taxation just as real property.

You can view your tax records in your Individual Online Account. This is the fastest, easiest way to: View, print or download your transcripts.

You must be 65 years old or older. You must be living in the home to which the exemption applies on January 1 of the year for which the exemption applies. Your net income, or the combined net income of you and your spouse must not be greater than $10,000 for the preceding year.

Can I get a copy of my property tax bill? You will need to contact the Tax Commissioner's office in the county where the property is located.