Movable Property With Example In Maryland

Description

Form popularity

FAQ

Responsibility for the assessment of all personal property throughout Maryland rests with the Department of Assessments and Taxation. Personal property generally includes furniture, fixtures, office and industrial equipment, machinery, tools, supplies, inventory and any other property not classified as real property.

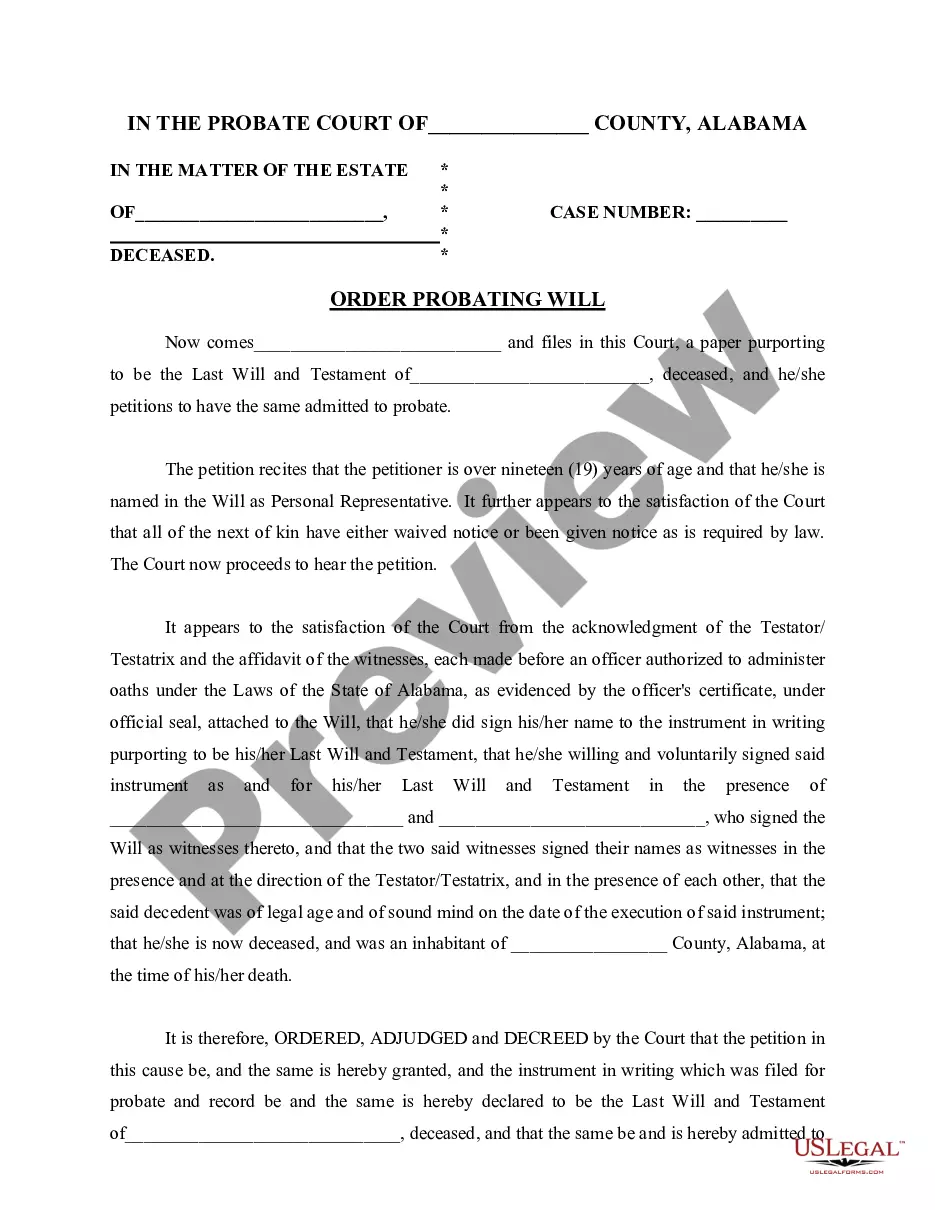

The process of distributing property under your Will is accomplished with a court proceeding referred to as “probate.” The probate process involves the Court appointing an executor (the “Personal Representative”), who is a person responsible for locating property, paying final debts and taxes, and distributing property ...

Parents with more than one child can distribute everything equally, give percentages, or leave specific assets to a certain child. A parent with one child can leave all their assets to the child. Others include other relatives and even charitable organizations besides their sole child.

Timelines for transferring property after the owner's death vary by state and can range from a few months to over a year.

A probate court monitors the probate process, which means the probate court can also have an executor removed. You can petition the court to have the executor removed, and once the old executor is removed, the court will find another representative to handle the estate.

The rights of mobile home residents are protected by the Maryland Mobile Home Parks Act of 1980. Before you buy. Unless you own a piece of property that you want to put your mobile home on, you'll have to rent space at a mobile home park, or buy a mobile home that is already in place at a park.

Do transfer on death deeds work in Maryland? No, Maryland does not recognize transfer on death deeds. These types of deeds allow for property to transfer to a named recipient as soon as the property owner dies.

A personal property tax is imposed by state or local governments on certain assets that can be touched and moved such as cars, livestock, or equipment. Personal property includes assets other than land or permanent structures such as buildings.

Tangible personal property refers to physical and movable possessions owned by individuals. Examples of personal property include clothing, furniture, electronics, and vehicles. Intangible property, on the other hand, covers valuable assets that you can't see or touch, such as bonds, franchises, and stocks.

You may be entitled to a tax waiver if one of the following applies: A new Missouri resident. First licensed asset you have ever owned. You did not own any personal property on January 1st of the prior year. You are in the military and your home of record is not Missouri (LES papers are required)