This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Personal Property Business Form Forsyth County In Clark

Description

Form popularity

FAQ

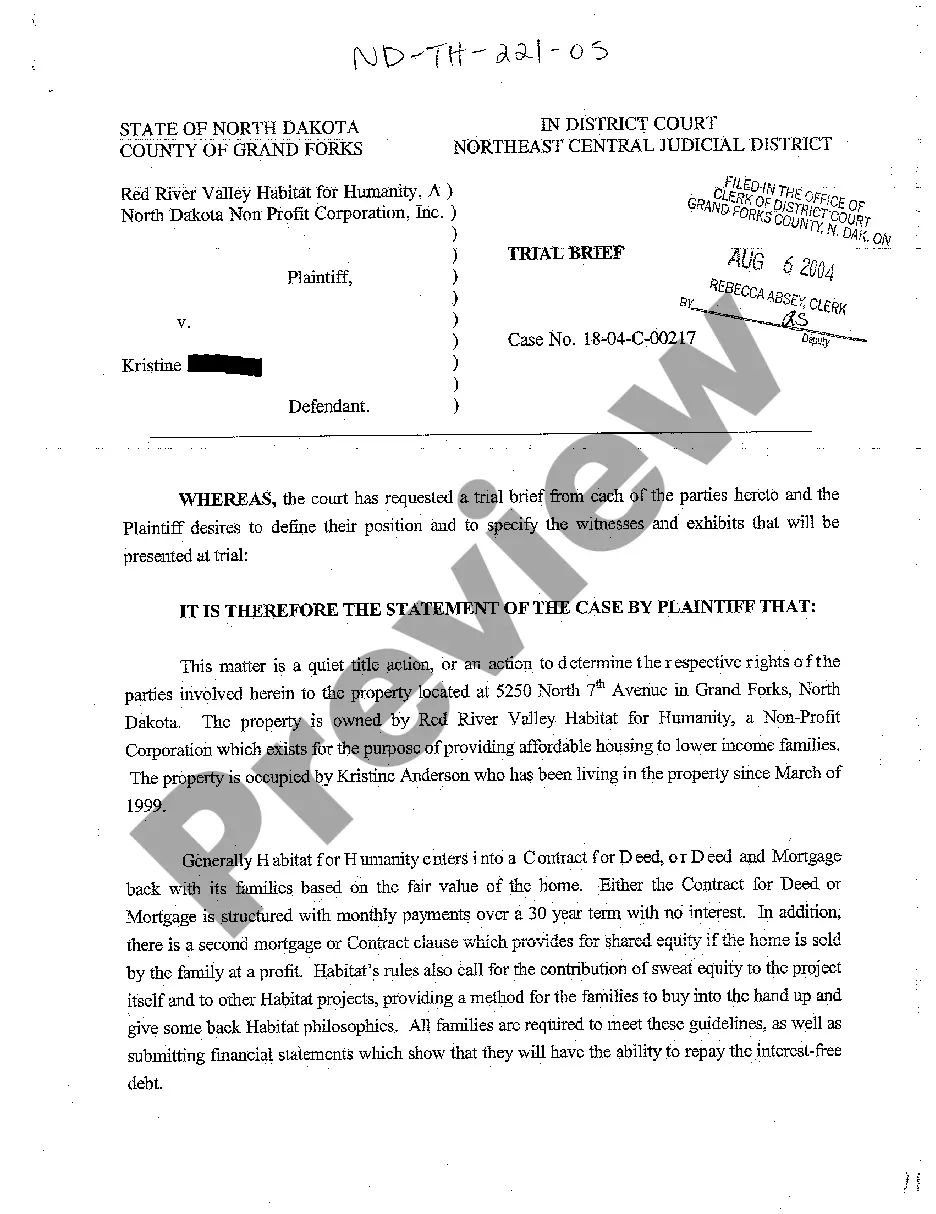

WHICH STATES DO NOT TAX BUSINESS PERSONAL PROPERTY? North Dakota. South Dakota. Ohio. Pennsylvania. New Jersey. New York. New Hampshire. Hawaii.

Any individual or business owning or possessing personal property used or connected with a business or other income producing purpose, is required to file a listing form with the Cumberland County Tax Office. Business personal property is tangible assets that are used in conjunction with a business.

A personal property tax is imposed by state or local governments on certain assets that can be touched and moved such as cars, livestock, or equipment. Personal property includes assets other than land or permanent structures such as buildings.

Business Personal Property Tax is a tax assessed on tangible personal property businesses own. This type of property includes equipment, furniture, computers, machinery, and inventory, among other items not permanently attached to a building or land.

What must be declared on the Personal Property Declaration? All personal property items used in the conduct of operating the business including items donated, given to you or owned prior to starting your business, unregistered motor vehicle(s), etc.