Certificate Of Discharge Form Withheld In Ohio

Description

Form popularity

FAQ

How to fill out a W-4 Step 1: Enter your personal information. Fill in your name, address, Social Security number and tax filing status. Step 2: Account for multiple jobs. Step 3: Claim dependents, including children. Step 4: Refine your withholdings. Step 5: Sign and date your W-4.

Categories of workers that are exempt from Ohio withholding taxes include agricultural workers, domestic service workers, providers of low-income services, foreign government services, underage paper deliverers, and non-trade services.

Tax Withholding Table If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be: Over $0 but not over $5,000 0.501% Over $5,000 but not over $10,000 $25.05 plus 1.001% of excess over $5,000 Over $10,000 but not over $15,000 $75.10 plus 2.005% of excess over $10,0003 more rows •

Note: The W-4 form 2024 steps are the same as the W-4 form 2025 steps. Step 1: Enter your personal information. Step 2: Account for all jobs you and your spouse have. Step 3: Claim your children and other dependents. Step 4: Make other adjustments. Step 5: Sign and date your form.

Generally, you want about 90% of your estimated income taxes withheld and sent to the government.12 This ensures that you never fall behind on income taxes (something that can result in heavy penalties) and that you are not overtaxed throughout the year.

Overview of Ohio Taxes Gross Paycheck$2,399 Federal Income 8.55% $205 State Income 1.40% $34 Local Income 0.96% $23 FICA and State Insurance Taxes 7.65% $18423 more rows

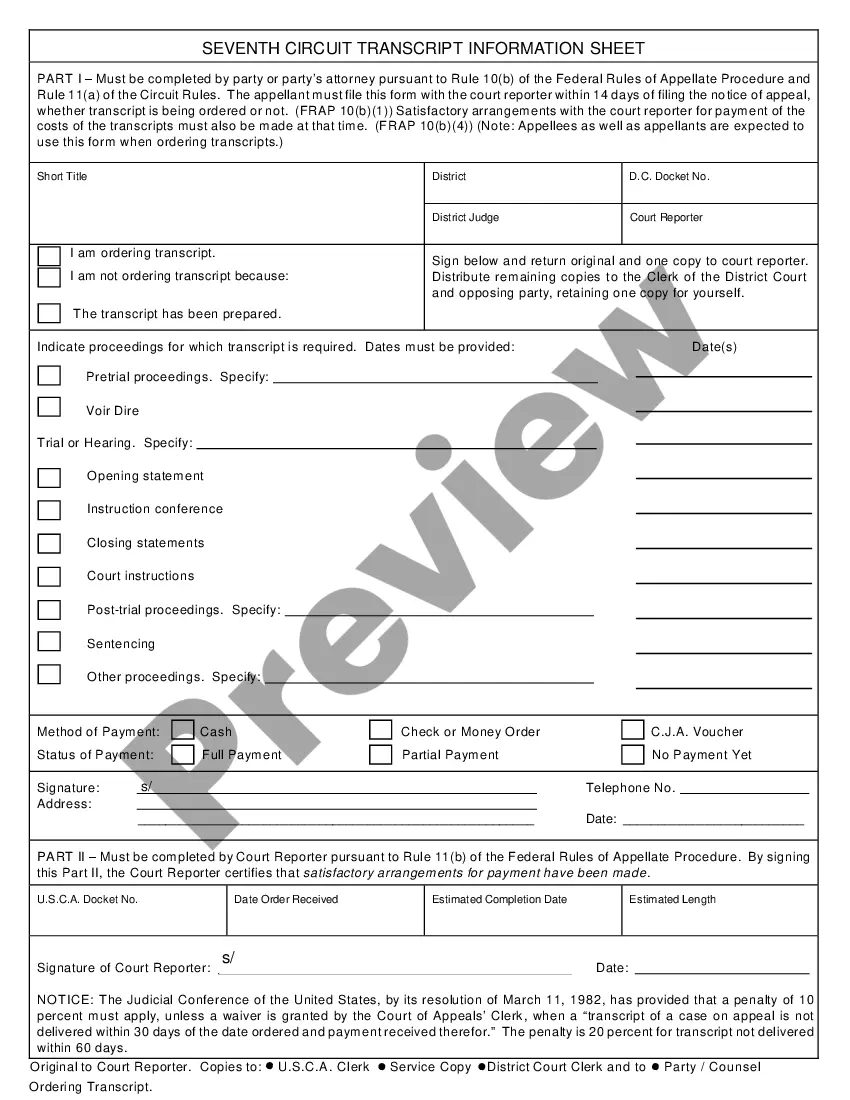

Ohio IT 942 Quarterly Reconciliation of Income Tax Withheld: ▪ Effective for tax year 2024 and every tax year thereafter, the requirement for partial- weekly filers to file an IT 942 quarterly reconciliation has been removed from ORC 5747.07. Ohio IT 942 4th Quarter/Annual Reconciliation of Income Tax Withheld: ▪

Employers in Ohio must conform with these state rules relating to filing income tax withholding returns. Periodic Returns. Employers required to withhold quarterly or monthly (excluding EFT) file Form IT 941 by January 31 of the succeeding calendar year.

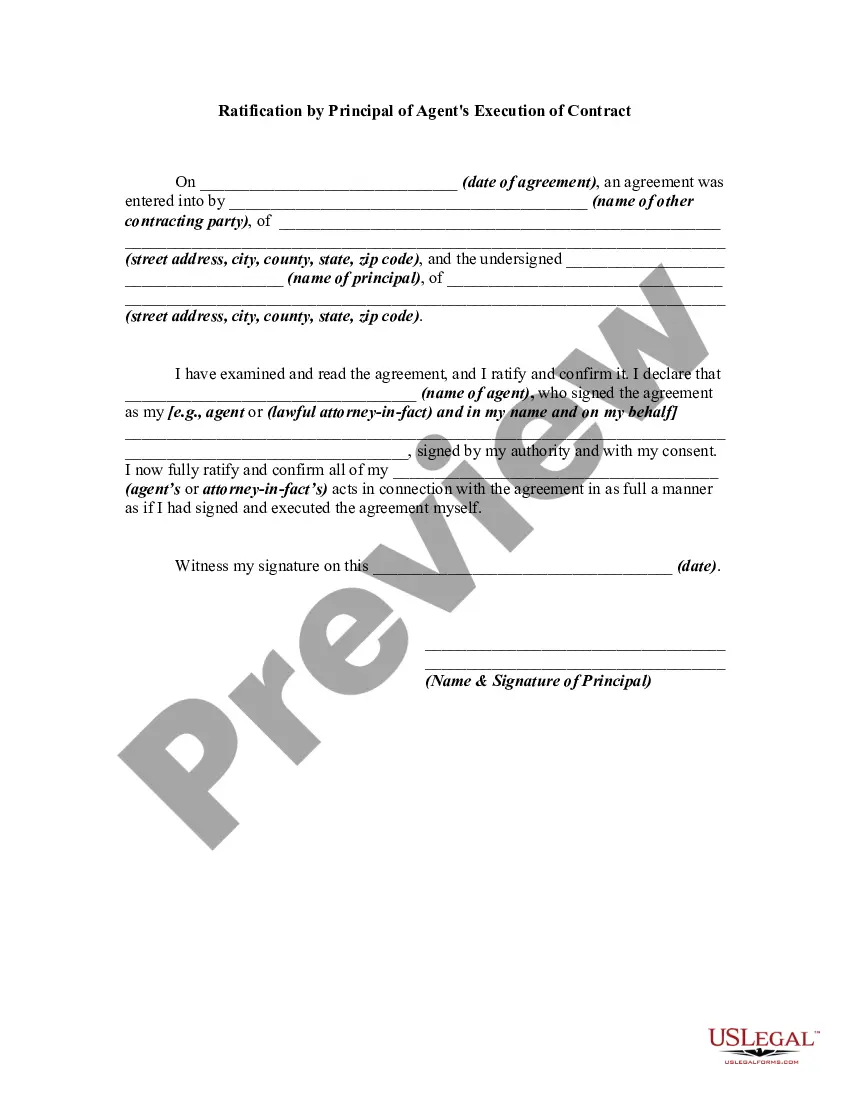

A withholding certificate is required when people want to claim exemptions from withholding the tax on the U.S source income. Moreover, people who want to inform about their foreign or U.S status to the withholding agents also file Withholding Certificate Forms.

Any individual (including retirees, students, minors, etc.) or estate that receives income while a resident of a taxing school district is subject to school district income tax. Individuals who work, but do not live, in a taxing school district are not subject to the district's income tax.