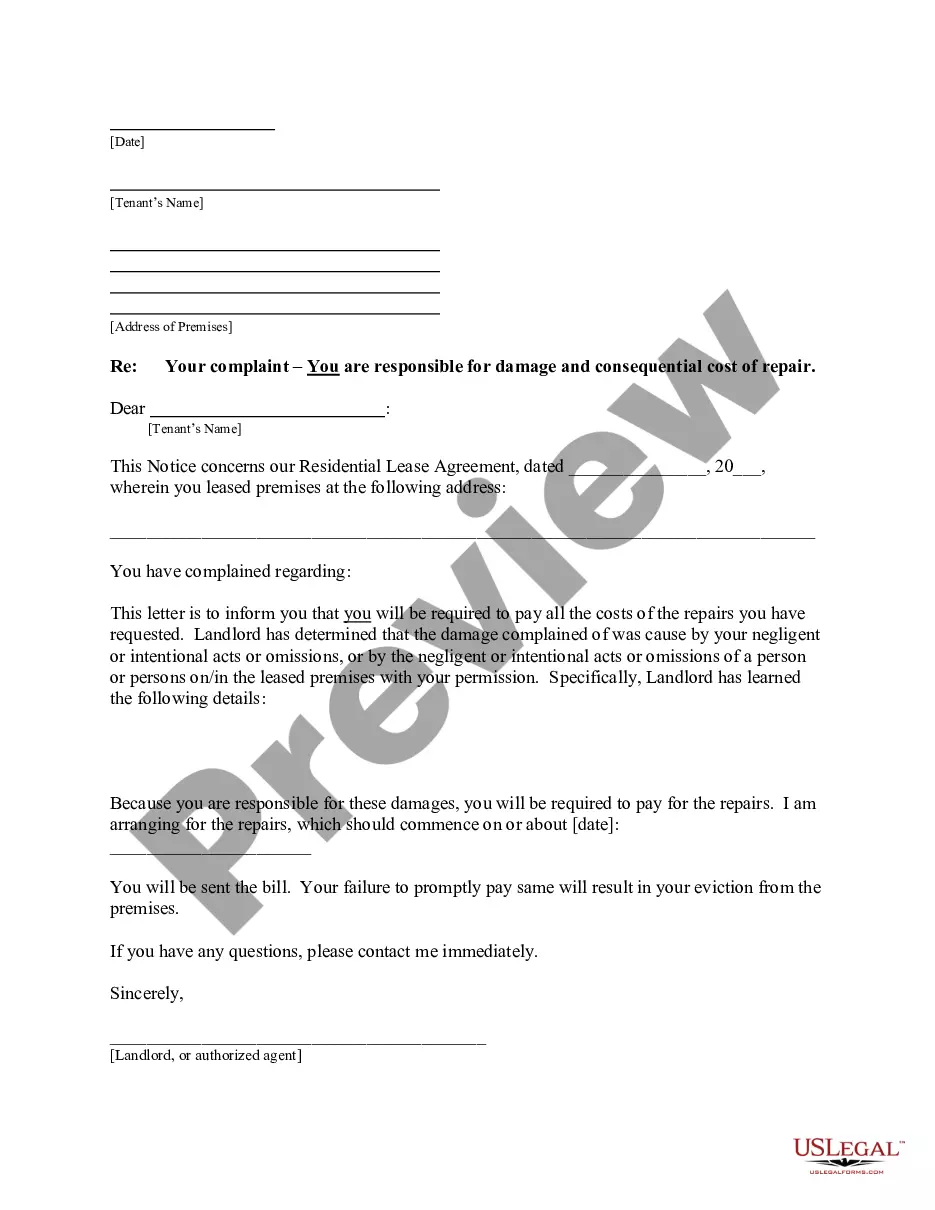

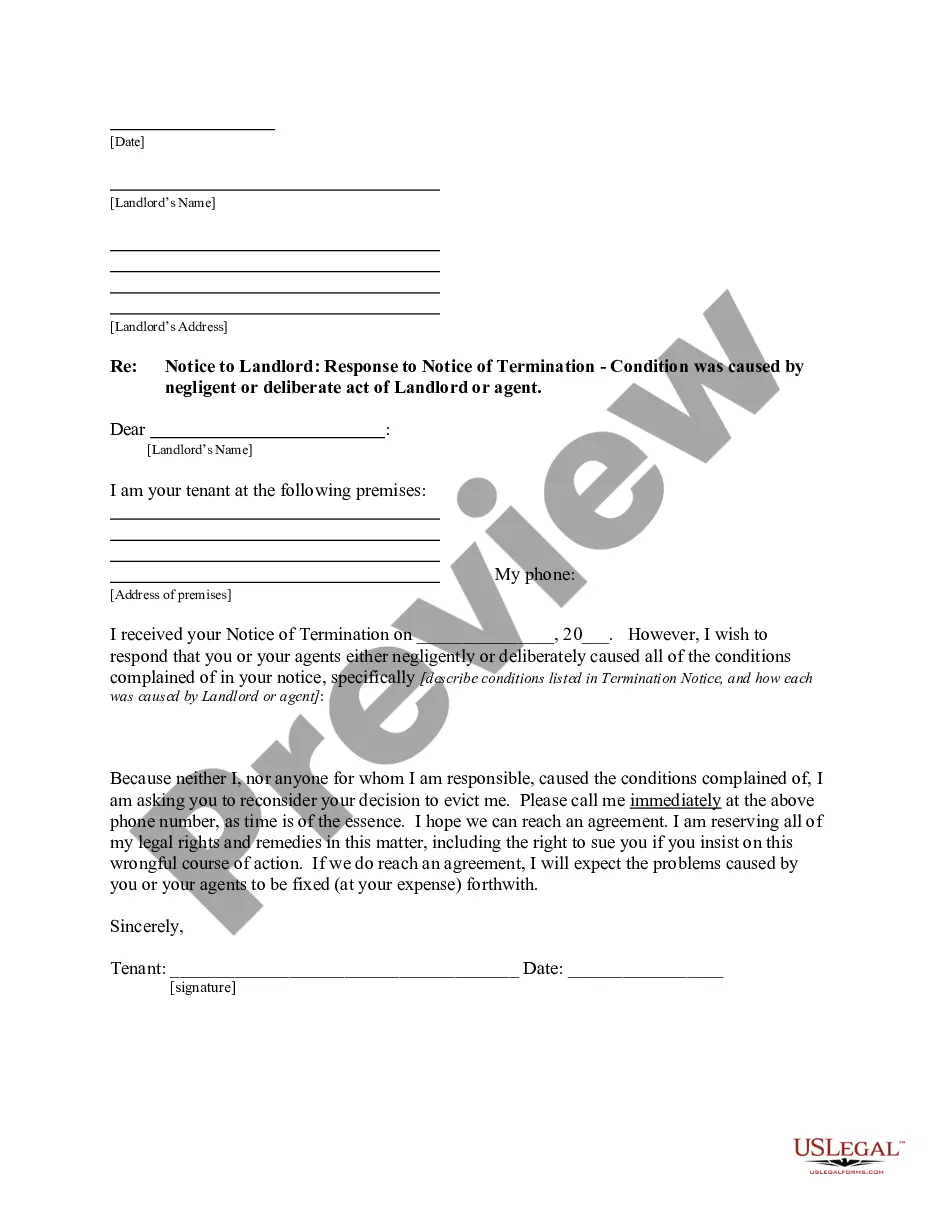

This form is a sample letter in Word format covering the subject matter of the title of the form.

Removal Request Letter For Non Profit In Hennepin

Description

Form popularity

FAQ

Ordinance #7 – Hazardous Waste Management establishes rules, regulations, and standards for hazardous waste management including the identification, labeling, and classification of hazardous waste; the handling, collection, transportation, and storage of hazardous waste; and the treatment, processing and disposal of ...

How to submit forms and documents and update your information Update information and upload documents to InfoKeep. Upload to MNbenefits. Fax to 612-288-2981. Mail to: Hennepin County Human Services Department. P.O. Box 107. Minneapolis, MN 55440.

Remove your homestead status Notify the county assessor within 30 days if you sell, move, or for any reason no longer qualify for homestead. Complete the notice-of-move form (PDF, 1MB).

In Minnesota there are two systems of public real estate records, Abstract and Torrens. Abstract – System of recording evidence of real estate title.

A deed is the instrument that transfers ownership of real property from one owner to another. It. contains the names of the current owner (the grantor) and the new owner (the grantee), the legal. description of the property, and is signed by the grantor.

You may come into the Recorder's Office and look at the official plat, order a copy online by entering the name of the plat instead of the document number, search for the property on LandShark GIS, search/download the plat using LandShark online searching, or contact the Public Works Department at 651-213-8700. 5.

To get title to the property after your death, the beneficiary must record the following documents in the county where the property is located: (1) an affidavit of identity and survivorship, (2) a certified death certificate, and (3) a clearance certificate (showing that the county will not seek reimbursement for ...

Top 7 Nonprofit Management Tips For Nonprofits Adaptability is Key. Focus on New and Younger Donors. Personalize Your Fundraising and Marketing Content. Revamp Your Tools. Diversify Your Leadership. Think About Your Employees. Focus on Your Mission.

The process typically involves passing a board resolution, notifying government agencies, settling debts, distributing assets, filing final tax returns, and canceling registrations. Specific steps may vary depending on local laws and the organization's structure. Do we need board approval to dissolve the nonprofit?

The IRS determination letter notifies a nonprofit organization that its application for federal tax exemption under Section 501(c)(3) has been approved. This is an exciting day for an emerging nonprofit! Having your IRS determination letter in hand affords your nonprofit organization several unique advantages.