Personal Property Statement With No Intrinsic Value Called In Georgia

Description

Form popularity

FAQ

All property in Georgia is taxed at an assessment rate of 40% of its full market value. Exemptions, such as a homestead exemption, reduce the taxable value of your property.

Georgia exempts a property owner from paying property tax on: Items of personal property used in the home if not held for sale, rental, or other commercial use. All tools and implements of trade of manual laborers in an amount not to exceed $2,500 in actual value.

(22) "Tangible personal property" means personal property which may be seen, weighed, measured, felt, or touched or which is in any other manner perceptible to the senses. The term "tangible personal property" shall not include intangible personal property.

5 steps to fill out a business personal property rendition quickly and accurately Review your property tax accounts. Take stock of your assets. Select the appropriate business personal property rendition forms. Prepare the personal property renditions. File your business personal property rendition packages.

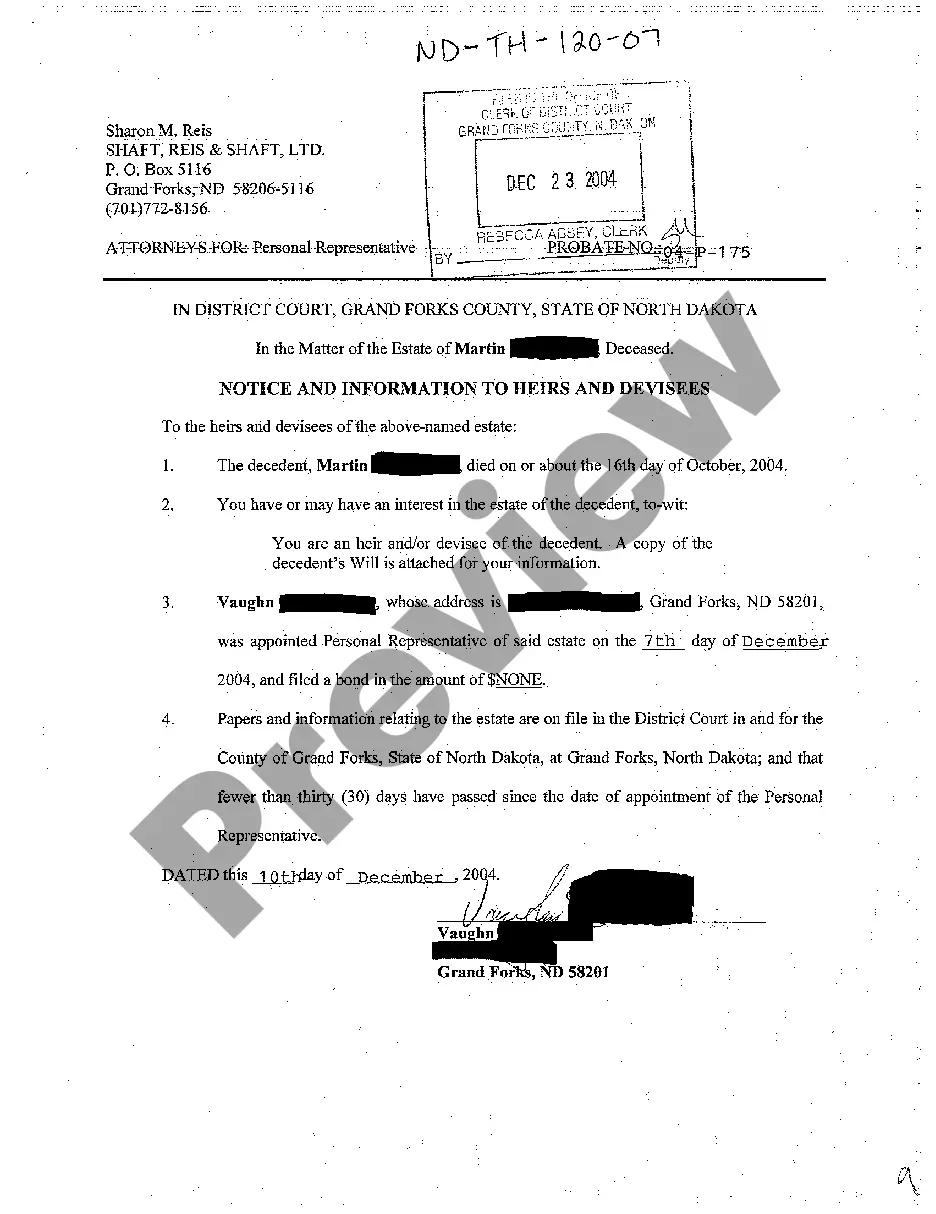

A Personal Property Memorandum, also known as a “tangible personal property memorandum,” is a supplementary document to a will or trust that allows individuals to specify the distribution of specific personal items to beneficiaries.

Personal property in the State of Georgia is generally defined as any movable property; that is, property that is not permanently affixed to and part of real estate.

Georgia's new estate planning law allows for a separate document to be incorporated into a Last Will and Testament as the will is being executed. This separate document could be a Personal Property Memoranda, a Letter of Instruction, or some other written item.