Personal Items With In Pennsylvania

Description

Form popularity

FAQ

Must be age 60 or older, or, if married, either spouse must be age 60; or be a widow or widower age 50 to 60 years; or permanently disabled and age 18 to 60 years. The applicant must meet the required age by end of the year of application.

What can I deduct for cell phone use? You can 30% of the data, messaging, and talk costs related to business. ¹ To deduct the expense, you would need to calculate the business-use percentage of the cell phone on a month-by-month basis.

“Personal property” means goods and chattels, including fixtures and buildings erected by the tenant and which he has the right to remove, agricultural crops, whether harvested or growing, and livestock and poultry.

Property tax in Pennsylvania is a local tax based on the assessed value of your home. Assessments and reassessments are conducted at the county level. The amount of tax owed is based on a millage rate, which is determined by your county or municipality.

The Pennsylvania personal income tax does not provide for a standard deduction or personal exemption. However, individuals may reduce tax liabilities through certain deductions, credits and exclusions.

Pennsylvania allows four deductions against income. Deductions are allowed for: Medical Savings Account contributions; Health Savings Account contributions; IRC Section 529 qualified Tuition Program contributions, and IRC Section 529A Pennsylvania ABLE Savings Account Program contributions.

Monroe County (4.73%) had the highest property tax burden in the state, 0.92 percentage points higher than the second highest, Pike County (3.81%).

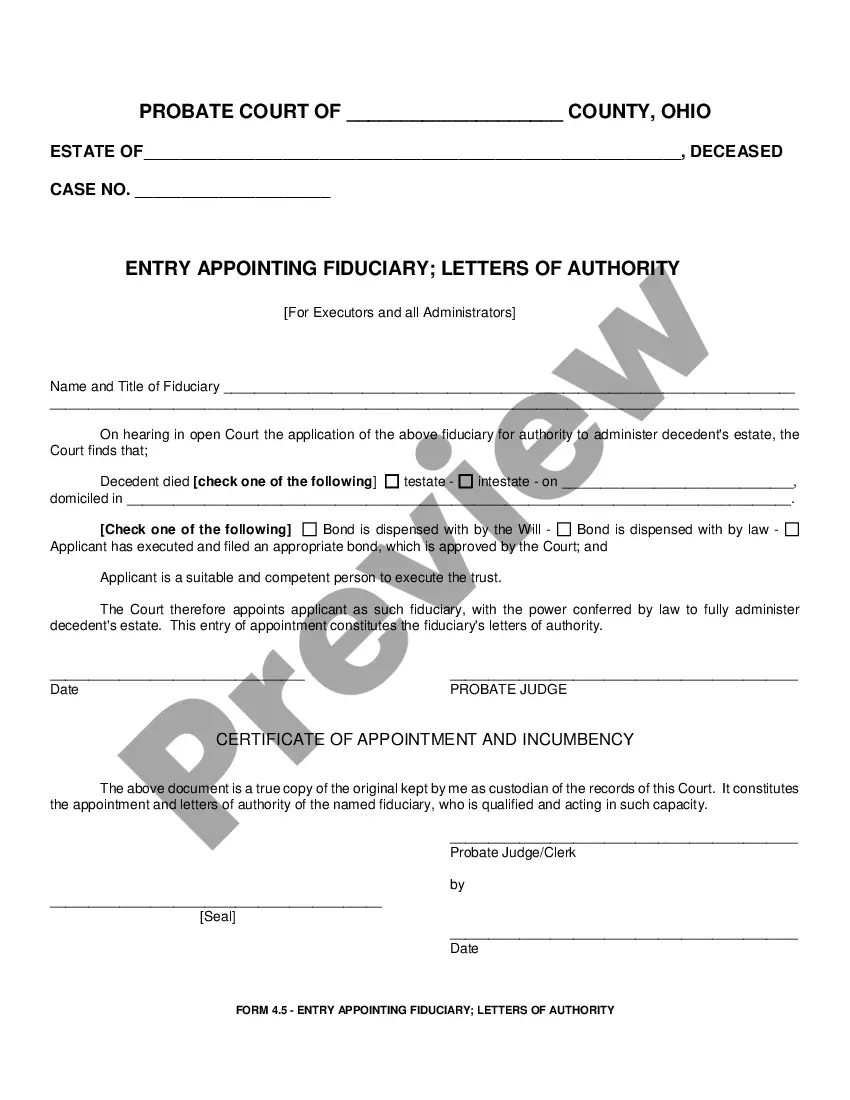

The inventory is used to report only assets which are part of the decedent's probate estate. Assets outside of Pennsylvania and assets which pass by a beneficiary designation are excluded from the inventory.

Major items exempt from the tax include food (not ready-to-eat); candy and gum; most clothing; textbooks; computer services; pharmaceutical drugs; sales for resale; and residential heating fuels such as oil, electricity, gas, coal and firewood.

Additionally, Pennsylvania does not allow a deduction for the personal exemption. The following tables provide examples of the types of deductions and exemptions allowed for federal purposes, but not for Pennsylvania purposes.