Chattel Mortgage Form Foreclose In Clark

Description

Form popularity

FAQ

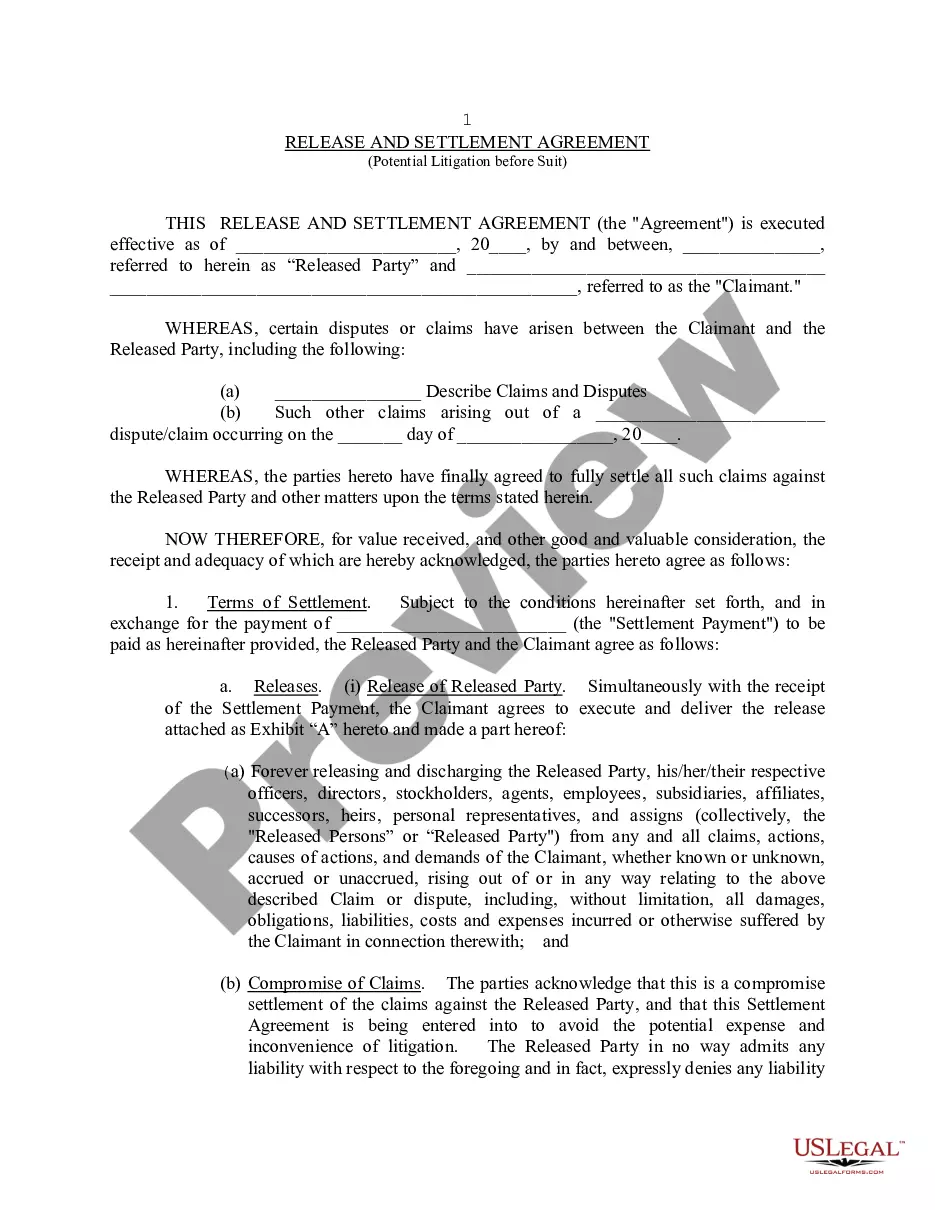

A Cancellation of Chattel Mortgage is used when the parties agree to cancel the mortgage over the property. It is often used when the obligation secured by the mortgage has been fulfilled, cancelled or is no longer existing for any reason.

In nonjudicial pre-foreclosure situations, the pre-foreclosure process is usually quick. For example, the pre-foreclosure process can be as short as 111 days in California. This includes a 90-day default notice period and a 21-day foreclosure sale notice.

Like homeowners in other states, a Nevada homeowner usually gets plenty of time to find a way to work out a way to keep the home before the bank can sell it at a foreclosure sale. Under federal law, in most cases, the bank must wait at least 120 days before starting a foreclosure.

Does Nevada Law Allow for a Redemption Period After a Foreclosure? Nevada law allows for both judicial and non judicial foreclosures. If a lender pursues a foreclosure through the judicial system then the owner has a 1 year right of redemption following the foreclosure sale.

Like homeowners in other states, a Nevada homeowner usually gets plenty of time to find a way to work out a way to keep the home before the bank can sell it at a foreclosure sale. Under federal law, in most cases, the bank must wait at least 120 days before starting a foreclosure.

Public records Throughout the foreclosure process, various legal notices must be filed in your County Recorder's Office. This information is public record and available to anyone. Just visit your county's office and you can search for a Notice of Default (NOD), lis pendens or Notice of Sale.

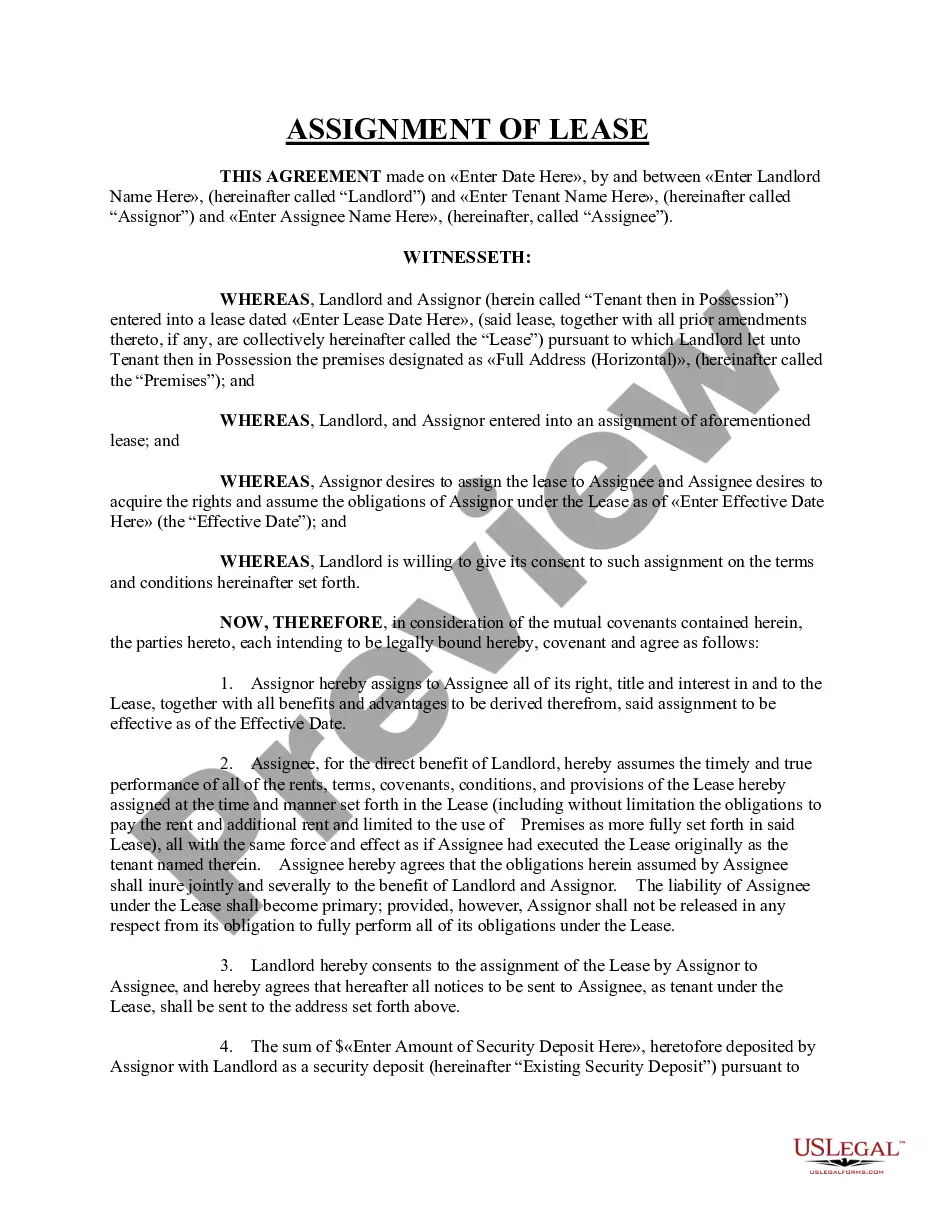

Chattel is any tangible personal property that is movable. Examples of chattel are furniture, livestock, bedding, picture frames, and jewelry.

Foreclosures can stay on your credit reports for up to seven years.

Deed in Lieu of Foreclosure It benefits both the lender and the borrower. To initiate the process, the borrower will submit a loss mitigation application to their mortgage provider. If all goes well, the borrower will be relieved of their debts on the property, though this is not always the case.