Form with which the secretary of a corporation notifies all necessary parties of the date, time, and place of the annual stockholder's meeting.

Annual Shareholder Meeting For In Pennsylvania

Description

Form popularity

FAQ

Companies Required to Hold an AGM A company must hold its AGM within a period of six months from the end of the financial year, i.e. within 30 September every year.

An AGM (Annual General Meeting) is a crucial event where shareholders review the company's progress and financial reports. Several important activities take place, including the presentation of the annual report, which details the company's performance over the financial year compared to the previous year.

In California, S-corporations are required to hold at least one annual meeting of shareholders. This frequency is designed to ensure ongoing communication between the corporation and its shareholders, allowing for regular updates on the company's performance and strategic direction.

(a) initially, no more than 18 months after the company's date of incorporation; and. (b) thereafter, once in every calendar year, but no more than 15 months after the date of the previous annual general meeting, or within an extended time allowed by the Companies Tribunal, on good cause shown.

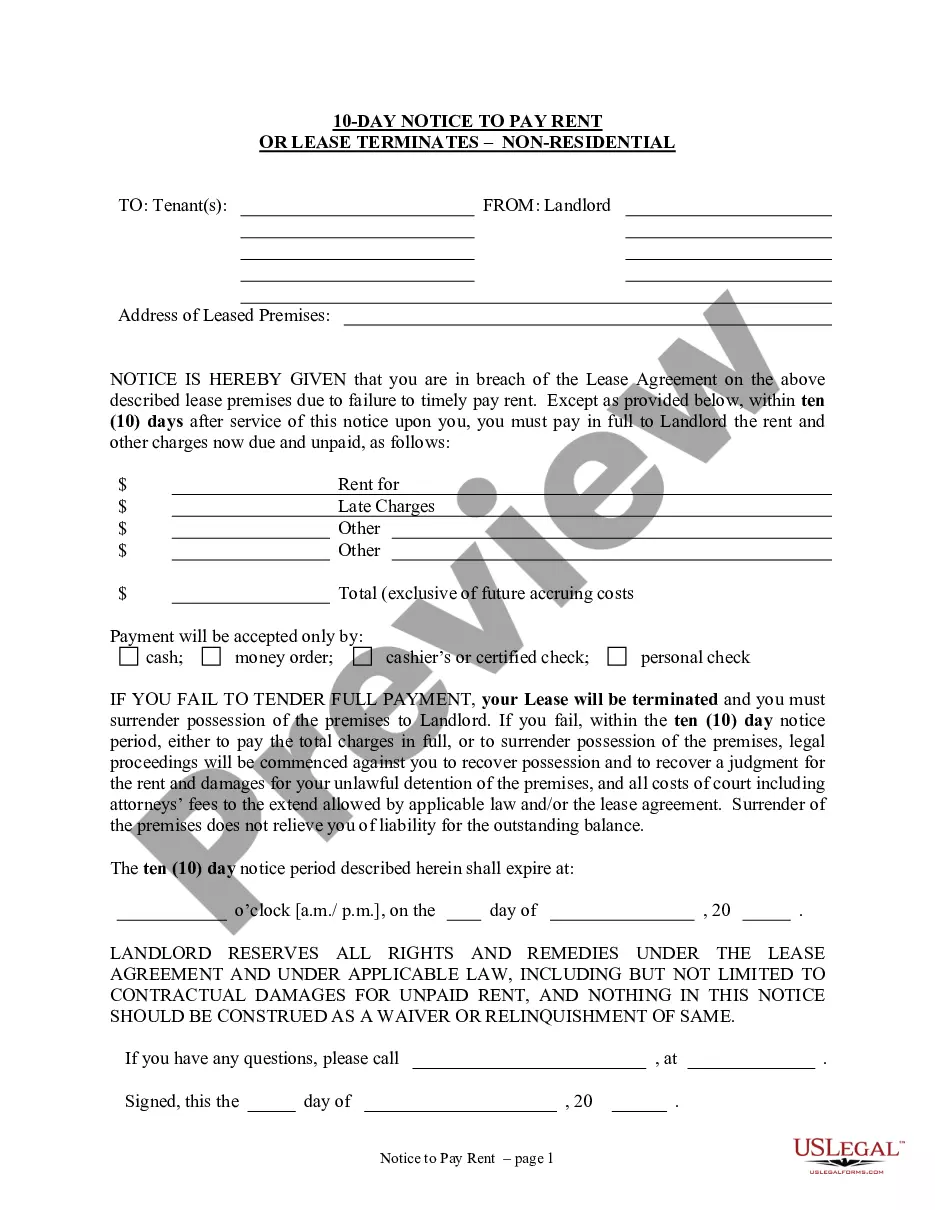

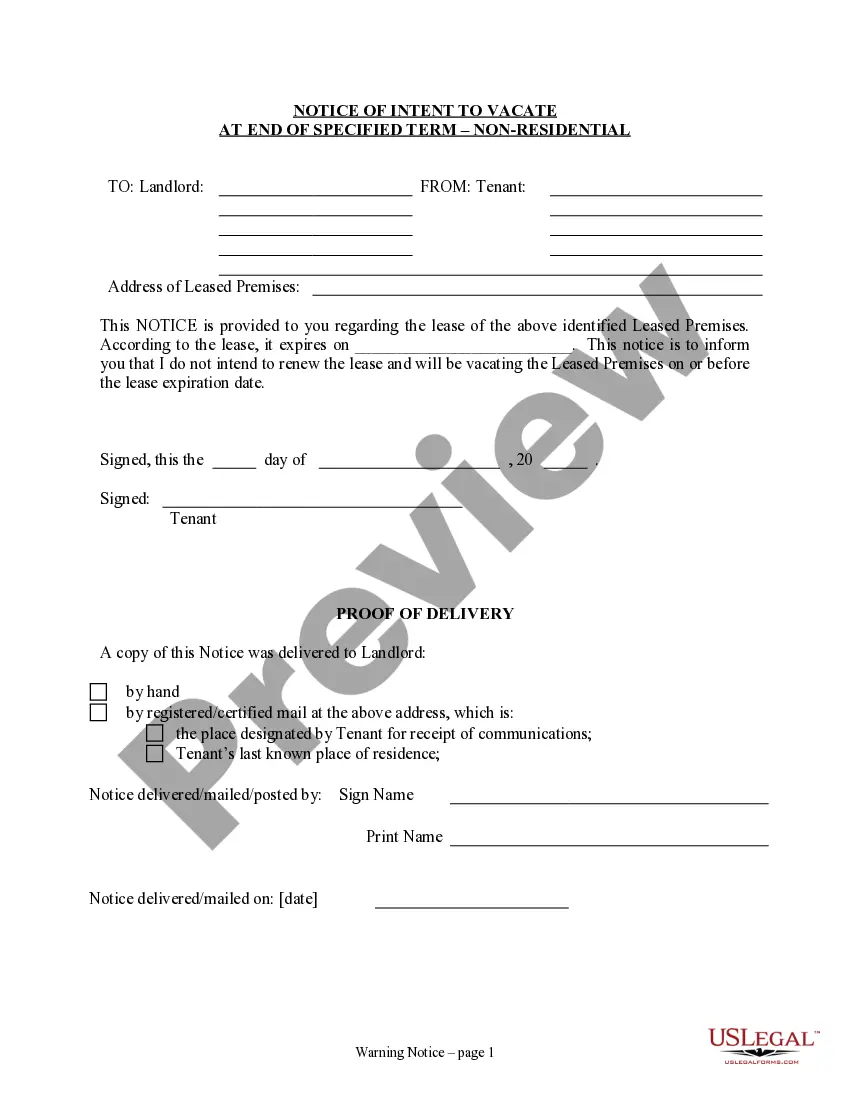

Shareholders must be given clear advance notice of the meeting's date, time, place, and agenda, typically within a state-specified timeframe. A corporation's bylaws or certificate of incorporation may allow the board, executives, or qualifying shareholders to call a special meeting.

An annual general meeting (AGM) is the yearly gathering of a company's interested shareholders. At an annual general meeting (AGM), directors of the company present the company's financial performance and shareholders vote on the issues at hand.

A shareholders' meeting is a required meeting held by the shareholders of a company to discuss the arrangements of the company or to vote in the election of board members.

Domestic or foreign limited liability companies will be required to file an annual report before on or before September 30, 2025; and. All other associations will be required to file an annual report on or before December 31, 2025.

Pennsylvania Business Owners: You must file an Annual Report starting in 2025. Know the requirements and deadlines. Beginning in 2025, most domestic and foreign filing associations are required to file an Annual Report DSCB:15-146.

Since the Pennsylvania Annual Report is a new requirement, the state is being lenient on LLCs for the 2025 and 2026 filing years. However, beginning in 2027, if you don't file your LLCs Annual Report within 6 months of the filing deadline, the state will administratively dissolve (shut down) your LLC.