Personal Property And Securities Act In Montgomery

Description

Form popularity

FAQ

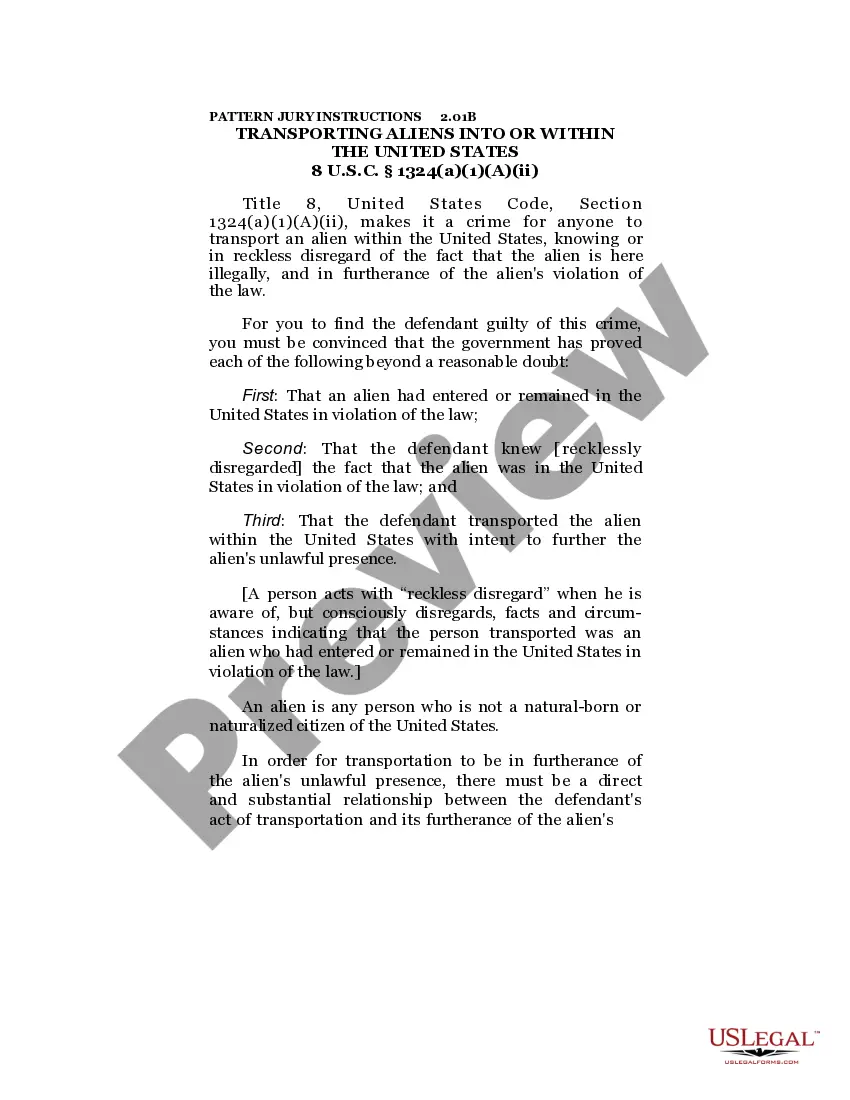

In order to have an enforceable security interest, the party's security interest must first "attach." Attachment occurs when (1) the creditor gives value, (2) debtor has rights in the collateral, and (3) there is an authenticated and signed security agreement, or the party takes control or possession of the collateral.

Other types of intangible personal property include life insurance contracts, securities investments, royalty agreements, and partnership interests.

The PPSA applies to security interests in relation to personal property. Understanding the PPSA therefore starts with understanding these two concepts. Where a security interest in personal property exists, there can be important consequences if the secured party fails to take steps to protect its interest.

Security interests for most types of collateral are usually perfected by filing a document simply called a "financing statement." You'll usually file this form with the secretary of state or other public office.

A secured party may perfect a security interest by having possession, either itself or through a third party, of the collateral. Possessory security interests are the oldest form of security interests in personal property. As commerce has expanded, however, possessory security interests are increasingly less common.

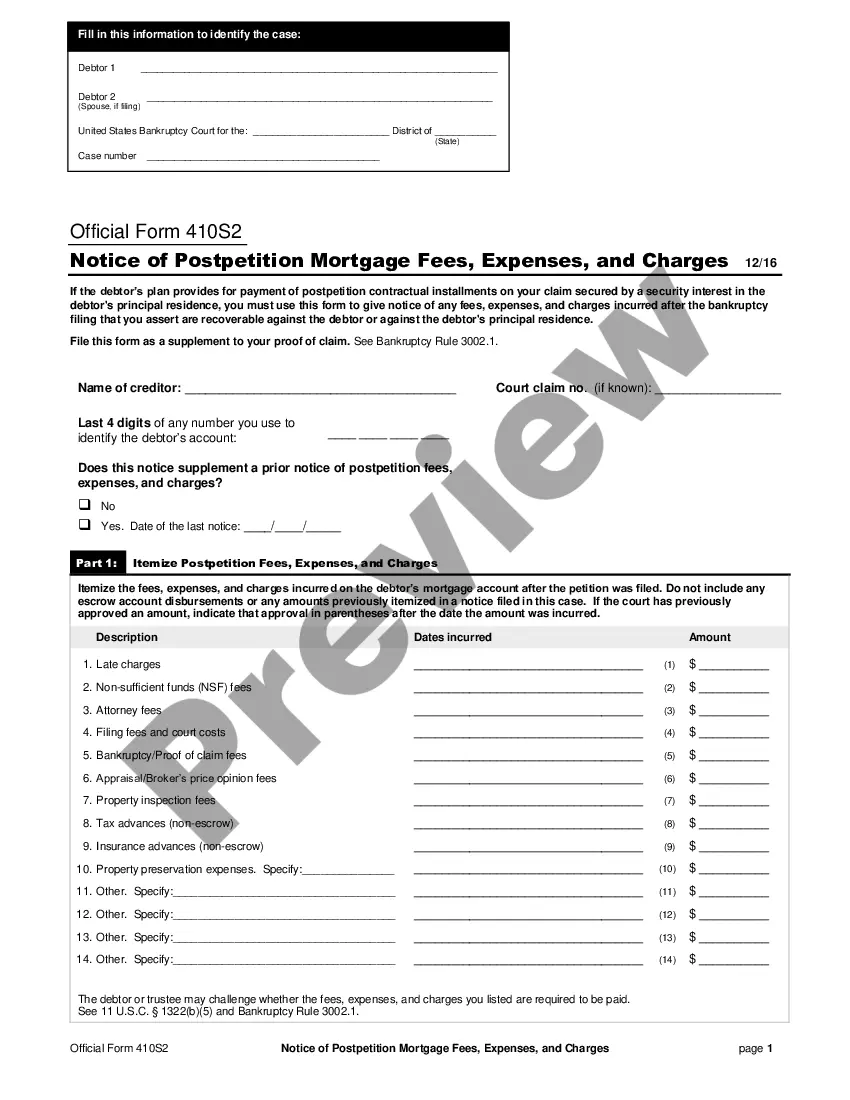

DOES MARYLAND HAVE A PROPERTY TAX ON CARS? Maryland does not have any personal property tax on personal vehicles; however, Maryland State imposes business personal property tax.

Personal property is considered Class II property and is taxed at 20 percent of market value. Market value multiplied by 20 percent equals the assessment value, which is then multiplied by the appropriate jurisdiction's millage rates to determine the amount of tax due.

Each tax rate is reported to the Department by local governments each year. Although the state does not have personal property tax rates, there are some counties that do.