Personal Property On Purchase Agreement In Franklin

Description

Form popularity

FAQ

Writing a Personal Property Demand Letter Step 1: Use a Professional Letterhead. Step 2: Address the Recipient. Step 3: Start with a Clear Introduction. Step 4: Clearly State Your Demand. Step 5: Specify a Deadline. Step 6: Explain Consequences of Non-Compliance. Step 7: Offer a Contact Point and Closing. Step 8: Keep Copies.

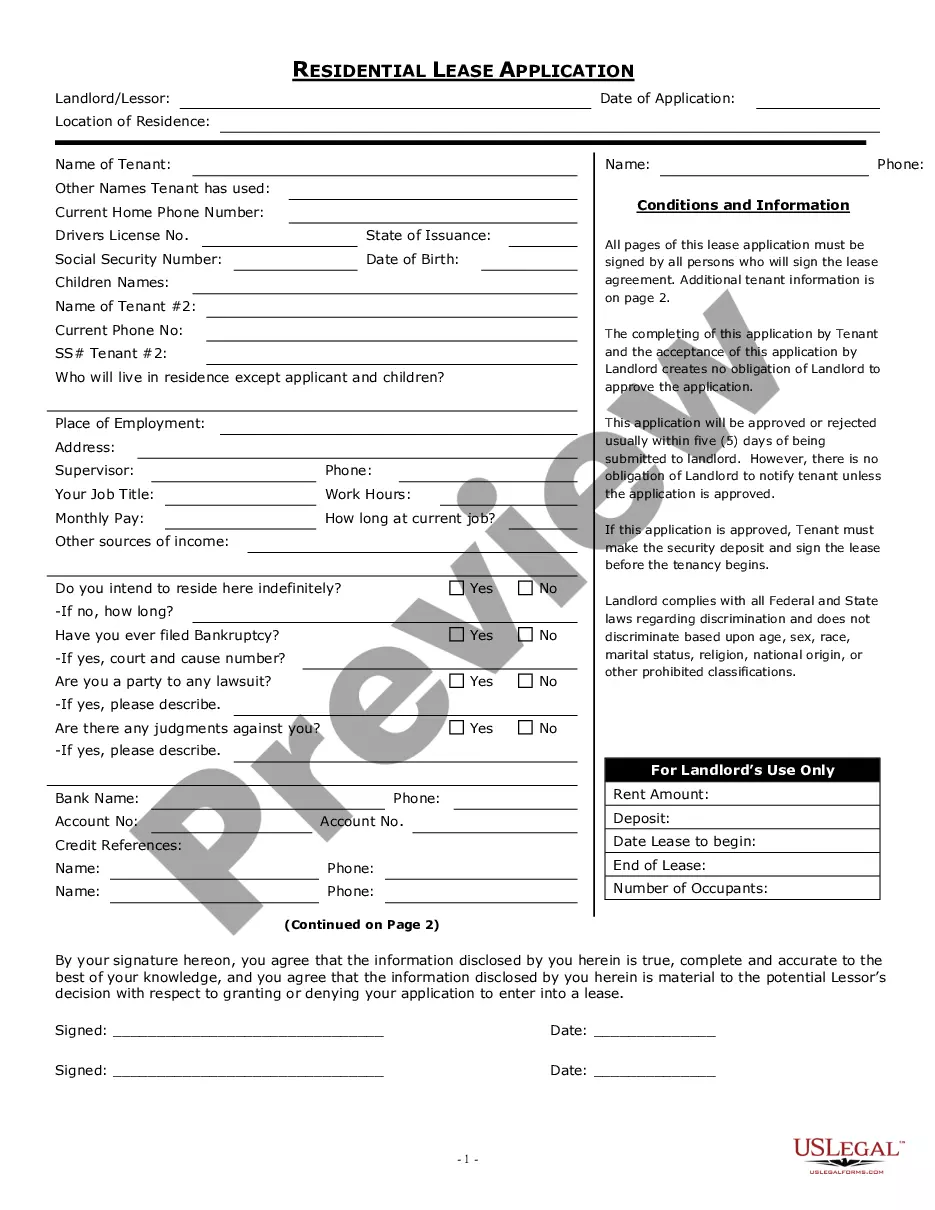

A separate contract has to be drawn up to transfer personal property. Personal property cannot be transferred with real property. The sales contract can include a section for listing any personal property that will be. How can personal property be conveyed along with real property?

Classifications Intangible. Tangible. Other distinctions.

The attachment method is the most important in determining the two. If the object has formed part of the home and has been used by the initial tenants, then it is considered a fixture and not personal property, for example, built-in electronics like a microwave or a fan.

The form of transfer depends on whether the property is real or personal. Real property is normally transferred by a deed, which must meet formal requirements dictated by state law. By contrast, transfer of personal property often can take place without any documents at all.

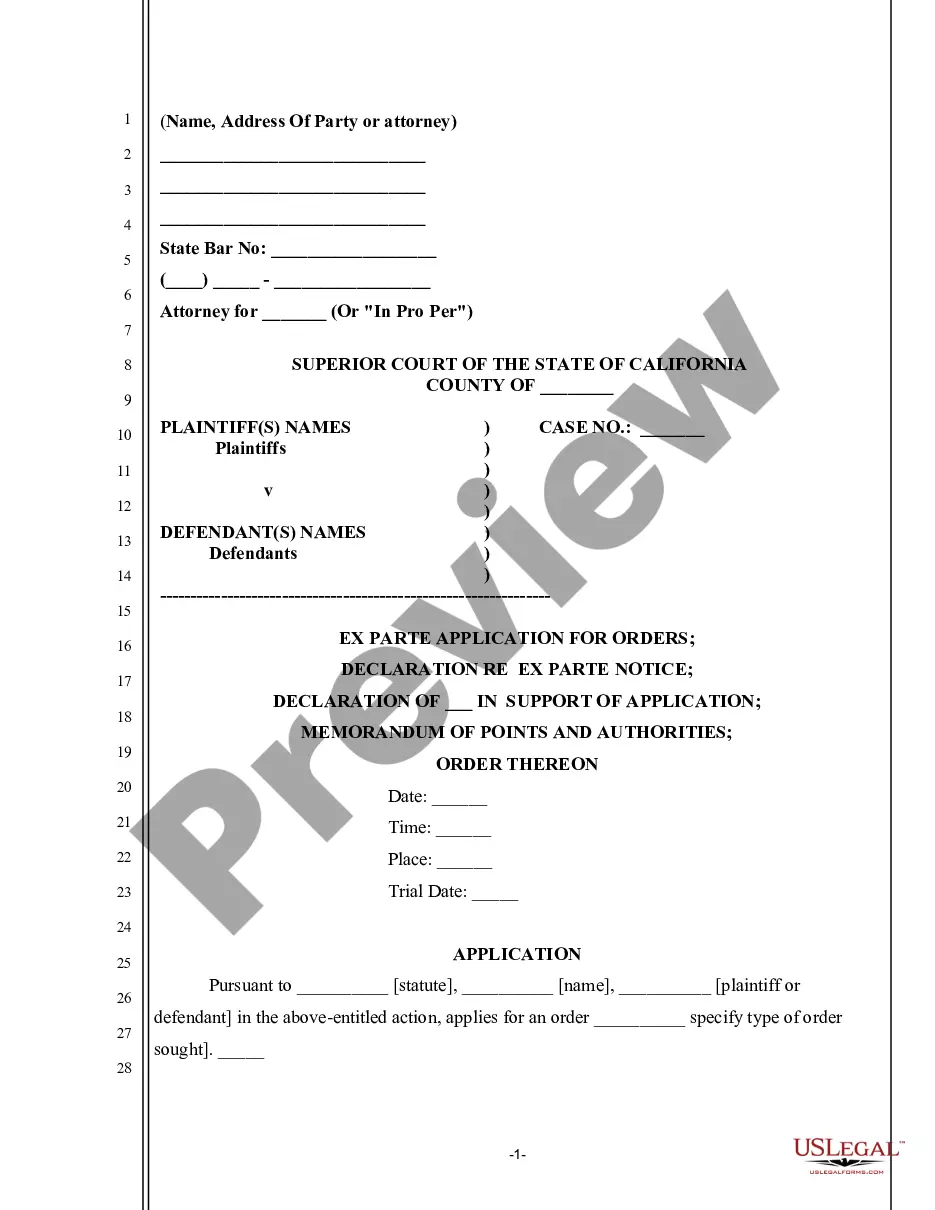

To convey is to make a transfer of a property interest to another individual by either sale or gift. This transaction is known as a conveyance. The standard way to convey a property interest is through a deed. The party who conveys property is known as the conveyor.

Classifications Intangible. Tangible. Other distinctions.

Answer: Connecticut General Statute 12-71 requires that all personal property be reported each year to the Assessor's Office. If you receive a declaration, it is because our office has determined that you may have property to report. If you feel the form is not applicable, return it with an explanation.

Personal property depends on a surprisingly simple test: Can you physically move it? The outcome of that test determines the distinction between real property and personal property, which in turn has real implications for taxation.