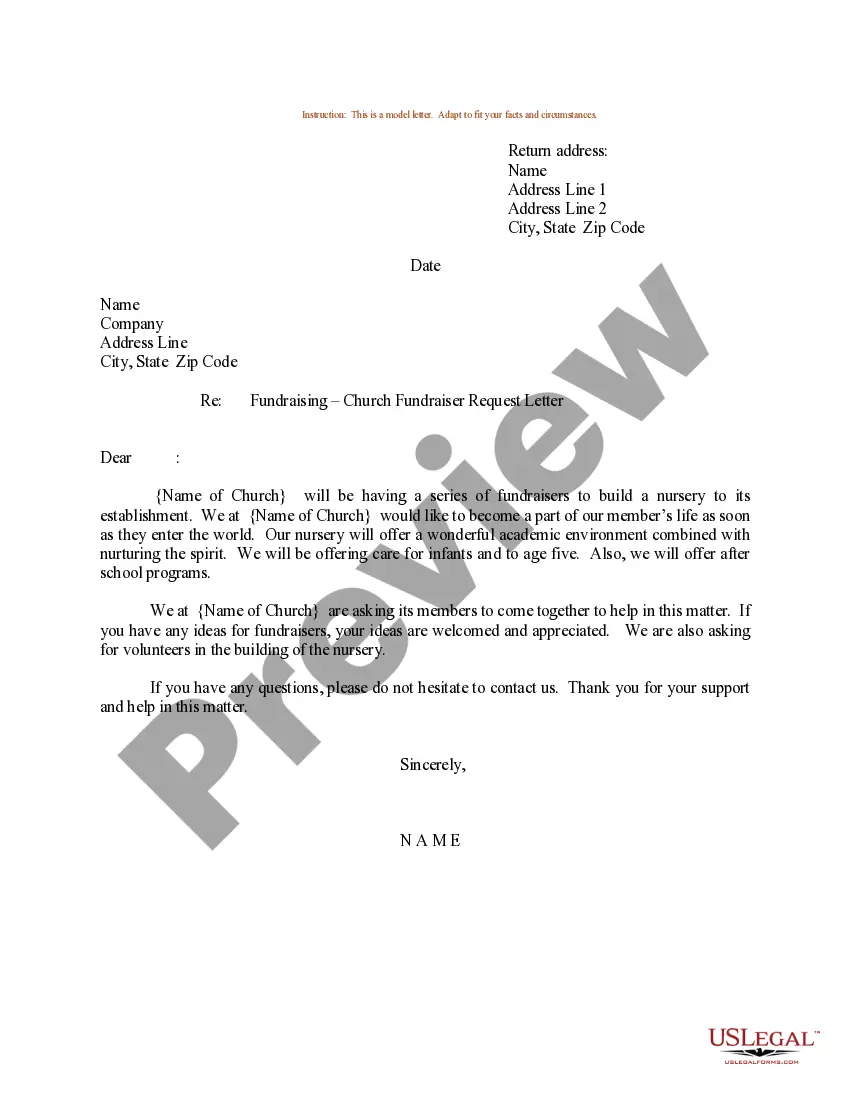

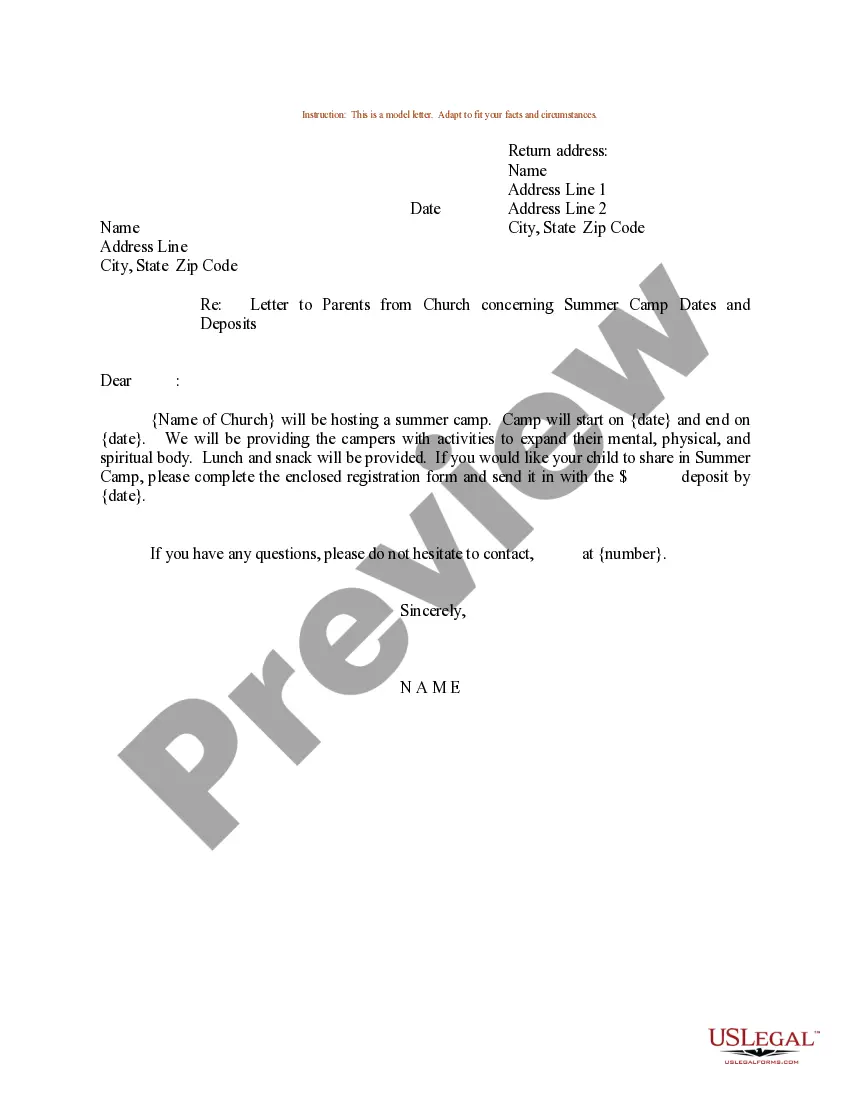

This form is a sample letter in Word format covering the subject matter of the title of the form.

Removal Request Letter For Certificate In Harris

Description

Form popularity

FAQ

Releases of Liens can be filed in person or by mail in the Real Property Department.

Send your request to: Harris County Tax Assessor-Collector & Voter Registrar - P.O. Box 4663 Houston, Texas 77210-4663 or by email to Voters@tax.hctx After you submit this completed form to the Harris County Tax Office, your voter registration record and/ or tax account statement will be removed from the website ...

If you have sold your property, or you own but no longer occupy the property as your primary residence, you can notify the appraisal district to update the ownership record or exemption status of the property. The forms are available at .hcad.

The best way to change Request to remove personal information from the harris county appraisal district website online Sign up and log in to your account. Add the Request to remove personal information from the harris county appraisal district website for redacting. Adjust your template. Complete redacting the template.

Homeowners granted a homestead exemption in the previous year will receive a renewal application in the mail. Complete and return this to the Appraisal District before April 30 to maintain your exemption.

Owners who are age 65 or older, are disabled or are a disabled veteran qualify to receive additional exemptions.

Contact the Harris County clerk's office to get the required form, or check out Texas Easy Lien online options. Once you've collected the information listed above, follow these steps: Fill out the form completely. Attach a copy of your contract, if relevant.

Releases of Liens can be filed in person or by mail in the Real Property Department. The nine annex offices can accept them for filing, however it may take 5 -7 business days to be filed based upon delivery of the work to the downtown office.