Certificate Of Discharge Form Withheld In Orange

Description

Form popularity

FAQ

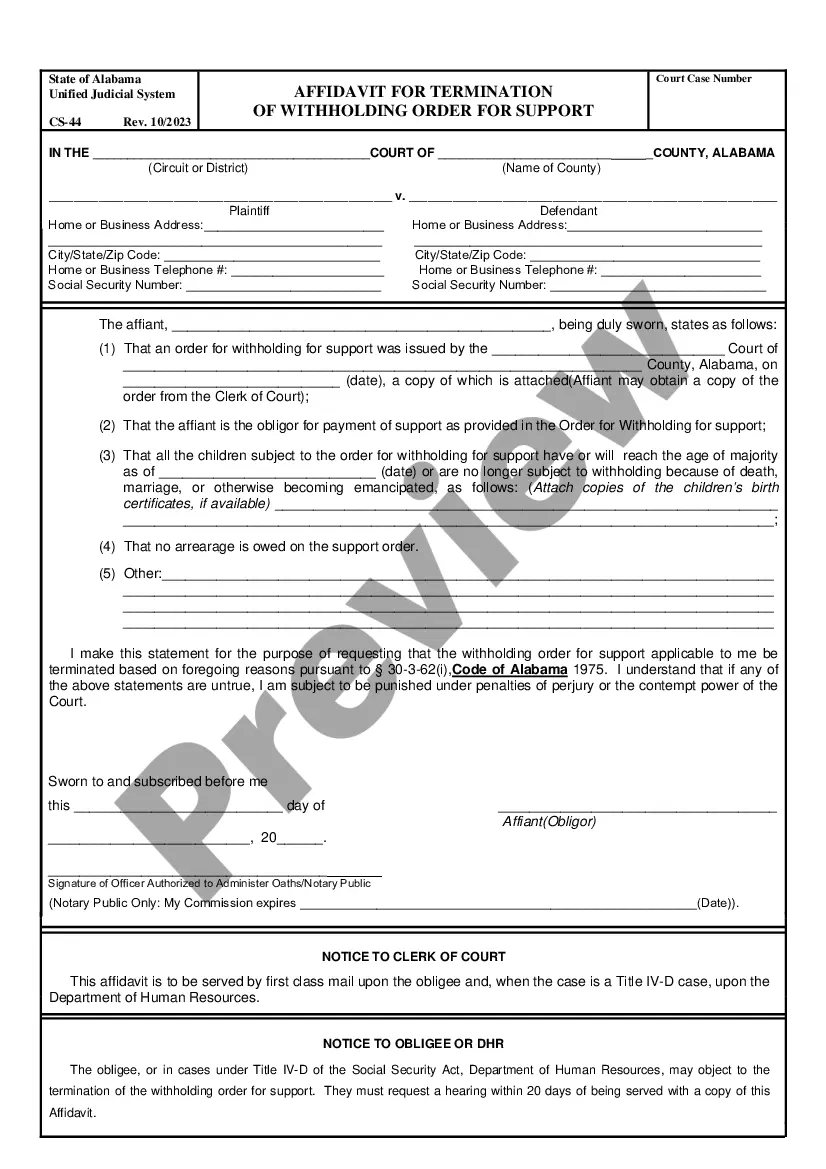

A certificate of discharge is a written statement that says one person has fulfilled their obligation to another person, who agrees that the obligation has been met.

Typically, a discharge letter summarizes a patient's medical history, treatment received, and future care plans. Your audience will consist of healthcare professionals who will be involved in the patient's ongoing care.

2. Mail the completed Form 14135 and the appropriate attachments to: IRS Advisory Consolidated Receipts 7940 Kentucky Drive, Stop 2850F Florence, KY 41042 (Refer to Publication 4235 Collection Advisory Group Addresses for additional contact information.)

A certificate of discharge is a written statement that one party has discharged its obligation to the other party who accepts the discharge. It is also known as satisfaction piece or satisfaction. A certificate of discharge may be given for different purposes.

Example: When a person pays off their mortgage, the lender will issue a certificate of discharge to confirm that the debt has been satisfied. Explanation: In this example, the certificate of discharge serves as proof that the borrower has fulfilled their obligation to the lender by paying off the mortgage.

How Can a Taxpayer Request a Discharge of an IRS Tax Lien? You need to submit form 14135, Application for Certificate of Discharge of Property from Federal Tax Lien at least 45 days before the sale or settlement meeting. Publication 783 provides the instructions for completing form 14135.

A Certificate of Discharge under Internal Revenue Code Section. 6325(b) removes the United States' lien from the property. named in the certificate.

Veterans Military Discharge Documents FormTitle DD 214 Certificate of Release or Discharge from Active Duty DD 217 Discharge Certificate DD 256A Honorable Discharge Certificate DD 256AF Honorable Discharge Certificate66 more rows

However, sole proprietors without employees (other than themselves) generally don't need to file it because they aren't subject to employment taxes. If a sole proprietor has employees, they may need to file Form 944 or Form 941, depending on their annual employment tax liability.

You can claim either 0 or 1 on your W-4. It won't create problems with the IRS, it will just determine how much you'll get back on your tax return next year. If you claim 0, you will get less back on paychecks and more back on your tax refund.