Submission Agreement Sample With Collateral In Philadelphia

Description

Form popularity

FAQ

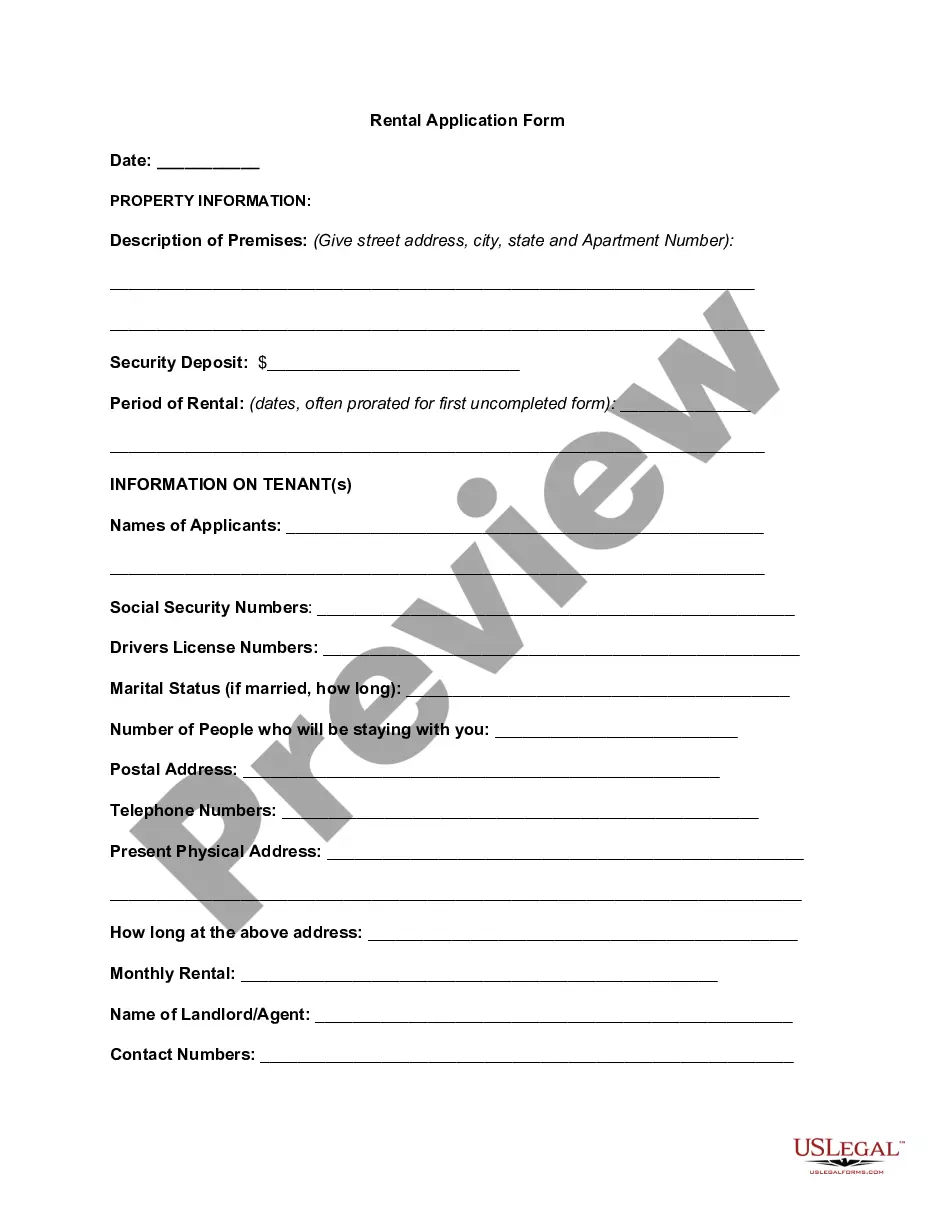

Most performing or investment-grade assets held by depository institutions are acceptable as collateral. Reserve Banks require a perfected security interest in all collateral pledged to secure Discount Window loans. Reserve Bank staff can offer guidance on other types of collateral that may be acceptable.

To pledge, the securities must be transferred to the pledging institution's restricted securities account (U102). Operating Circular 7, Book-Entry Securities Account Maintenance and Transfer Services contains specific information regarding Fedwire® accounts. Additional information can be found at FRBservices.

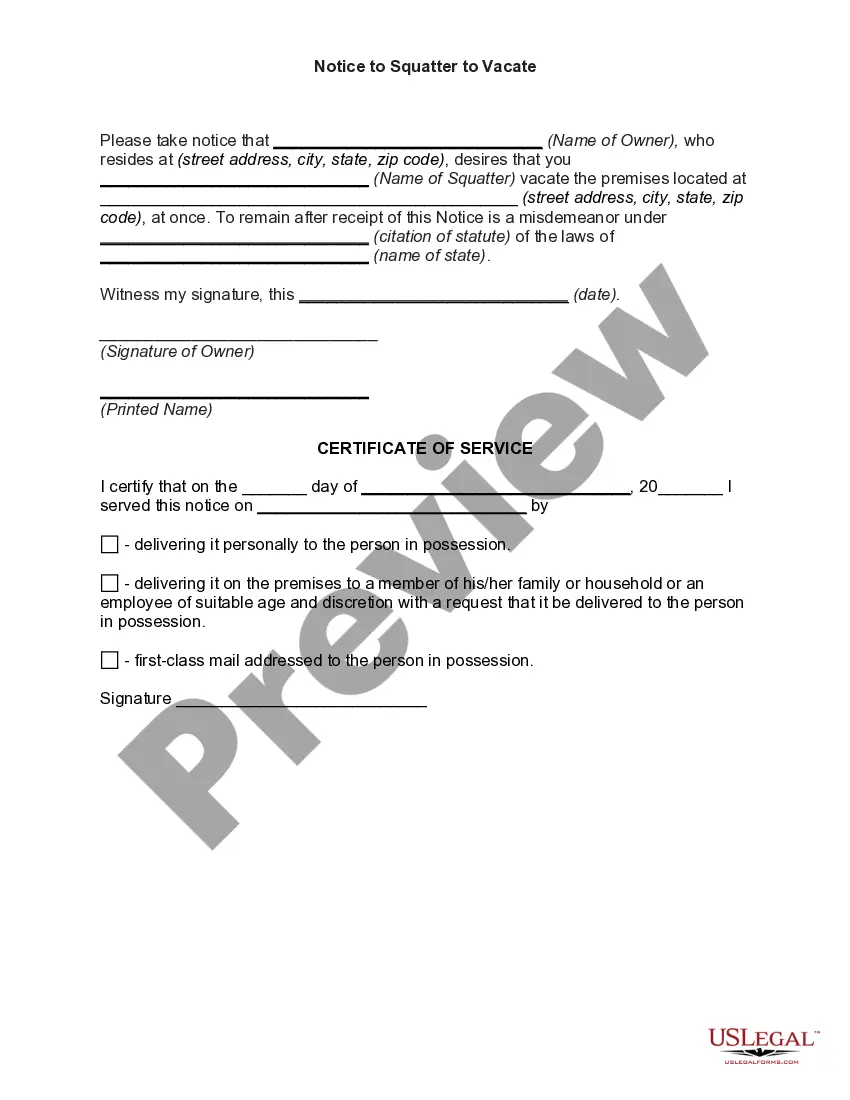

By providing ready access to funding, the discount window helps depository institutions manage their liquidity risks efficiently and avoid actions that have negative consequences for their customers, such as withdrawing credit during times of market stress.

Anticipatory stigma reduces the discount window's effectiveness because borrowing requires operational preparations, which a bank may see as not worth the effort if it anticipates that stigma would ultimately deter it from borrowing.

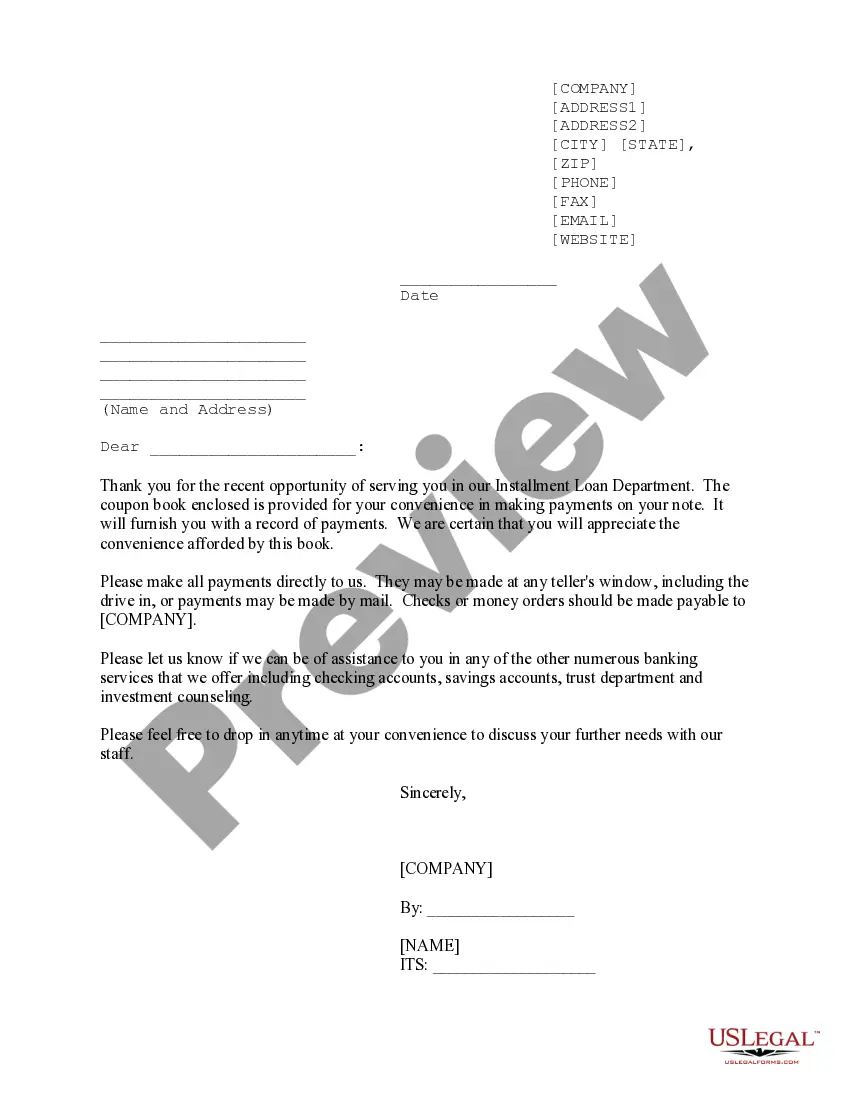

The discount window allows depository institutions and U.S. branches and agencies of foreign banks to borrow from Federal Reserve Banks after executing legal agreements and pledging collateral.

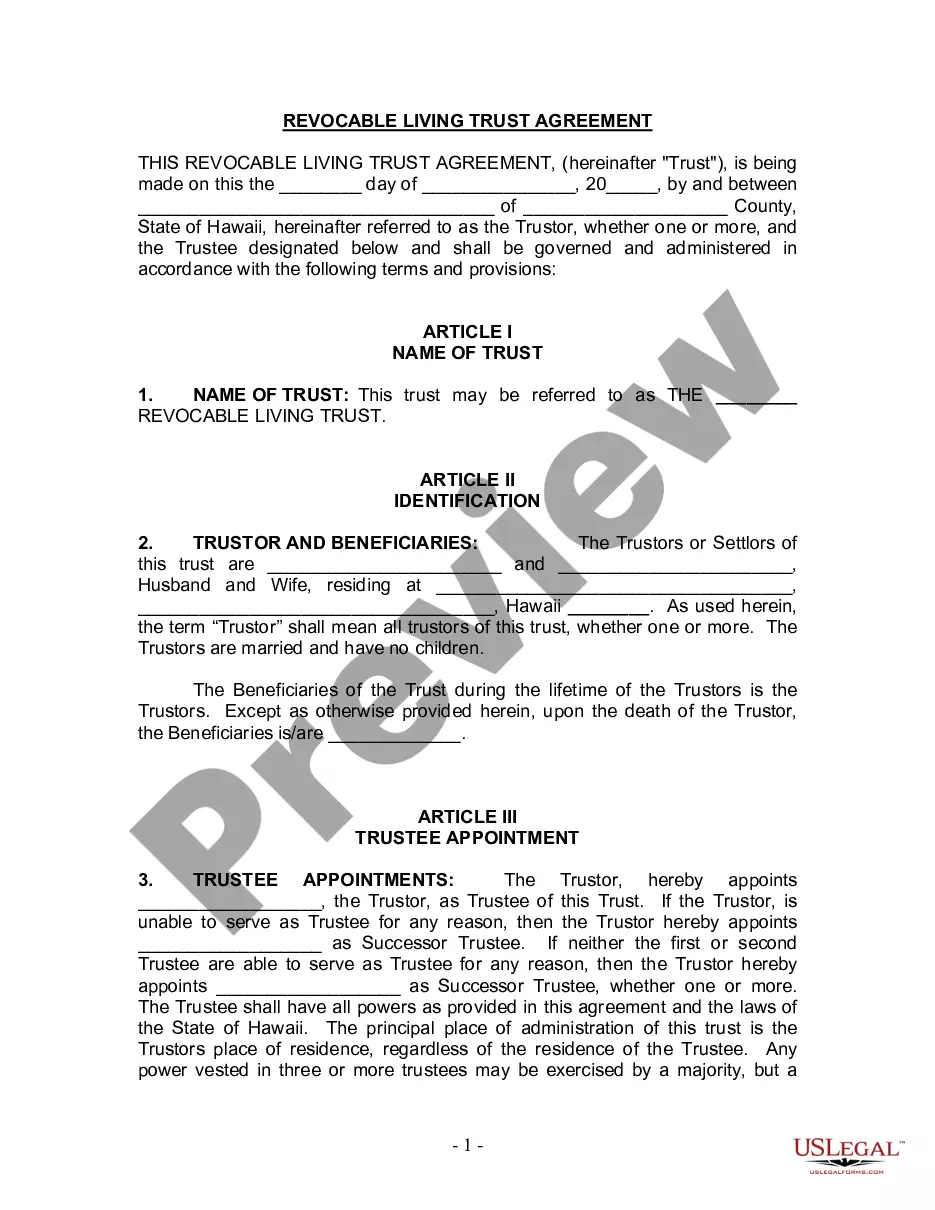

One of the main purposes of a collateral agreement is to reduce the credit risk of the parties involved in a financial transaction. Credit risk is the risk of loss due to the default or deterioration of the creditworthiness of a counterparty.

Ancillary Agreements and Forms The Agreement for Third-Party Custodian to Hold Collateral allows an institution to designate a third-party custodian to provide collateral custody services in connection with the discount window.

These agreements allow the secured party to perfect a security interest in collateral posted by the pledgor while ensuring that, in the event of the bankruptcy or insolvency of the secured party, such collateral will not become a part of the secured party's estate and will, to the extent owed to the pledgor, be ...

A Security Agreement, also known as a Collateral Agreement or Pledge Agreement, gives to a lender or other party a security interest in property that a debtor or obligor owns.