Chattel Mortgage Form With Decimals In Washington

Description

Form popularity

FAQ

When can a lien be filed against you? A lien against a consumer must be filed within 90 days of work stoppage, or delivery of materials. Additional information regarding the timeline for filing liens may be found in RCW 60.04.

For both residential and commercial projects, general contractors and subcontractors must file a claim of lien at the county auditor's office in the county where the work was performed within ninety (90) days after the last day labor, materials, equipment or services were provided at the site.

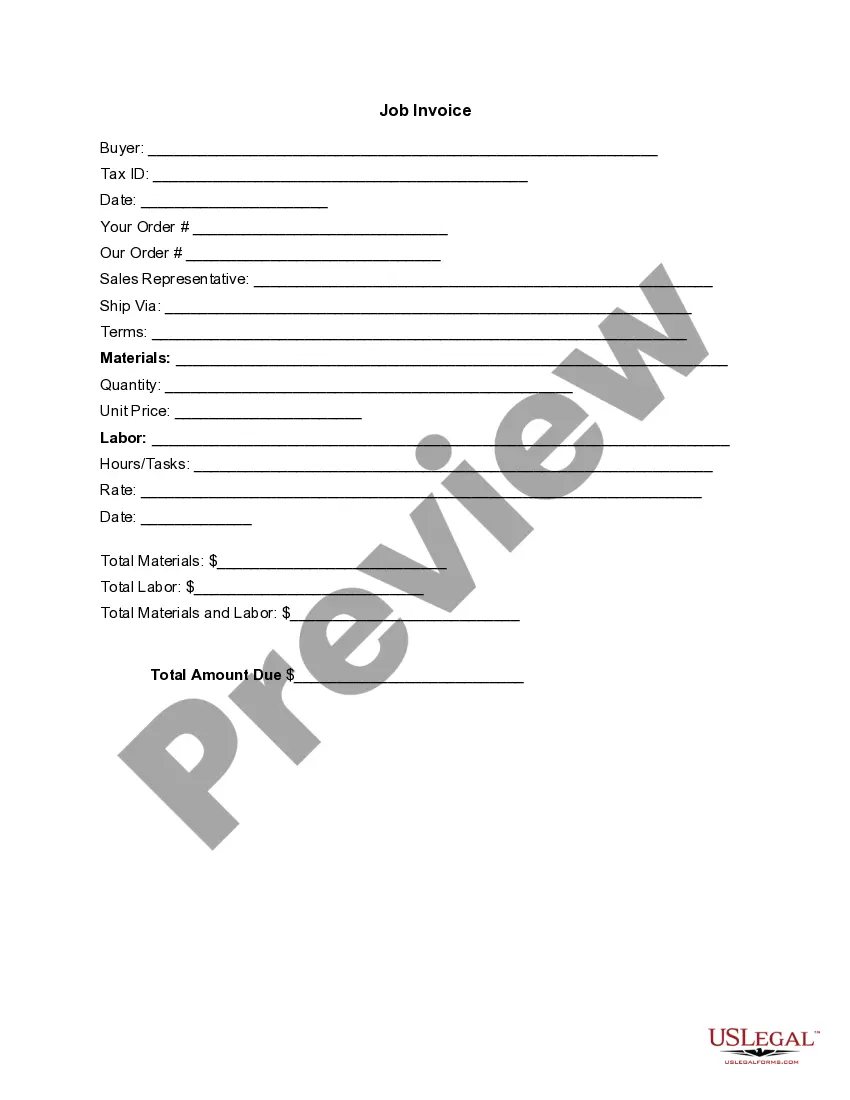

Every person, firm or corporation who shall have performed labor or furnished material in the construction or repair of any chattel at the request of its owner, shall have a lien upon such chattel for such labor performed or material furnished, notwithstanding the fact that such chattel be surrendered to the owner ...

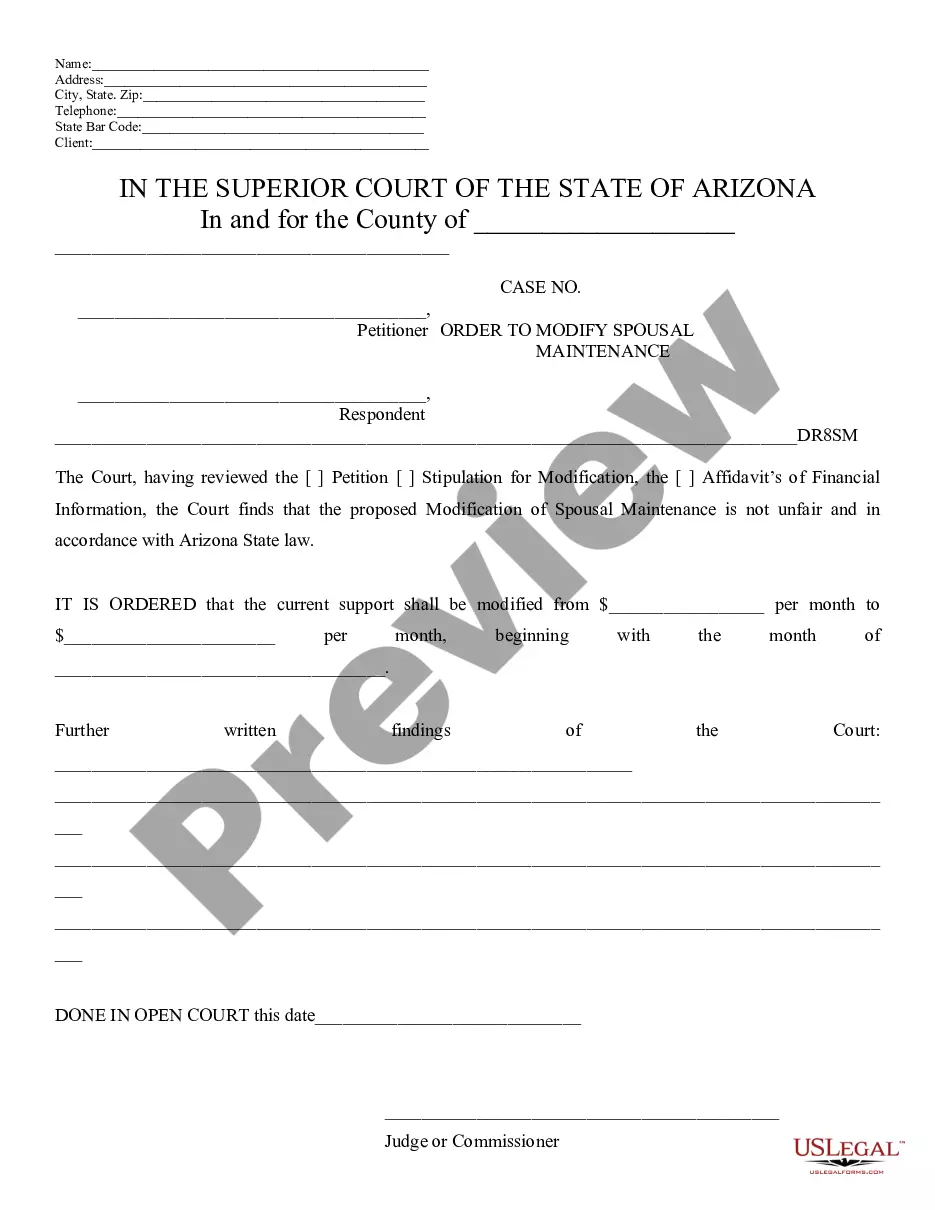

A judgment lien in Washington will remain attached to the debtor's property (even if the property changes hands) for ten years.

Chattel is any tangible personal property that is movable. Examples of chattel are furniture, livestock, bedding, picture frames, and jewelry.

By chattel mortgage, personal property is recorded in the Chattel Mortgage Register as a security for the performance of an obligation. If the movable, instead of being recorded, is delivered to the creditor or a third person, the contract is a pledge and not a chattel mortgage.

A pledge involves transferring possession of the property to the lender, who retains it until the debt is repaid. On the other hand, a mortgage entails transferring ownership interest in the property to the lender, while the borrower retains possession and usage rights.

The traditional mortgage is only for stationary property. It's suited for long-term real estate investments. Chattel loans are for property that can be easily moved. They're also an option for borrowers who want their loans approved faster and with shorter repayment times.