Publication 783 With Irs In Suffolk

Description

Form popularity

FAQ

If the debt is $10,000 or more (up from $5,000 before the IRS Fresh Start program), then the IRS will file a federal tax lien as early as ten days after you receive your notice.

Many of these services are available 24 hours a day, seven days a week. Copies of forms, publications and other helpful information are also available around-the-clock at the IRS Web site at .irs. You can call 1-800-829-1040 to get answers to your federal tax questions 24 hours a day.

You should report fraudulent or abusive returns, including those with questionable Forms W-2, to the IRS by submitting Form 3949-A, Information Referral PDF.

4 ways to search for UCC and federal or state tax liens Use a dedicated lien search tool. Search business records at a state Secretary of State office. Look for liens on a state or county recorder's office website. Get a list from the IRS via a Freedom of Information Act request.

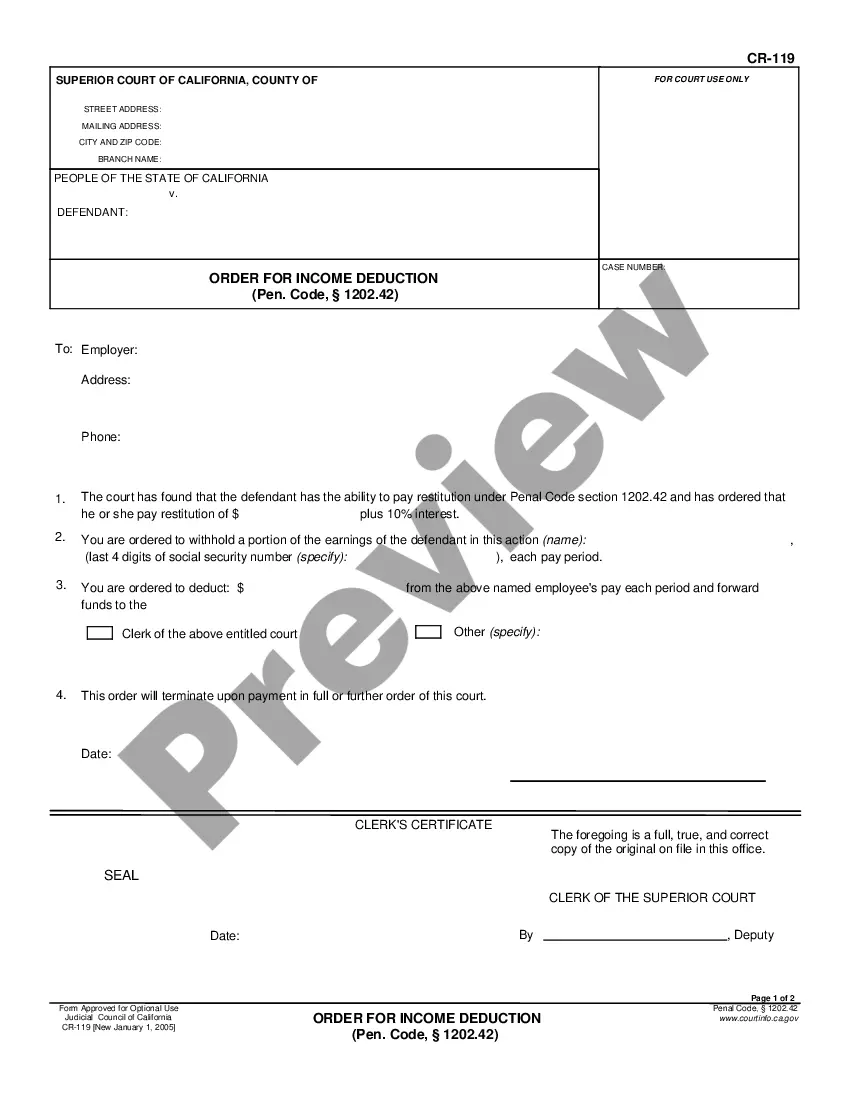

How Can a Taxpayer Request a Discharge of an IRS Tax Lien? You need to submit form 14135, Application for Certificate of Discharge of Property from Federal Tax Lien at least 45 days before the sale or settlement meeting. Publication 783 provides the instructions for completing form 14135.

Centralized Lien Operation — To resolve basic and routine lien issues: verify a lien, request lien payoff amount, or release a lien, call 800-913-6050 or e-fax 855-390-3530.

You can apply to have the lien withdrawn by using Form 12277, Application for Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien (Internal Revenue Code Section 6323(j). A “discharge” removes the lien from specific property.

To get a copy, visit the IRS web site at .irs under the “Forms and Pubs” section. It can be accessed directly at ftp.fedworld/pub/irs- pdf/p17. pdf. Or it can be ordered by calling 1-800-829-3676.

Complete Form 14135, Application for Certificate of Discharge of Federal Tax Lien attached with this publication.

These forms and publications are available on the Internet, on CD-ROM, through fax on demand, over the telephone, through the mail, at local IRS offices, at some banks, post offices, and libraries, and even at some grocery stores, copy centers and office supply stores.