Debt Settlement Letter Sample With Bank In Bexar

Description

Form popularity

FAQ

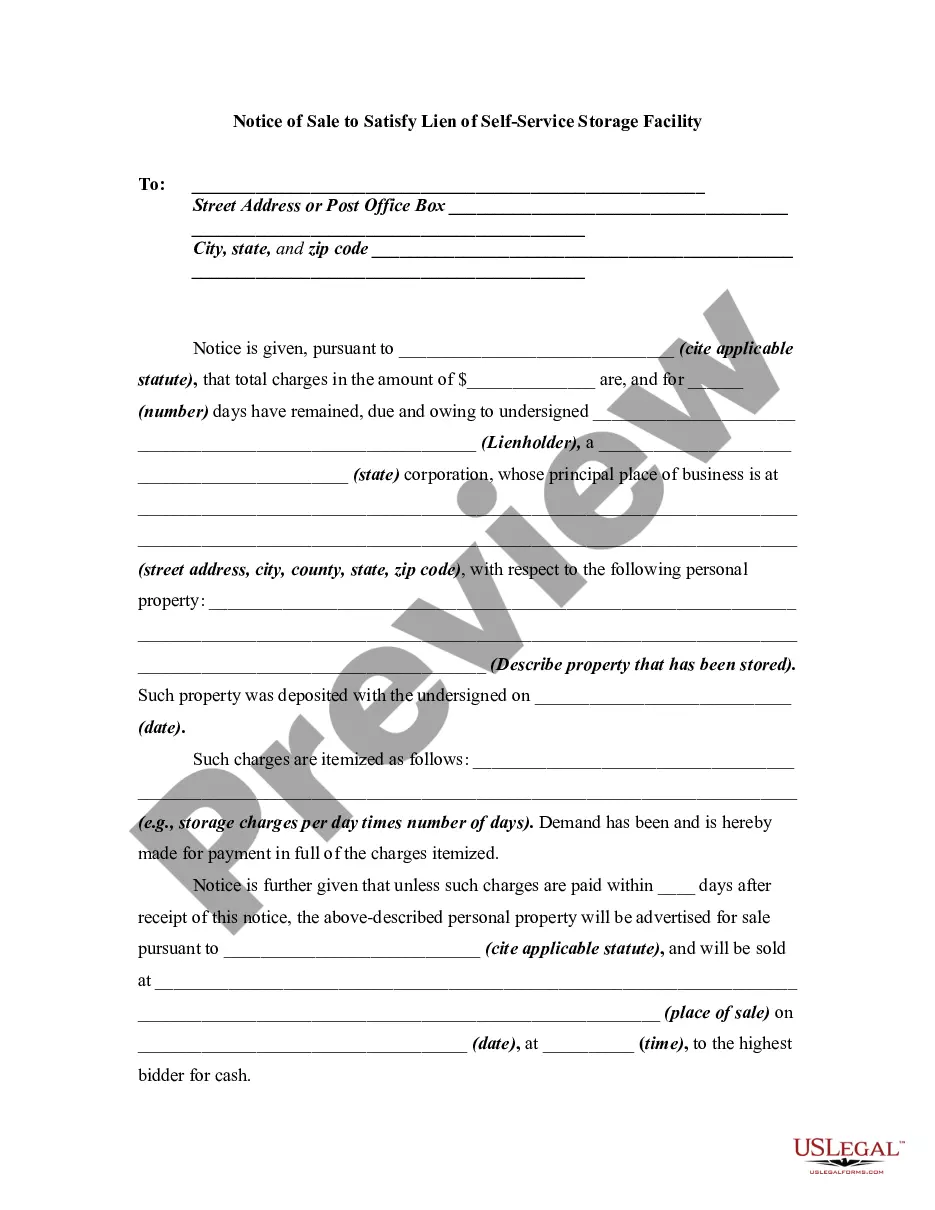

Clearly define objectives before drafting the settlement offer. If monetary compensation is involved, the offer should specify the amount, payment schedule, and contingencies for non-payment. Non-monetary terms, such as confidentiality clauses, mutual releases, or other protective measures, should also be considered.

Explain your circumstances and propose a settlement amount. The lender might counteroffer, and the goal is to reach a mutually agreeable amount. 4. Get It in Writing: Once a settlement amount is agreed upon, ensure you receive a written agreement from the lender.

Tip for Drafting an Effective Settlement Letter Be concise. Your letter might be 20-30 pages long if your claim is complex. Be organized. Reread your letter to make sure you haven't said anything that the opposing party can twist around to use against you. Be polite and professional.

I am writing this letter to state that on _ (Day) i.e. (Date), I got relieved from your _ (Company/ Organization) but my full and final settlement has not been done. I request you to kindly do the full and final settlement and send me all dues (if any).

Consult a Credit Counselor Determine If Negotiation Is Right for You. Set Your Terms. Tell the Truth and Keep a Consistent Story. Learn Your Rights Under the Fair Debt Collection Practices Act (FDCPA) Keep Detailed Communication Notes. Negotiate with Creditors Directly. Get All Agreements in Writing.

Treat the following as a set of general guidelines: Gather complete information before you start writing. Describe your injuries and medical treatment. List your medical expenses, lost wages, and non-economic damages. Make a settlement demand. Include a deadline for legal action if you want to, but don't bluff.

Treat the following as a set of general guidelines: Gather complete information before you start writing. Describe your injuries and medical treatment. List your medical expenses, lost wages, and non-economic damages. Make a settlement demand. Include a deadline for legal action if you want to, but don't bluff.

These are the steps to follow: Work out what you can offer the people you owe. Send your offer to them in writing. Ask them to confirm they accept your offer in writing. Keep any letters your creditors send you about the settlement offer. Negotiate with your creditors if you need to.

Your settlement letter should begin with a heading that clearly identifies it as a settlement proposal. Be sure to include your contact information, such as your name, address and phone number so that the recipient can get in touch with you if necessary.