Movable Property Form In Railway In San Antonio

Description

Form popularity

FAQ

A personal property tax is imposed by state or local governments on certain assets that can be touched and moved such as cars, livestock, or equipment. Personal property includes assets other than land or permanent structures such as buildings.

Residence Homestead of 100% or totally Disabled Veterans: House Bill 3613 of 81st Texas Legislature authorized the creation of Section 11.131 of the Texas Property Tax Code. This newly created Section entitles a 100% exemption for a residence homestead of a qualifying Disabled Veteran.

Tax Code Section 11.35 allows a qualified property that is at least 15 percent damaged by a disaster in a governor-declared disaster area to receive a temporary exemption of a portion of the appraised value of the property.

Part of Senate Bill 1588 prevents HOAs from restricting homeowners from displaying religious items on their property or ordering residents to remove religious displays on their properties.

(a) An organization is entitled to an exemption from taxation of real property owned by the organization that the organization constructs or rehabilitates and uses to provide housing to individuals or families meeting the income eligibility requirements of this section.

For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Tax Code Section 11.13(d) allows any taxing unit to adopt a local option residence homestead exemption. This local option exemption cannot be less than $3,000.

11.001. PLACE OF RECORDING. (a) To be effectively recorded, an instrument relating to real property must be eligible for recording and must be recorded in the county in which a part of the property is located.

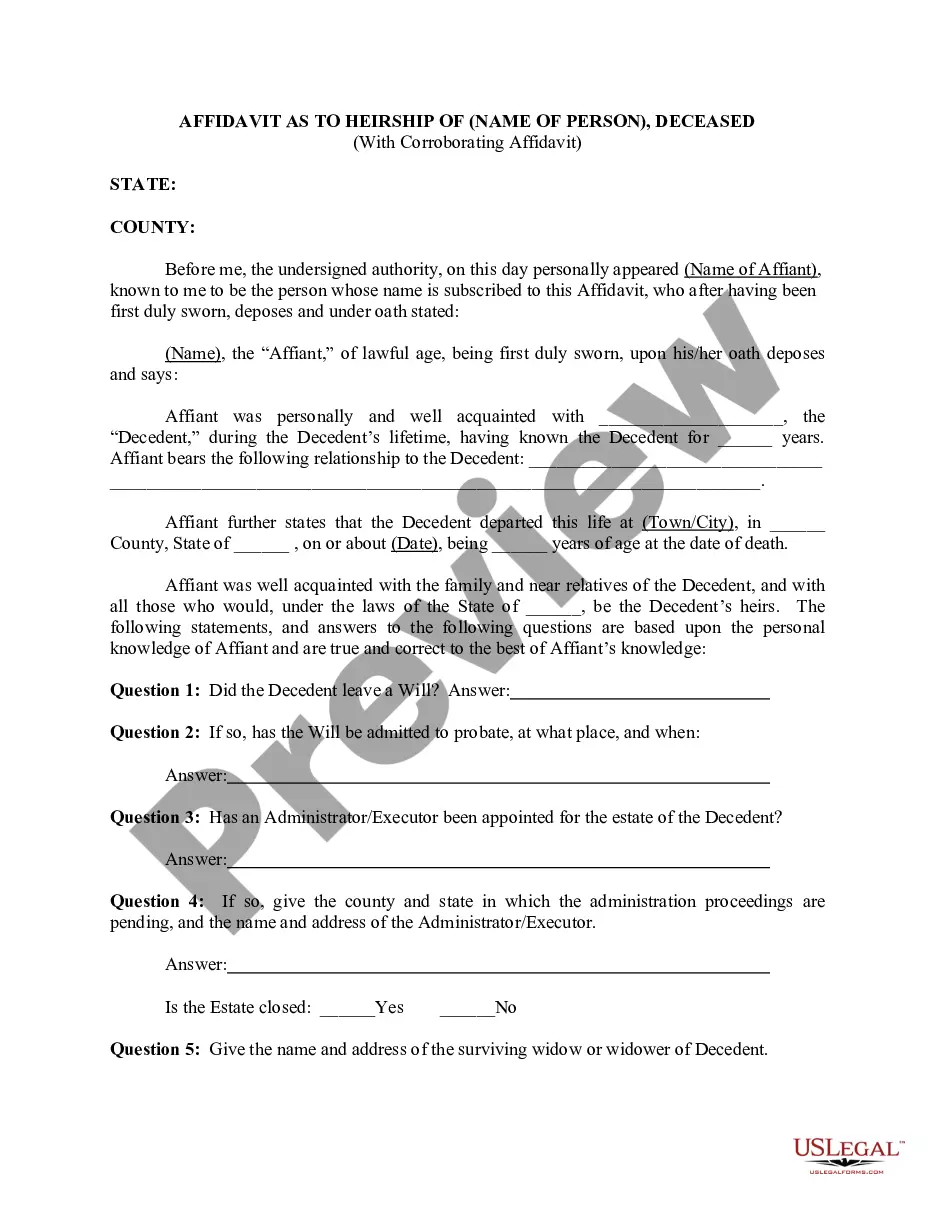

Who Must File? Individuals, corporations, partnerships, executors, administrators, guardians, receivers, and trustees that own or hold personal property in trust in the District of Columbia must file a DC personal property tax return.

This form is designed to report tangible personal property that is owned or managed for income production. Ensure you provide accurate information as required by law. Complete the necessary sections to submit your rendition for the current tax year.

Fill in the business start date, sales tax permit number, and check any boxes that apply. If sold, please fill in the New Owners name. If moved, please fill in the new location address. Please check the box with the value that describes the property owned and used by the business.