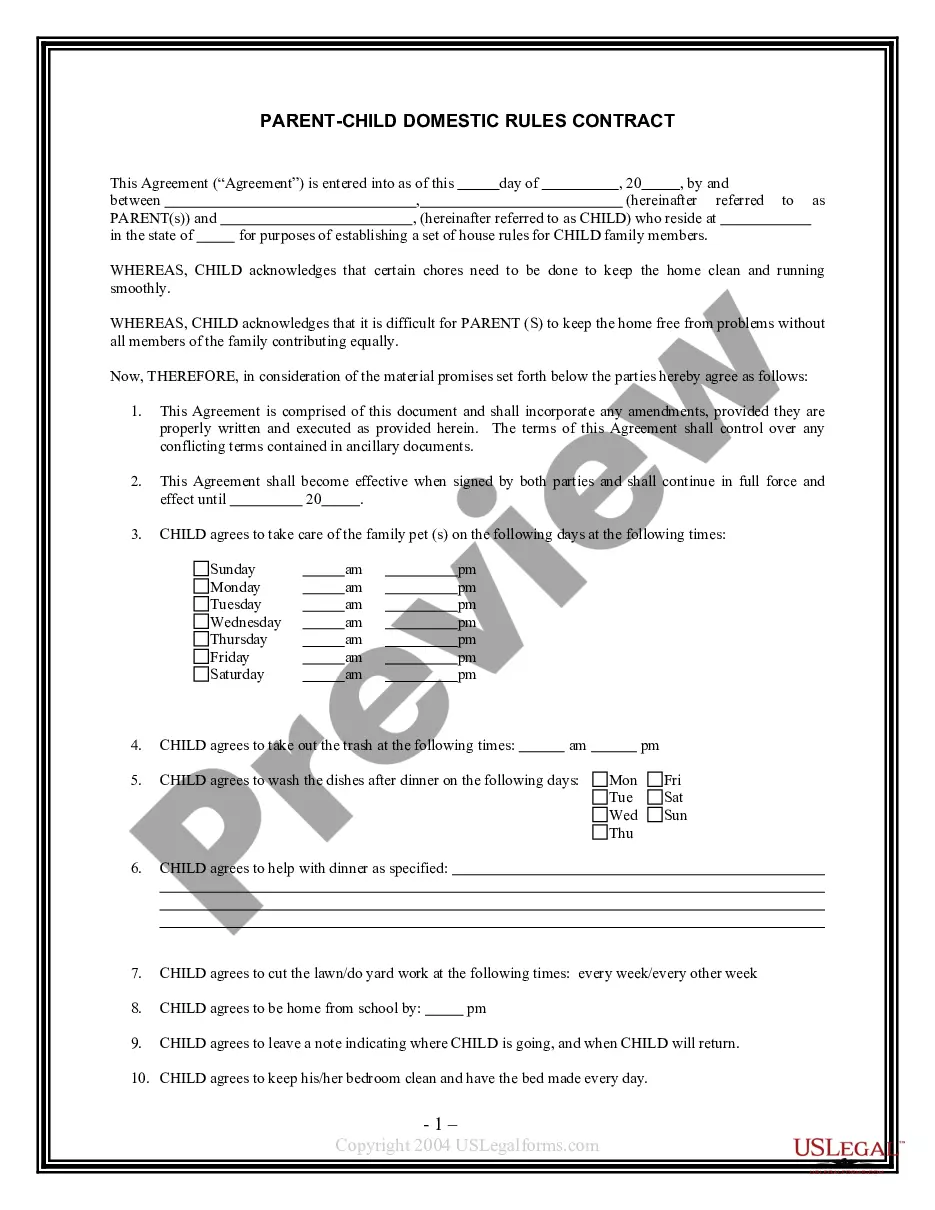

This form is a contract for the lease of personal property. The lessor demises and leases to the lessee and the lessee takes and rents from the lessor certain personal property described in Exhibit "A".

Personal Property For Business In Dallas

Description

Form popularity

FAQ

What is business personal property? Business personal property is all property owned or leased by a business except real property.

You can write off property tax for your business. This turns a fact-of-life into a strategic deduction that lowers your overall taxable income. Commercial landlords, self-employed workers and small business owners who own property solely for commercial intent can qualify for this deduction.

5 steps to fill out a business personal property rendition quickly and accurately Review your property tax accounts. Take stock of your assets. Select the appropriate business personal property rendition forms. Prepare the personal property renditions. File your business personal property rendition packages.

Business Personal Property Tax is a tax assessed on tangible personal property businesses own. This type of property includes equipment, furniture, computers, machinery, and inventory, among other items not permanently attached to a building or land.

Business personal property (BPP) insurance covers the equipment, furniture, fixtures and inventory that you own, use or rent inside your workspace. Basically, it covers almost everything except the building itself.

Section 42.001 - Personal Property Exemption (a) Personal property, as described in Section 42.002, is exempt from garnishment, attachment, execution, or other seizure if: (1) the property is provided for a family and has an aggregate fair market value of not more than $100,000, exclusive of the amount of any liens, ...

Per Section 22.01(a) of the Texas Property Tax Code, taxable personal property includes assets used for the production of income, such as inventories, machinery, equipment, vehicles, furniture and supplies used in the business.

Business owners are required by State law to render personal property that is used in a business or used to produce income. This property includes furniture and fixtures, equipment, machinery, computers, inventory held for sale or rental, raw materials, finished goods, and work in process.

What is business personal property? Business personal property is all property owned or leased by a business except real property.

What is business personal property? Business personal property is all property owned or leased by a business except real property.