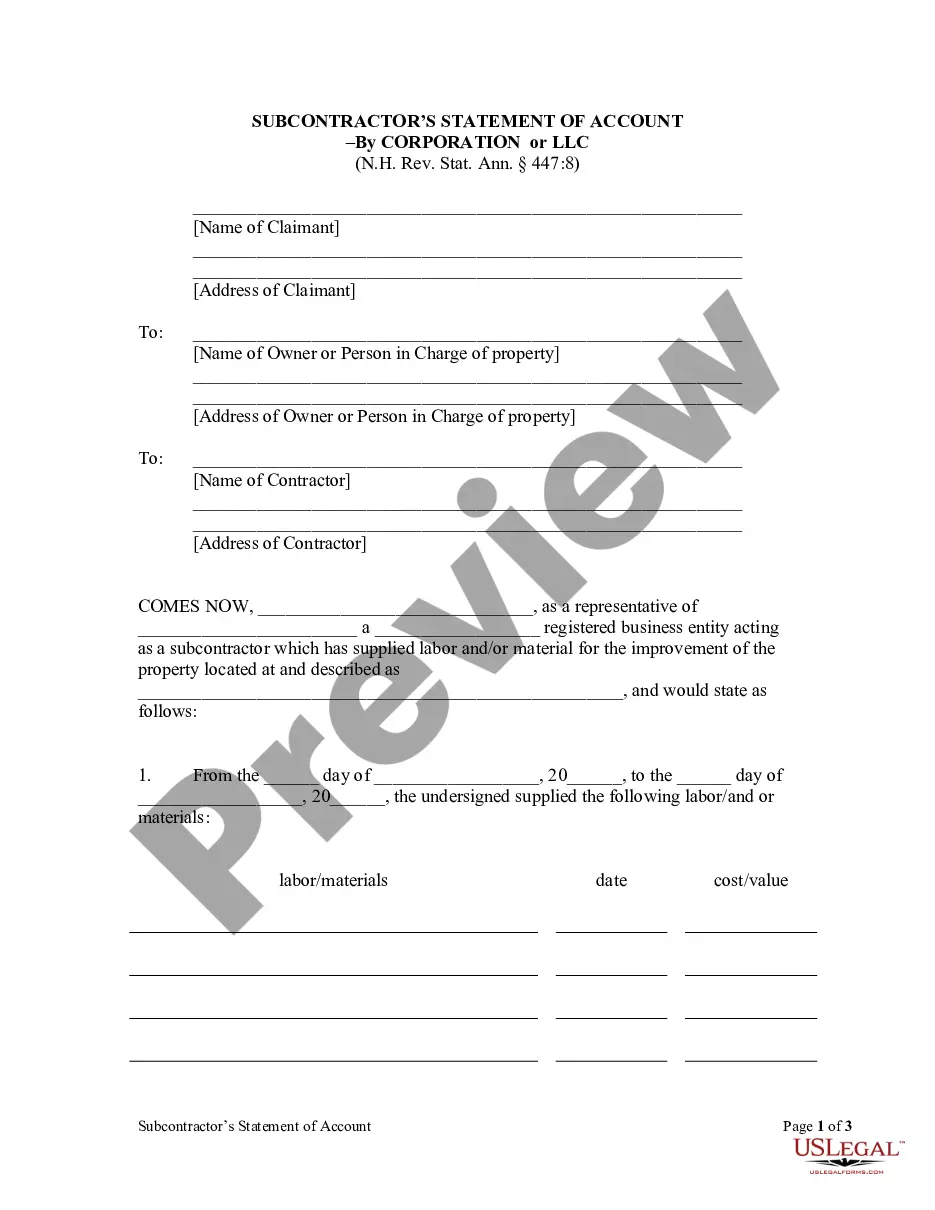

This form is a sample letter in Word format covering the subject matter of the title of the form.

Admission Letter For Form One 2023 In Massachusetts

Description

Form popularity

FAQ

The Massachusetts RMV-1 Application Form is used for vehicle registration, title transfer, and related processes.

When filling out Line 14 (which is for nonresidents): Line 14a: Total 5% income - Get it from Line 12 of Massachusetts Form 1-NR/PY.

You may need the following: Copies of last year's federal and state tax returns. Personal information including. Records of your earnings (W-2 forms from each employer or 1099-MISC forms if you're a contractor) Records of interest and dividends from banks (1099 forms: 1099-INT, 1099-DIV, etc.)

The Massachusetts RMV-1 Application Form is used for vehicle registration, title transfer, and related processes.

Form 1 - Massachusetts Resident Income Tax Return.

A Final Total Scaled Score of 270 or greater is required to pass the Massachusetts Bar Examination.

The official form for filing a Massachusetts amended return is MA Form CA-6 - Application for Abatement/Amended Return. The tax program generates Form 33X for accountant's use only.

If you would like your State Income Tax withholding exemptions to be different than what you are claiming on your W-4 (Federal), you will need to fill out a Massachusetts Employee's Withholding Exemption Certificate (M-4).