Officers Certificate Example Withholding In San Bernardino

Description

Form popularity

FAQ

Accreditation officer in British English (əˌkrɛdɪˈteɪʃən ˈɒfɪsə ) noun. a person who is responsible for all aspects of the accreditation of an educational institution.

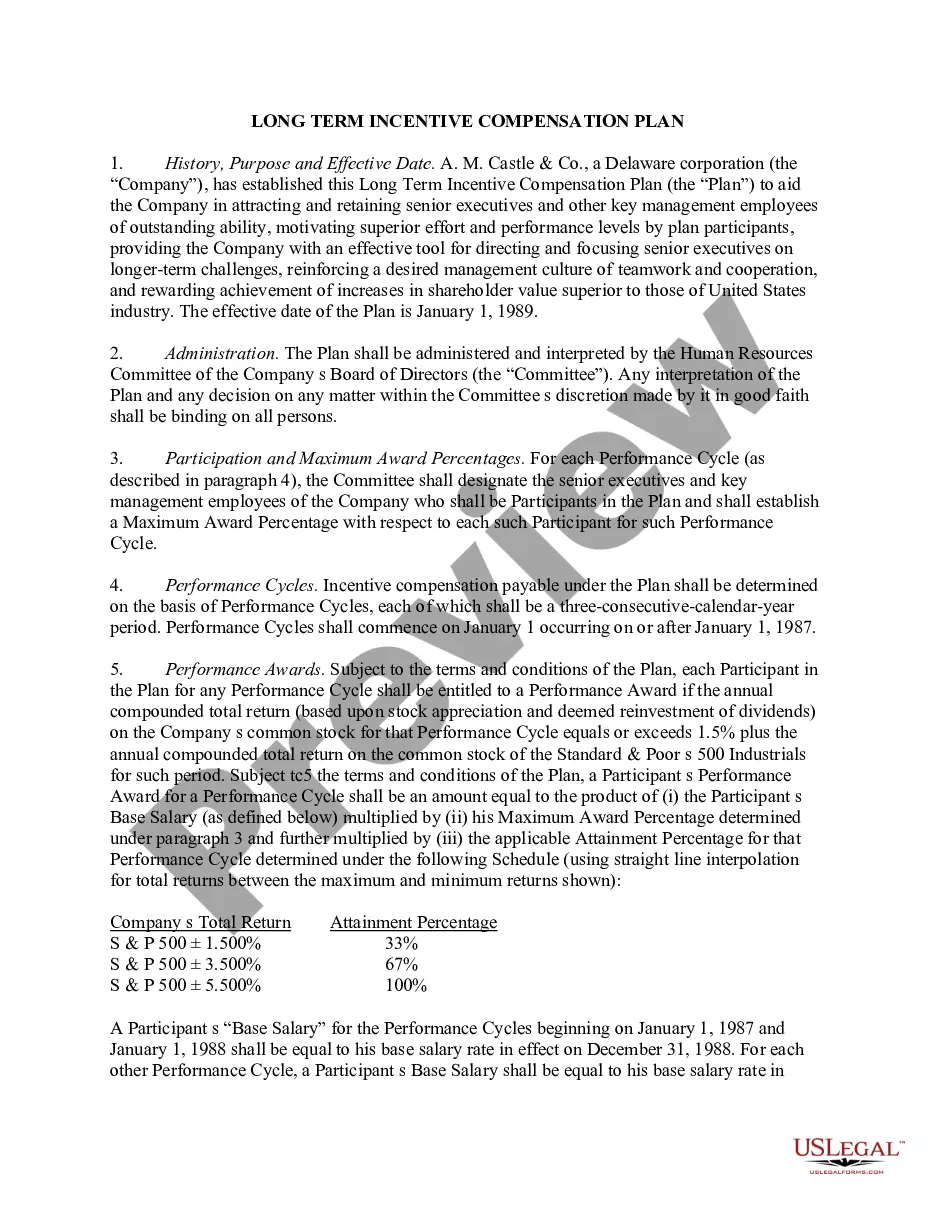

"Officers' certificate" means a certificate signed and verified by the chairperson of the board, the president or any vice president and by the secretary, the chief financial officer, the treasurer or any assistant secretary or assistant treasurer.

An Officers Certificate is a document signed by a company's officer certifying certain facts about the company.

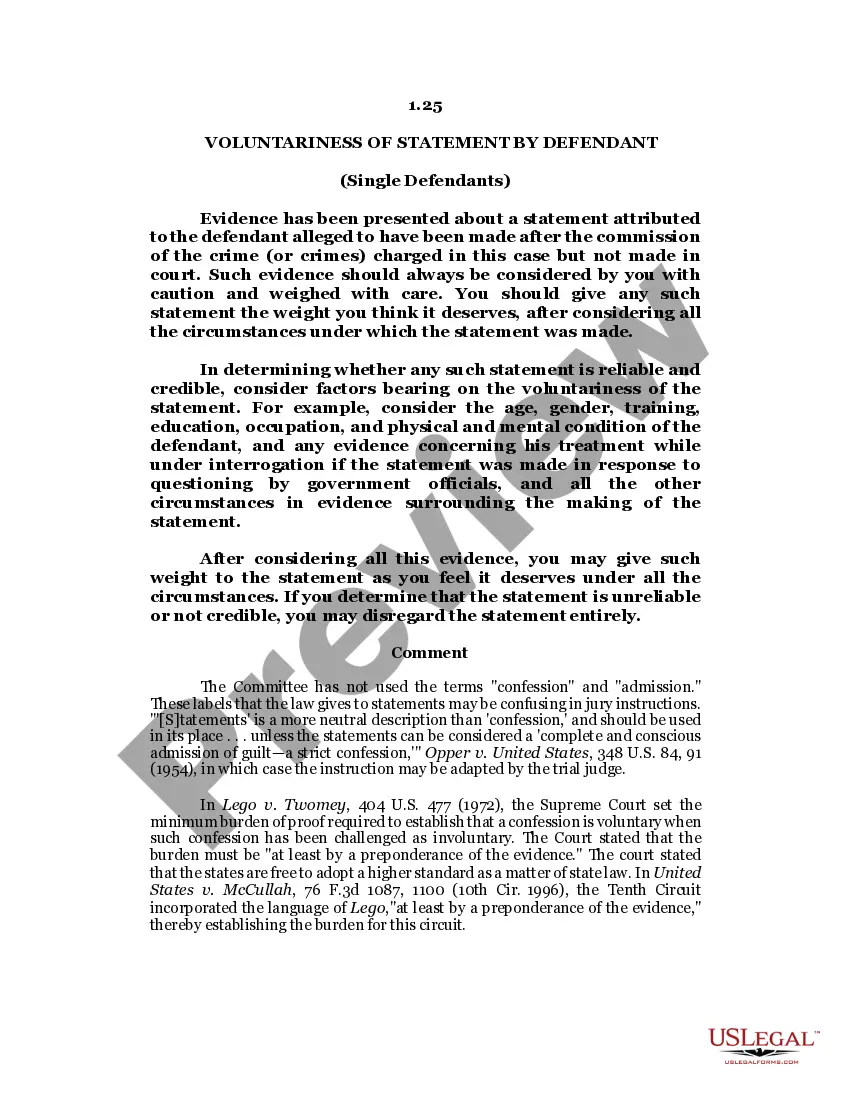

Complete California State DE-4 Form Select Form DE-4 tab. Review your Full Name and Home Address. Select your Filing Status. Enter the Number of allowances you wish to claim in Section 1. Enter any Additional amount you want withheld from each paycheck in Section 2.

As referenced above, a typical officer's certificate certifies that various closing conditions have been satisfied as of the closing date, whereas the secretary's certificate is necessary during the closing to ensure that the selling entity is duly organized or incorporated and capable of effecting the transaction.

Complete California State DE-4 Form Select Form DE-4 tab. Review your Full Name and Home Address. Select your Filing Status. Enter the Number of allowances you wish to claim in Section 1. Enter any Additional amount you want withheld from each paycheck in Section 2.

You can claim anywhere between 0 and 3 allowances on the W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

Overview of California Taxes Gross Paycheck$2,415 Social Security 6.20% $150 Medicare 1.45% $35 State Disability Insurance Tax 1.00% $24 State Unemployment Insurance Tax 0.00% $023 more rows

California (CA) State Withholding Tax Laws The UC Accounting Manual directs that honorarium payments to residents of foreign countries who perform services in California or who received income from California sources are subject to State income tax withholding.

Effective January 1, 2024, the annual standard deduction will increase to $5,363 or $10,726 based on the employee's filing status and the number of allowances claimed. The value of a state allowance increases to $158.40 annually.