Borrowing For Rental Property In Tarrant

Description

Form popularity

FAQ

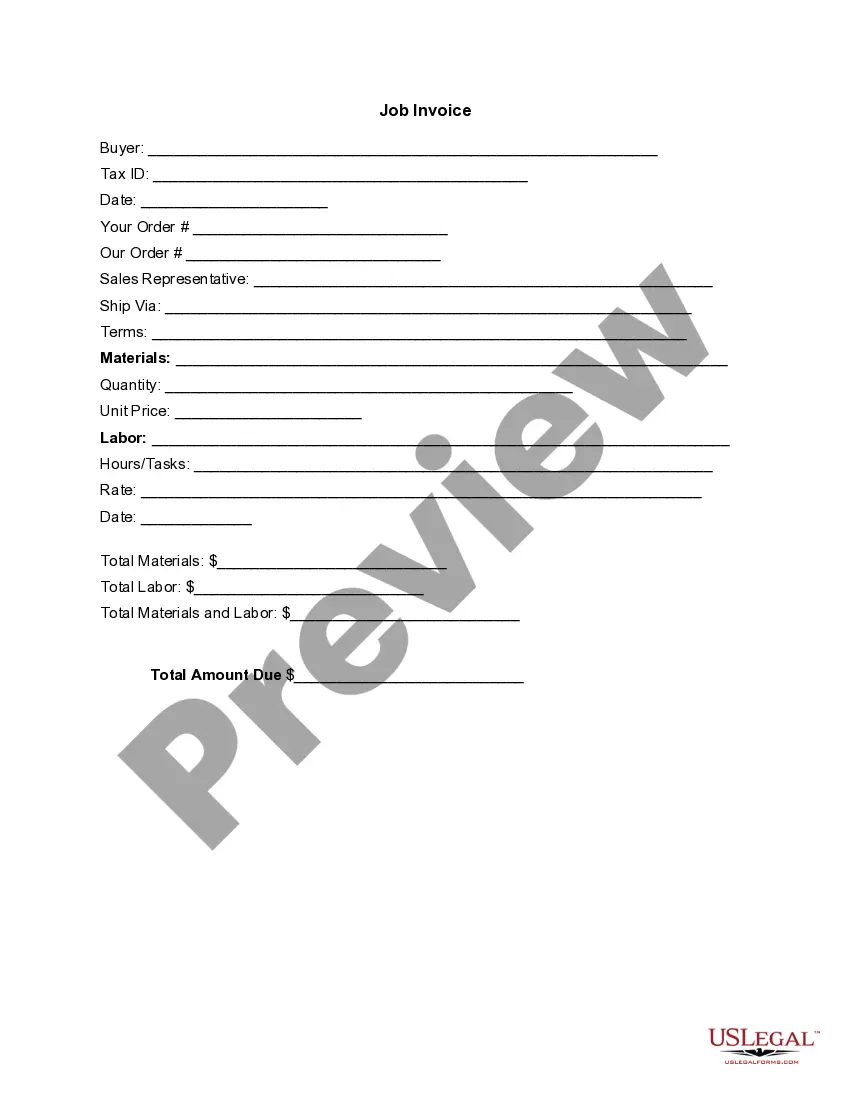

50 Percent Rule Formula For Real Estate You are literally just multiplying the monthly rent by 0.5 to estimate the property 's operating expenses. To do the calculation in your head, you can just divide the rental income by 2 (mathematically this is exactly the same as multiplying the rent by 0.5).

The 50% rule or 50 rule in real estate says that half of the gross income generated by a rental property should be allocated to operating expenses when determining profitability. The rule is designed to help investors avoid the mistake of underestimating expenses and overestimating profits.

Minimizing or eradicating taxes on rental income involves employing strategies such as 1031 exchanges, utilizing self-directed IRAs, claiming depreciation and deductions, leveraging equity through borrowing, deferring sales, and potentially becoming a real estate agent.

The rule suggests that about half of the property's rental income should cover expenses, and the other half is an estimate of the property's net operating income (NOI). The 50% rule is a starting point and not a strict formula. Different property types, locations, and market conditions can affect actual expenses.

Your deposit You'll typically need a 20% deposit to buy an investment property. This can come from your savings or equity from your existing home. Learn how to supercharge your savings and use equity to buy an investment property. If you don't have a full 20% deposit, you can take out Lender's Mortgage Insurance (LMI).

Typically, Texas lenders require a minimum of 20% down payment for investment property loans to account for the higher risk involved compared to owner-occupied properties.

Texas has a diverse economy and a large range of industries, which makes it a good place for investment property opportunities.

Thanks to its favorable regulations for rental property owners, Texas holds its reputation as one of the most landlord-friendly states in the US. From favorable eviction processes to light restrictions on security deposits, the state maintains an open market for real estate investors.

With landlord-tenant laws that favor landlords, relatively low median house prices, and consistently strong population growth, investors have many reasons to consider investing in the Lone Star State. As you know, some markets within a state are better than others, and Texas is no different.