Property Sell Out With Me Tonight In Clark

Description

Form popularity

FAQ

If you're planning on selling in the future 88% of agents say updated kitchens and appliances are lead selling points for buyers.

Reasons Why Your Home Isn't Selling. The real estate market is complex and numerous factors contribute to the saleability of a property. These reasons can include an overpriced listing, a slow market, necessary repairs, inadequate marketing, or even the lack of an experienced real estate agent.

Because demand for properties decreases at this time of the year, houses sell at lower prices, making December and January the worst months to sell a home.

Know the two hot spots The rooms buyers most closely inspect (and judge) in a house are the kitchen and master bath. These are the interior spaces where the most value can be added during a sale, so they need to look their best.

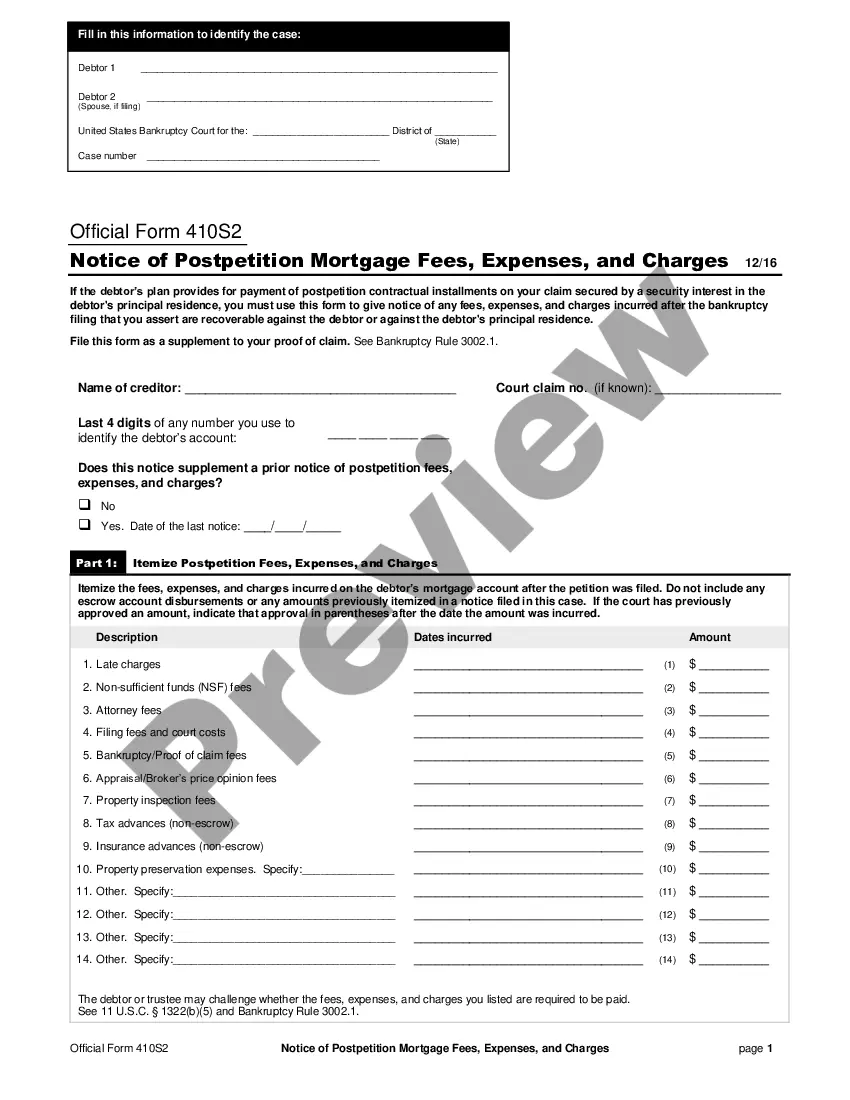

The Form 1099S is the reporting form adopted by the I.R.S. for submitting the seller's gross proceeds information required by law. The information is transferred onto magnetic media by the settlement agent who will make the required report to the I.R.S.

Clark County sales tax details The minimum combined 2025 sales tax rate for Clark County, Nevada is 8.38%. This is the total of state, county, and city sales tax rates. The Nevada sales tax rate is currently 4.6%. The Clark County sales tax rate is 3.78%.

Use Form 1099-S to report the sale or exchange of real estate.

The median property tax rate in Clark, NJ is 11.54%, significantly higher than both the national median of 0.99% and New Jersey's state median of 2.82%. With the median home value in Clark at $80,400, the typical annual property tax bill reaches $8,519, far exceeding the national median of $2,690.

Additionally, you must report the sale of the home if you can't exclude all of your capital gain from income. Use Schedule D (Form 1040), Capital Gains and Losses and Form 8949, Sales and Other Dispositions of Capital Assets when required to report the home sale.

If you sold a personal use asset for more than what you bought it for, then you would generally report that on the Stock or Investment Sale Information screen. You can report any selling expenses by reducing the amount you enter as "Sale Proceeds" by the amount of your selling expenses.