Letter Acceptance Form With Two Points In Bexar

Description

Form popularity

FAQ

Residence Homestead of 100% or totally Disabled Veterans: House Bill 3613 of 81st Texas Legislature authorized the creation of Section 11.131 of the Texas Property Tax Code. This newly created Section entitles a 100% exemption for a residence homestead of a qualifying Disabled Veteran.

Taxes are calculated by subtracting the value of any exemptions and, if applicable, the cap value from the homestead value of the property, and then adding any productivity or non-qualifying value. This result, the taxable value, is then multiplied by the tax rate per $100.

Persons with a residence homestead are entitled to a 20% exemption of the market valuation of their home.

Do you have your Residential Homestead Exemption? To find out, visit our website by clicking the green box here ? application and then mail to BCAD, P.O. Box 830248, San Antonio, TX 78283. For more information, please call 210-335-2251.

Persons with a residence homestead are entitled to a 20% exemption of the market valuation of their home.

Procedures: Please e-file all appropriate documents for your case with the Bexar County Probate Clerk's office, including Proposed Orders, Judgments, Affidavits of Heirship, and Proof of Death for review.

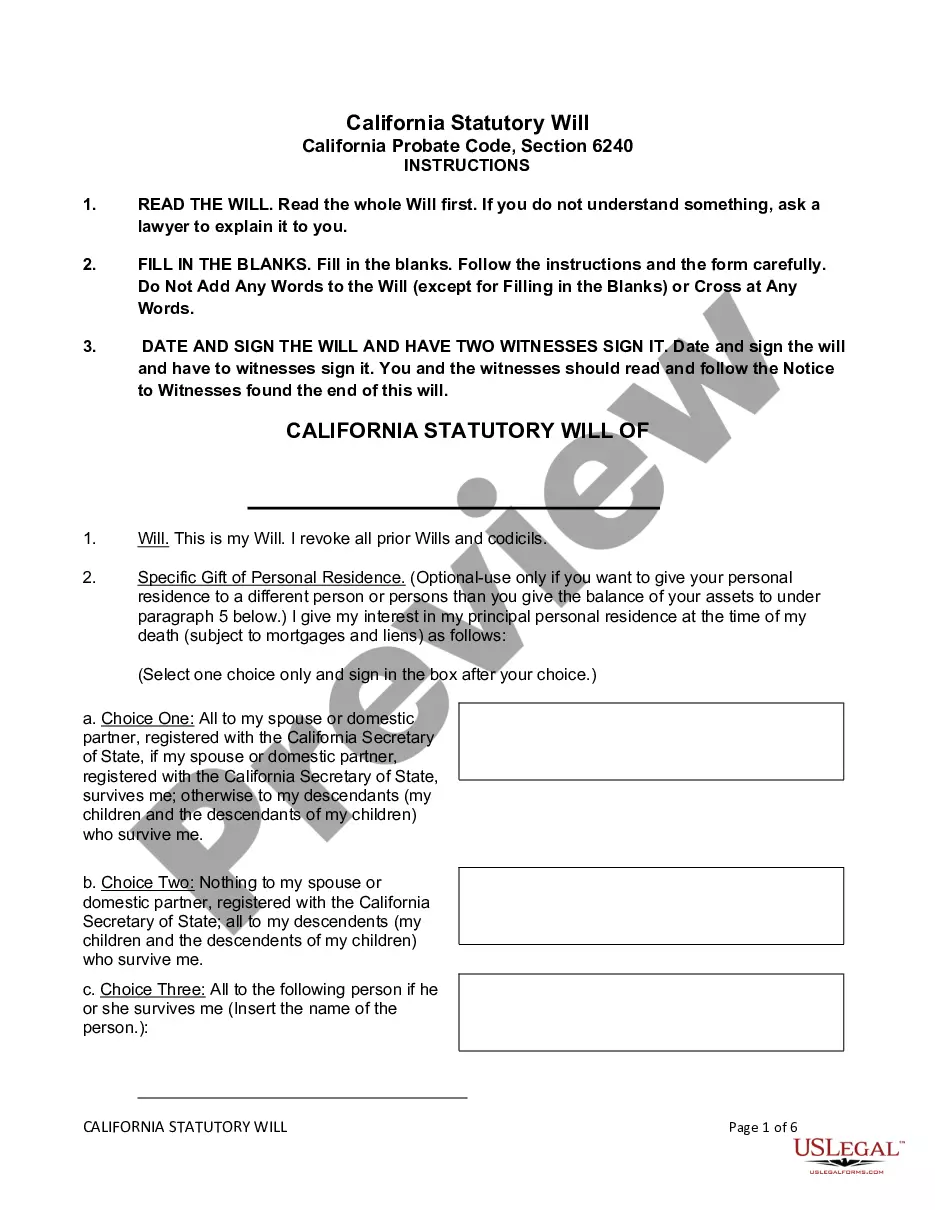

The Texas affidavit of heirship form must be filled out and filed on behalf of a decedent's heir and can not be completed by the heir. Instead, two disinterested parties who know the necessary details about a decedent's family life need to fill out the form.

Once you complete the small estate affidavit and the affidavit of heirship, you must file them with the clerk of the court at the probate court in the county where the deceased was a resident.

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the “AFFIANT”.