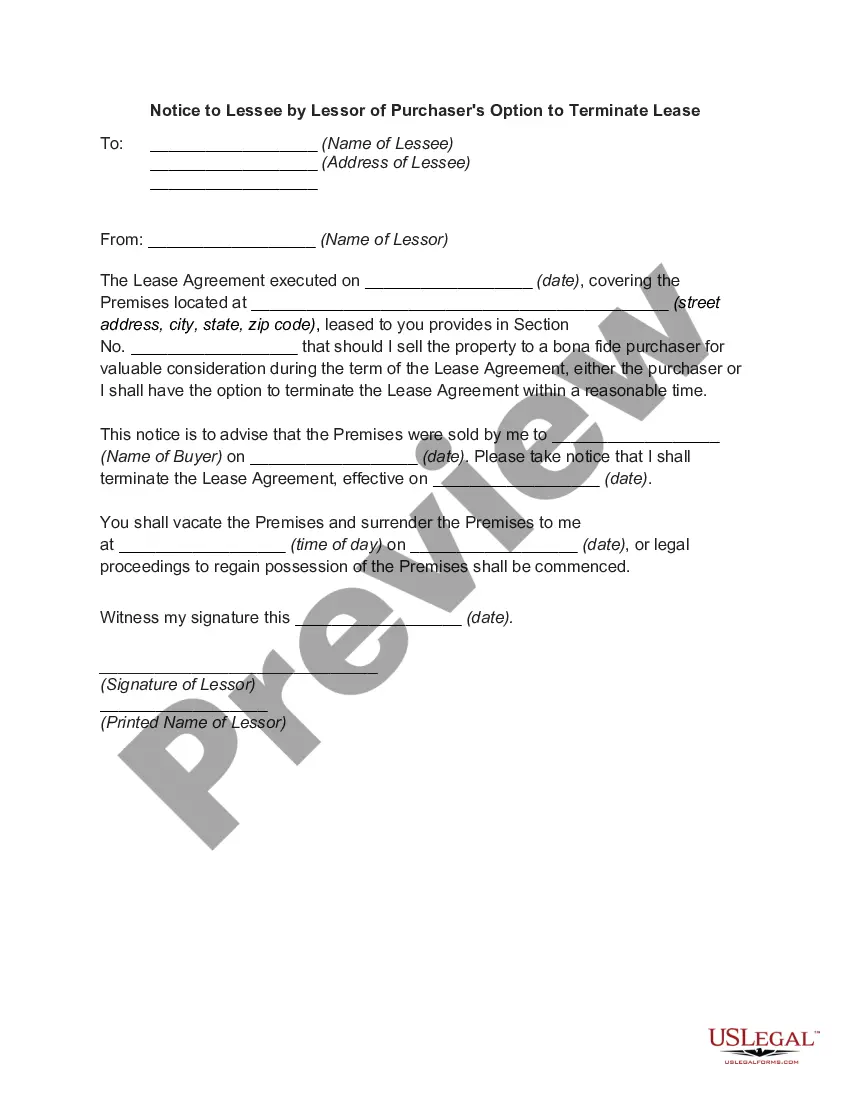

This form is a contract for the lease of personal property. The lessor demises and leases to the lessee and the lessee takes and rents from the lessor certain personal property described in Exhibit "A".

Personal Property On Purchase Agreement Fannie Mae In Cuyahoga

Description

Form popularity

FAQ

This is one of those times. Fannie Mae (more about them in a minute) has lowered their required down payment for owner-occupied, multi-family (2-4 unit) properties from 15%-25% to 5%. This means you can buy a property with 5% down, live in one unit, and rent out the other 1-3 units.

If the account is held jointly, an access letter, stating the borrower has access to 100% of the account funds is required when business funds are being used for down payment and/or closing costs.

The full access letter can be short and simple, and say the following: “To whom it may concern, (mortgage borrower's name) has full access to use all the monies in the (name of the bank/financial institution) bank account/s with the following account number/s (account number/s).

A Fannie Mae HomePath property is a house that's being sold directly by Fannie Mae to an investor or a traditional buyer. There are two situations in which Fannie Mae ends up owning a house. One is if the house has gone through foreclosure and Fannie Mae owned the mortgage on it.

Fannie Mae is a government-sponsored enterprise that buys mortgages from lenders. When a home owned by Fannie Mae is foreclosed, the agency lists and sells the property on the HomePath market. This program – which launched in 2009 – aims to support neighborhood stabilization and help families find the perfect home.