Personal Property Business Form Withholding In Collin

Description

Form popularity

FAQ

Tax Rates and Exemptions 2023 EntityExemptions OfferedOV65 Amount Collin College (JCN) DP, FR, GIT, HS, OV65 $100,000 Collin County (GCN) DP, FR, HS, OV65 $30,000 Collin County MUD #1 (WCCM1) DP, FR, GIT, OV65 $10,000 Collin County MUD #2 (WCCM2) FR, GIT $042 more rows

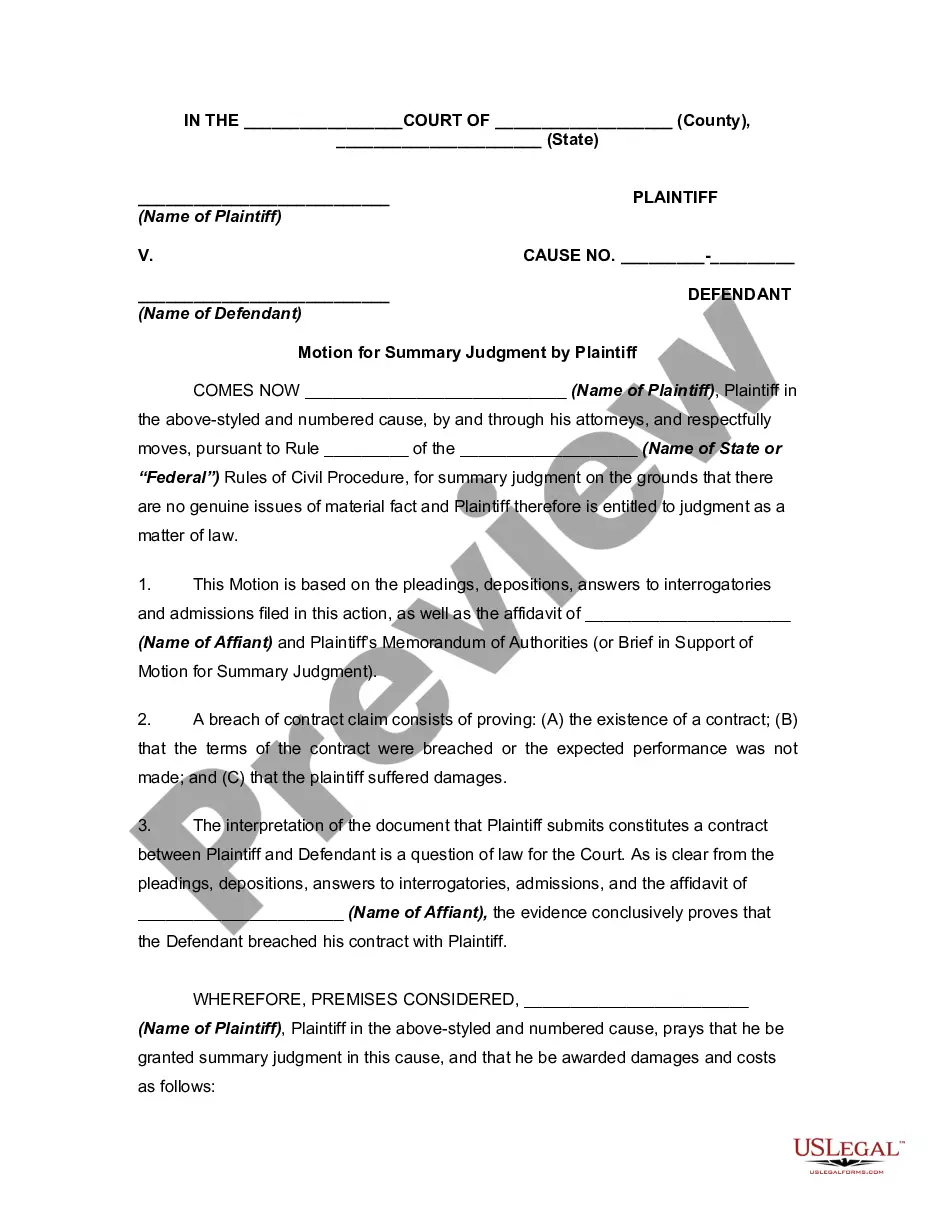

Total exemptions may be granted for public properties or those owned by qualifying organizations such as churches, schools, or charitable organizations. Homestead, over sixty-five, and disabled veterans exemptions are examples of partial exemptions, which reduce the taxable value on qualifying property.

You must own your home. To qualify for a general or disabled homestead exemption you must own your home on January 1. If you are 65 years of age or older you need not own your home on January 1. You will qualify for the over 65 exemption as soon as you turn 65, own the home and live in it as your principal residence.

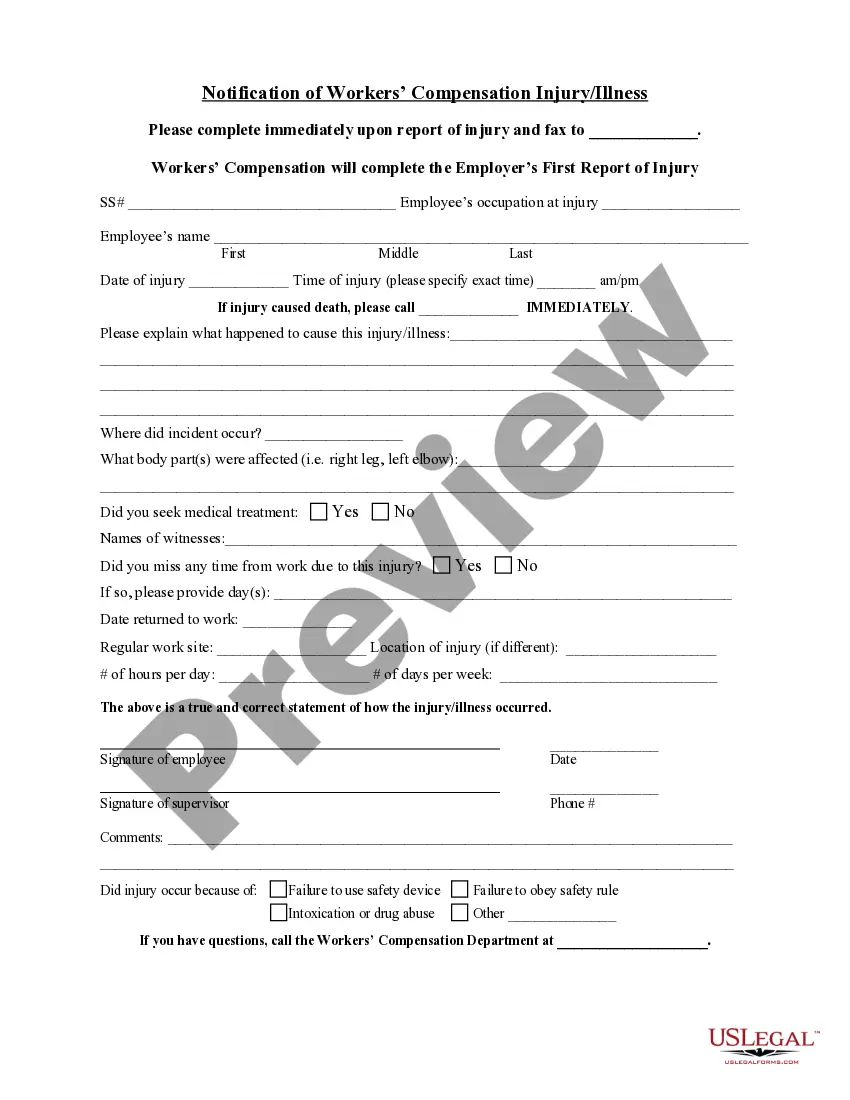

Business Personal Property Tax is a tax assessed on tangible personal property businesses own. This type of property includes equipment, furniture, computers, machinery, and inventory, among other items not permanently attached to a building or land.

Over 65 Homestead Exemption For residents 65 and older, your school district tax bill should never increase, even if their property values increase (excluding property improvements) as long as an approved Homestead and Over 65 Exemption application is on file with the Collin County Appraisal District.

Where to Report Personal Property on Your Taxes. Claim the itemized deduction on Schedule A – State and local personal property taxes (Line 5c). Taxes you deduct elsewhere on your return — like for a home office or rental — don't qualify for this deduction.

Ing to the Comptroller, there is no provision for the cessation of property taxes at any stage. However, there is a Texas property tax exemption for people over the age of 65, which offers temporary tax relief for seniors. At the age of 65, seniors can apply for an exemption from Texas property taxes.

Business Personal Property tax is an ad valorem tax on the tangible personal property that is used for the production of income. The State of Texas has jurisdiction to tax personal property if the property is: Located in the state for longer than a temporary period.

Business Personal Property Tax is a tax assessed on tangible personal property businesses own. This type of property includes equipment, furniture, computers, machinery, and inventory, among other items not permanently attached to a building or land.