Private Property For Sale In Pima

Description

Form popularity

FAQ

The Pima County Assessor's Office created the Senior Property Valuation Protection program to help seniors save on property taxes. Homeowners can apply to the "Senior Freeze Program" in order to freeze the limited property value of their home for three years.

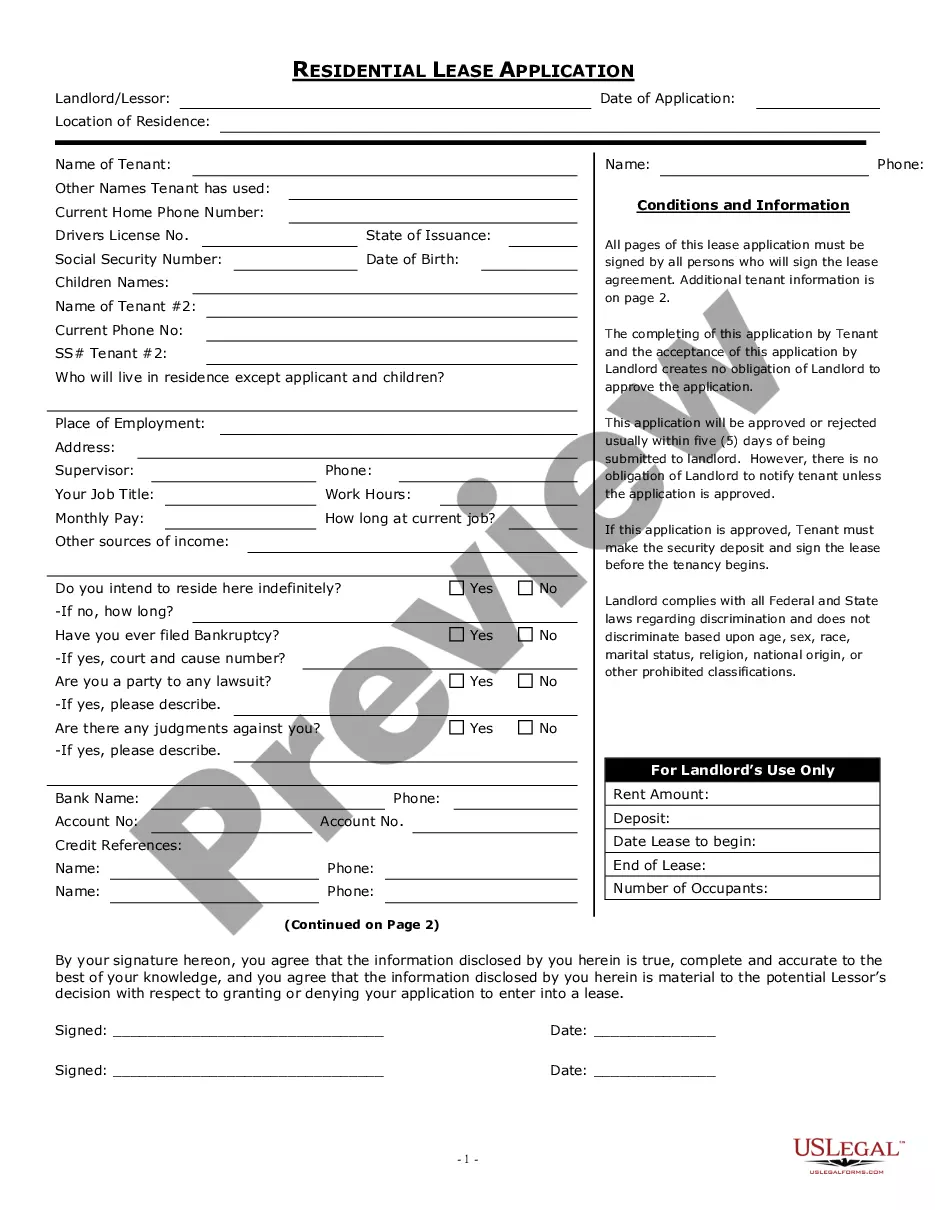

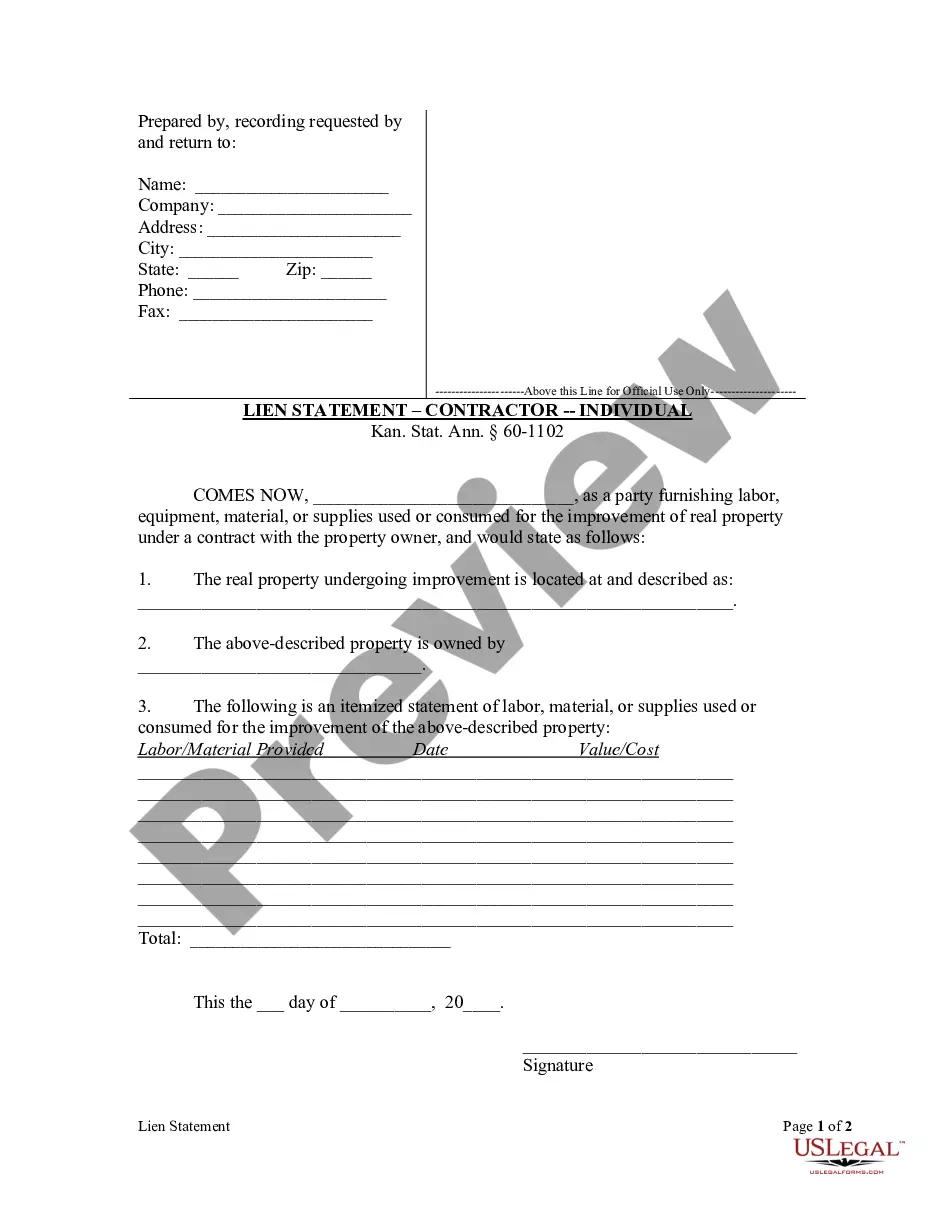

Each document must be an original or a copy of the original, and shall be sufficiently legible for recorder to make certified copies from the photographic or micrographic record. SIGNATURES: Each document must have original signatures or carbon copies of original signatures, except when otherwise provided by law.

Arizona allows a $4,476 Assessed Value property exemption to Arizona resident property owners qualifying as a widow/widower, or a person with total and permanent disability, or a veteran with a service or non-service connected disability.

As a senior in Arizona, you may be eligible for a Tax Freeze on the taxable market value of your home. This includes Phoenix's active adult communities, as well as, homes outside of those communities. The intent is to help low-income seniors. Let's explore Arizona senior homeowner's tax relief in more detail below.

As a senior citizen, you probably will end up paying property taxes for as long as you are a homeowner. However, depending on the state you live in and often once you hit your 60s (usually around the ages of 61 to 65), you may be eligible for a property tax exemption.

The average tax rate on a home in PIMA County will be approximately 1% of market value. Or 10% of “Assessed Value”. Tucson home Assessed Value will be about 10% of the market value.

Arizona law requires notarization for the deed to be valid. File with the County Recorder: Once notarized, the quitclaim deed must be filed with the county recorder's office where the property is located. This step is crucial as it makes the deed part of the public record and completes the transfer process.

Pima County sales tax details The minimum combined 2025 sales tax rate for Pima County, Arizona is 11.1%. This is the total of state, county, and city sales tax rates. The Arizona sales tax rate is currently 5.6%. The Pima County sales tax rate is 0.5%.