Board Meeting Minutes Corporate Withholding In Phoenix

Description

Form popularity

FAQ

If mailing, send your completed form to the Georgia Department of Revenue, Taxpayer Services, at 1600 West Monroe Street, Phoenix AZ 85007. Important dates for filing the Arizona Form 140 include the submission deadline of April 15, 2024. To avoid penalties, ensure timely filing.

Once registered with ADOR, the business' withholding ID number with the Arizona Department of Revenue is the company's EIN. If a letter from DES is not received, please contact DES to check on the status of the UI employer account number.

NOTE: An amended Form A1-QRT can only be electronically filed through by a PSC or by an employer filing through a registered transmitter. All other employers required to file an amended Form A1-QRT must file a paper return.

If you have an Arizona tax liability when you file your return or if at any time during the current year conditions change so that you expect to have a tax liability, you should promptly file a new Form A-4 and choose a withholding percentage that applies to you.

Keep in mind for tax year 2023 and beyond, the tax rate for Arizona taxable income is 2.5%.

To register for both an income tax withholding account with the Department of Revenue and an unemployment insurance account with the Department of Economic Security, the employer will need to complete the JT-1 application on AZTaxes or complete the form and return the completed form to the department.

You may change the withholding amount by completing Arizona Form A-4 to change the previous withholding amount or percentage. Complete Arizona Form A-4 and provide it to your employer. Keep a copy for your records.

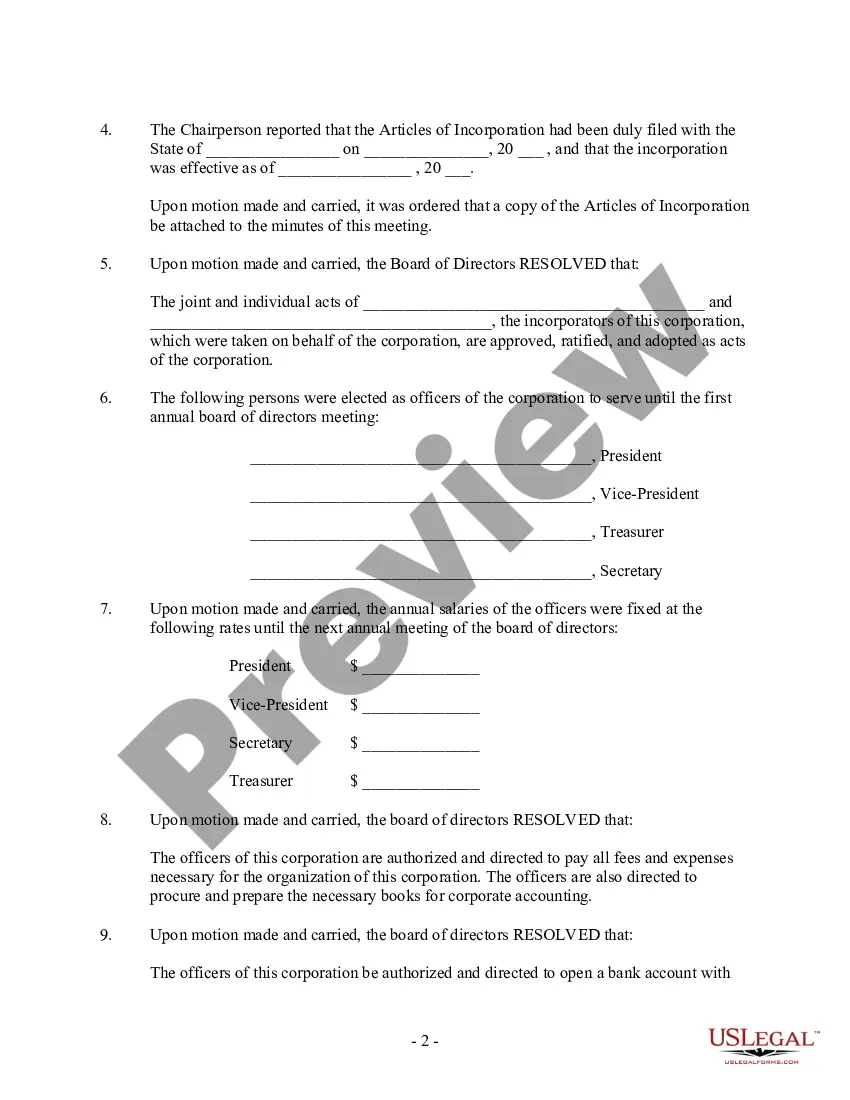

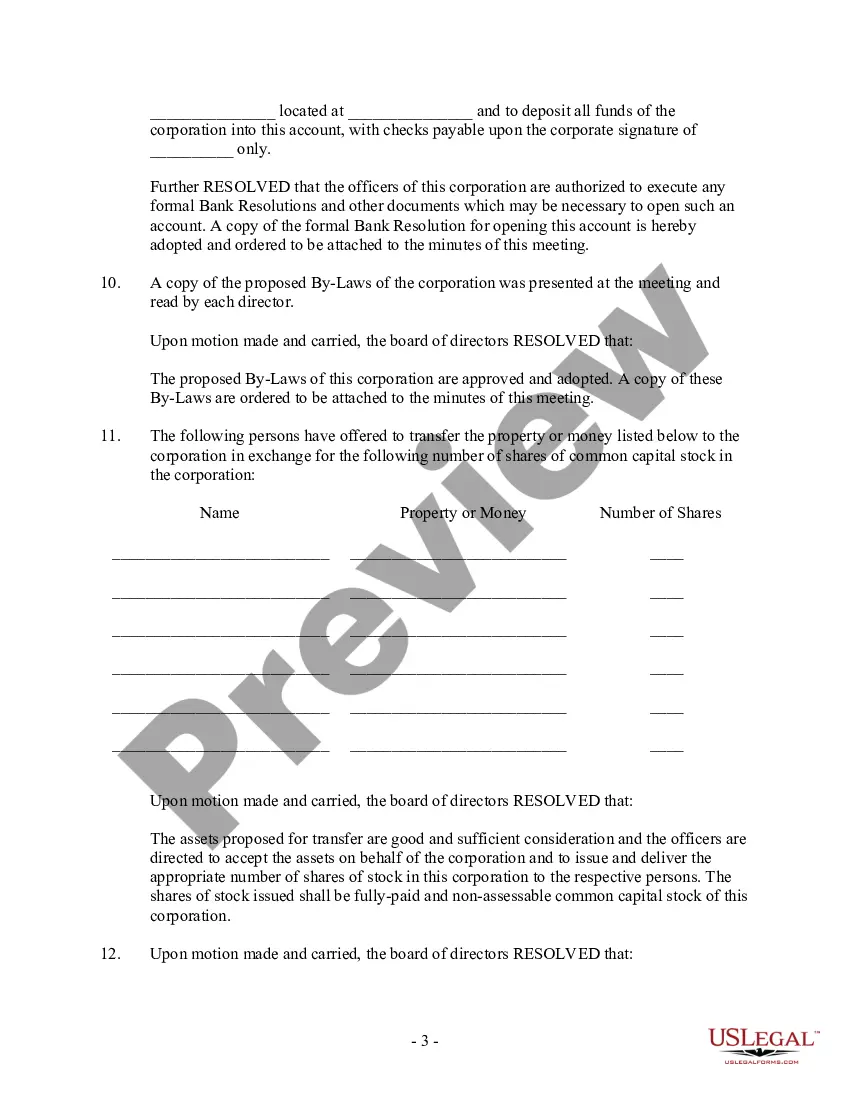

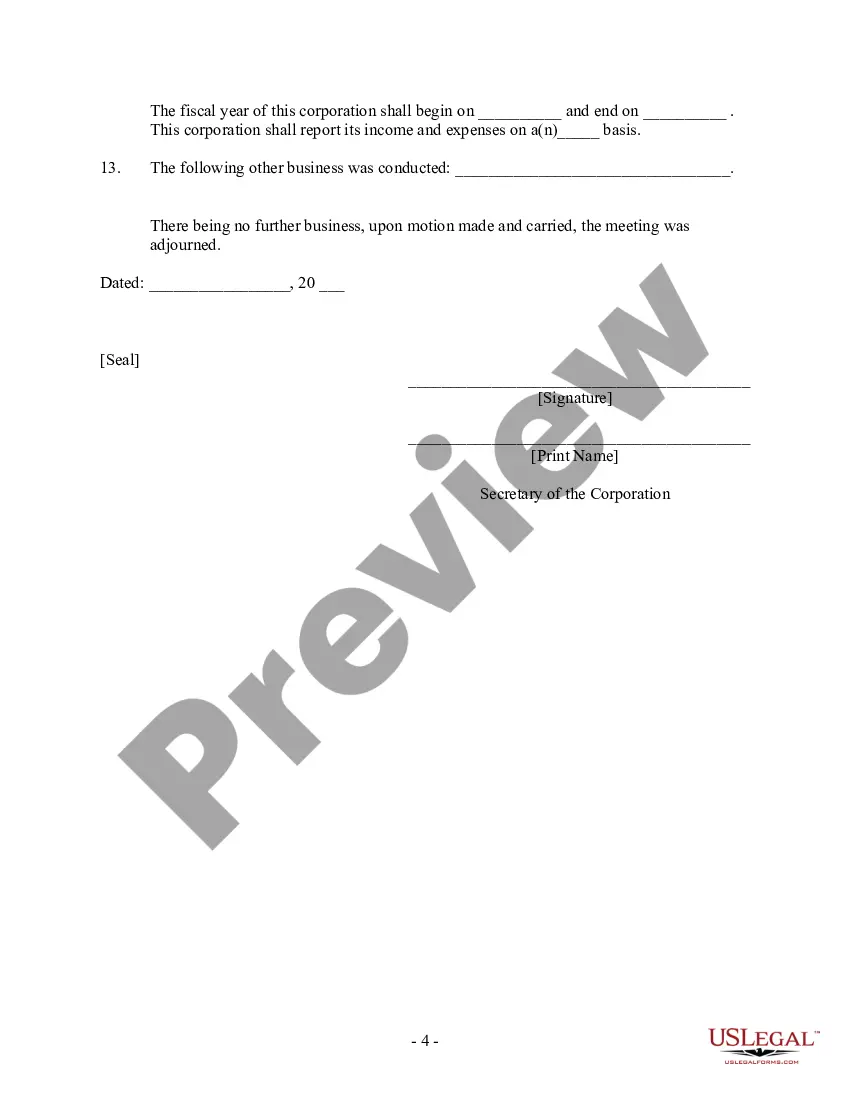

Be Objective: Avoid subjective comments and stick to facts. Use Bullet Points: They help in making the minutes easier to scan. Be Concise: Summarize discussions and decisions without unnecessary detail. Use Clear Language: Avoid jargon unless it's commonly understood by all attendees.

How to write meeting minutes Prepare a template before the meeting. Take notes during the meeting. Collect copies of any reports or presentations. Review your notes. Create a final draft. Request approval from leadership. Deliver the meeting minutes.

Board meeting minutes should be prepared and distributed in a timely manner after each board meeting. Ideally, minutes should be circulated to board members for review and approval within a reasonable timeframe, such as before the next scheduled meeting.