Arbitration Case Sample For Web Developer In Maricopa

Description

Form popularity

FAQ

But first, let's get some context. What is arbitration? ... #1: Understand the arbitration agreement deeply. #2: Understand the applicable rules. #3: Conduct preliminary research and gather information. #4: Know your arbitrator. #5: Prepare your client. #6: Draft the opening statement. #7: Manage the hearing day.

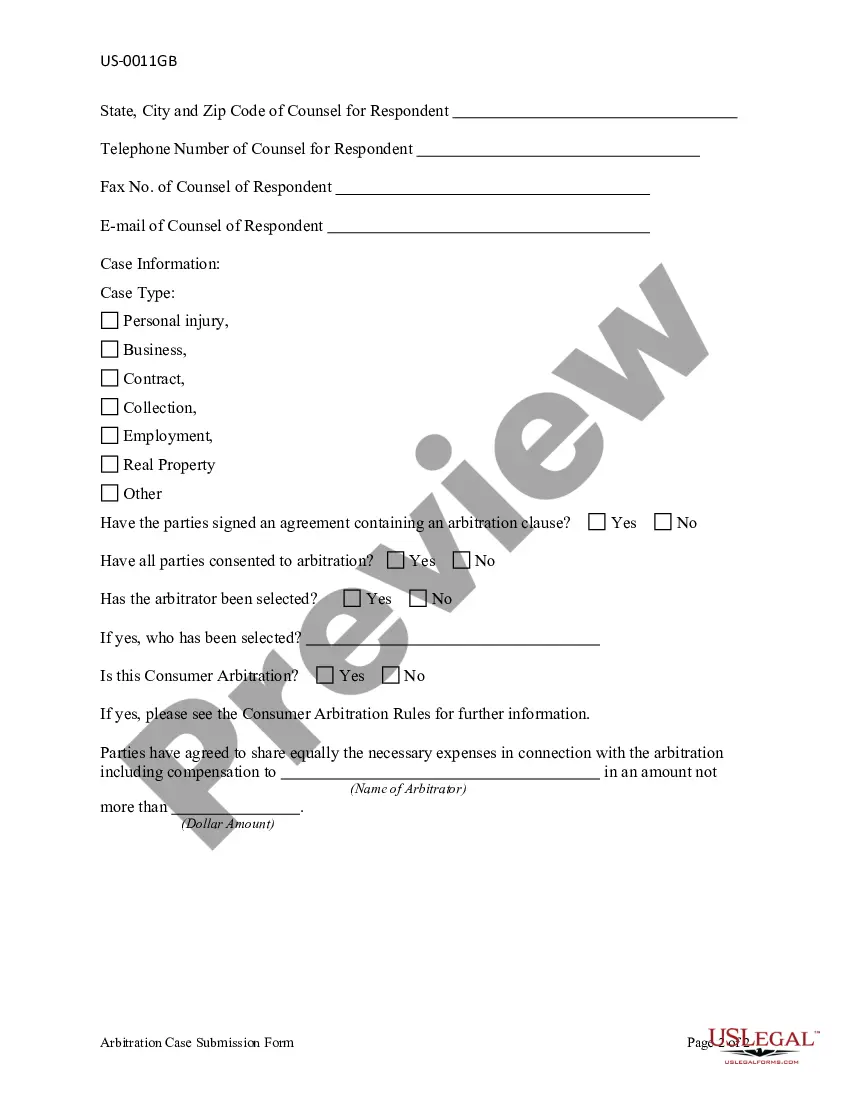

Include the name and contact details of all parties (including e-mail, street address and telephone number) be signed and dated by the requesting party or its representative. enclose proof of the representative's authority to act, e.g., a power of attorney or a letter of engagement.

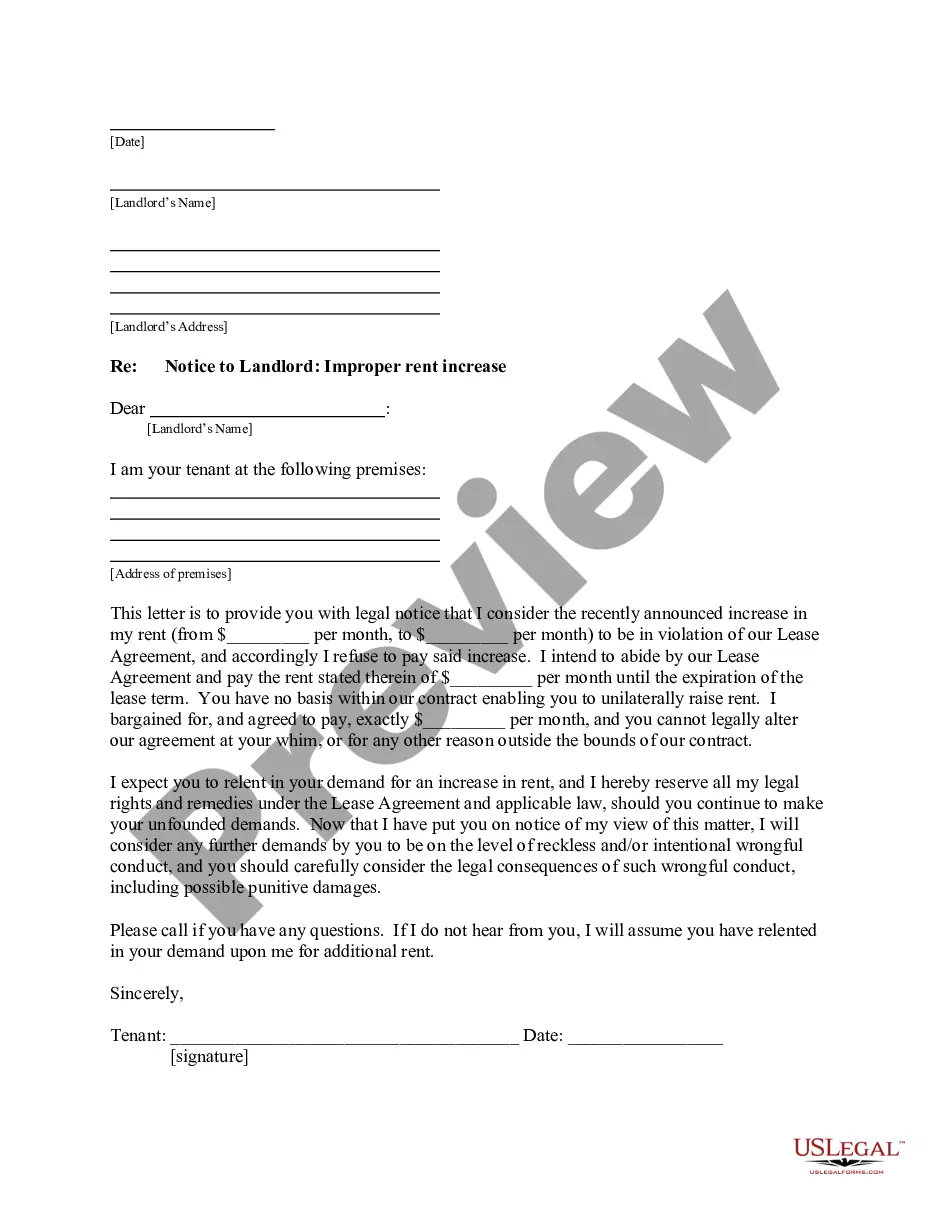

Usually, when the court intervenes, it could cause the case to drag on for a long time without a meaningful resolution. Arbitration as a dispute resolution is used mostly in commercial disputes, consumer disputes, credit obligation disputes, and state or investor disputes.

Compulsory Arbitration is a mandatory program for disputes valued under $50,000. A court-appointed arbitrator reviews the case to decide a just resolution and award.

Consumers are more likely to win in arbitration than in court. This research from ndp | analytics demonstrates that in disputes initiated by a consumer, consumers fare much better in arbitration than they do in litigation.

Arbitration is often the choice for sorting out issues such as business disputes. Here, everyone involved agrees to have a neutral third party, called an arbitrator, hear their case.

Ing to the Financial Industry Regulatory Authority (FINRA), the most common types of disputes that are settled by arbitration are as follows: Breach of fiduciary duty; Failure to supervise; Negligence; Misrepresentation; Breach of contract; Suitability; Omission of facts; Fraud; and.

Parties typically agree to arbitrate in order to avoid the time, expense, and complexity of litigation. Arbitration clauses that require parties to submit all disputes to arbitration are widely used in domestic consumer and employment contracts.