Personal Property In Purchase Contract In Philadelphia

Description

Form popularity

FAQ

Recent Trends in Tangible Personal Property Taxation State2006 Personal Property2017 Personal Property California 4.11% 5.20% Colorado 12.06% 6.90% Connecticut 6.09% 13.28% Florida 7.43% 7.00%29 more rows •

Major items exempt from the tax include food (not ready-to-eat); candy and gum; most clothing; textbooks; computer services; pharmaceutical drugs; sales for resale; and residential heating fuels such as oil, electricity, gas, coal and firewood.

Pennsylvania state taxes include income taxes, sales taxes, real and personal property taxes, an inheritance tax, and even an obsolete estate tax.

Common exemptions from Pennsylvania sales and use tax include: Groceries, Prescription medicines and medical supplies. Coal. Newspapers. Caskets, burial vaults, and grave markers. Many items used in farming or manufacturing, especially the Dairying, Mining, Printing, Timbering, and Processing industries.

While there is no state in the U.S. that doesn't have property taxes on real estate, some have much lower property tax rates than others. Here's how property taxes are calculated. The effective property tax rate is used to determine the places with the lowest and highest property taxes in the nation.

The attachment method is the most important in determining the two. If the object has formed part of the home and has been used by the initial tenants, then it is considered a fixture and not personal property, for example, built-in electronics like a microwave or a fan.

If you're using a real estate agent: Interview agents until you find the one you want to use. Find a property. Consult with the agent on what to offer and what terms to request. The agent submits the contract. If the other party/parties sign the contract, you've now put the property under contract.

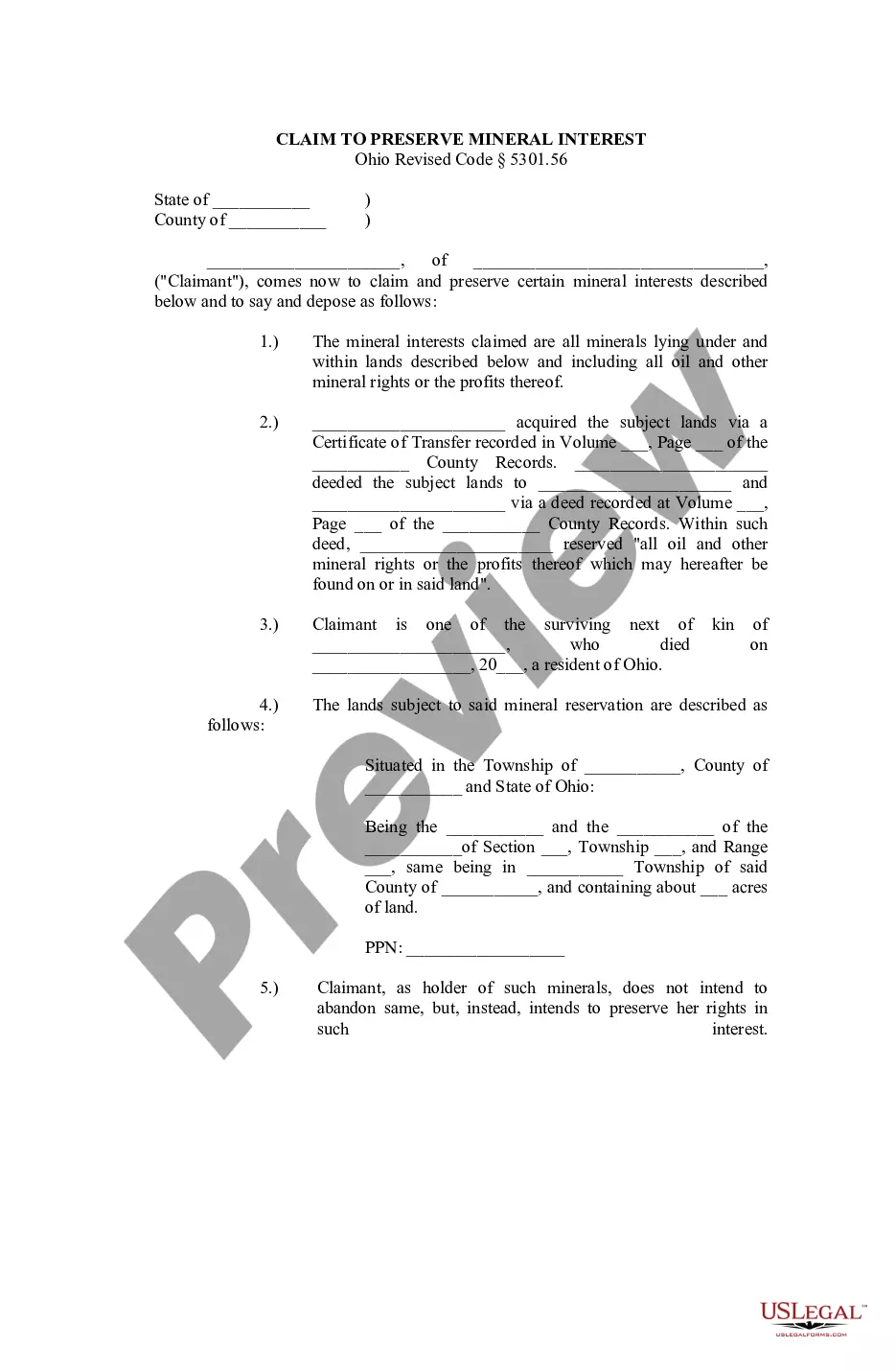

A separate contract has to be drawn up to transfer personal property. Personal property cannot be transferred with real property. The sales contract can include a section for listing any personal property that will be. How can personal property be conveyed along with real property?

The form of transfer depends on whether the property is real or personal. Real property is normally transferred by a deed, which must meet formal requirements dictated by state law. By contrast, transfer of personal property often can take place without any documents at all.

To convey is to make a transfer of a property interest to another individual by either sale or gift. This transaction is known as a conveyance. The standard way to convey a property interest is through a deed. The party who conveys property is known as the conveyor.