Letters Of Appreciation With Numbers In Minnesota

Description

Form popularity

FAQ

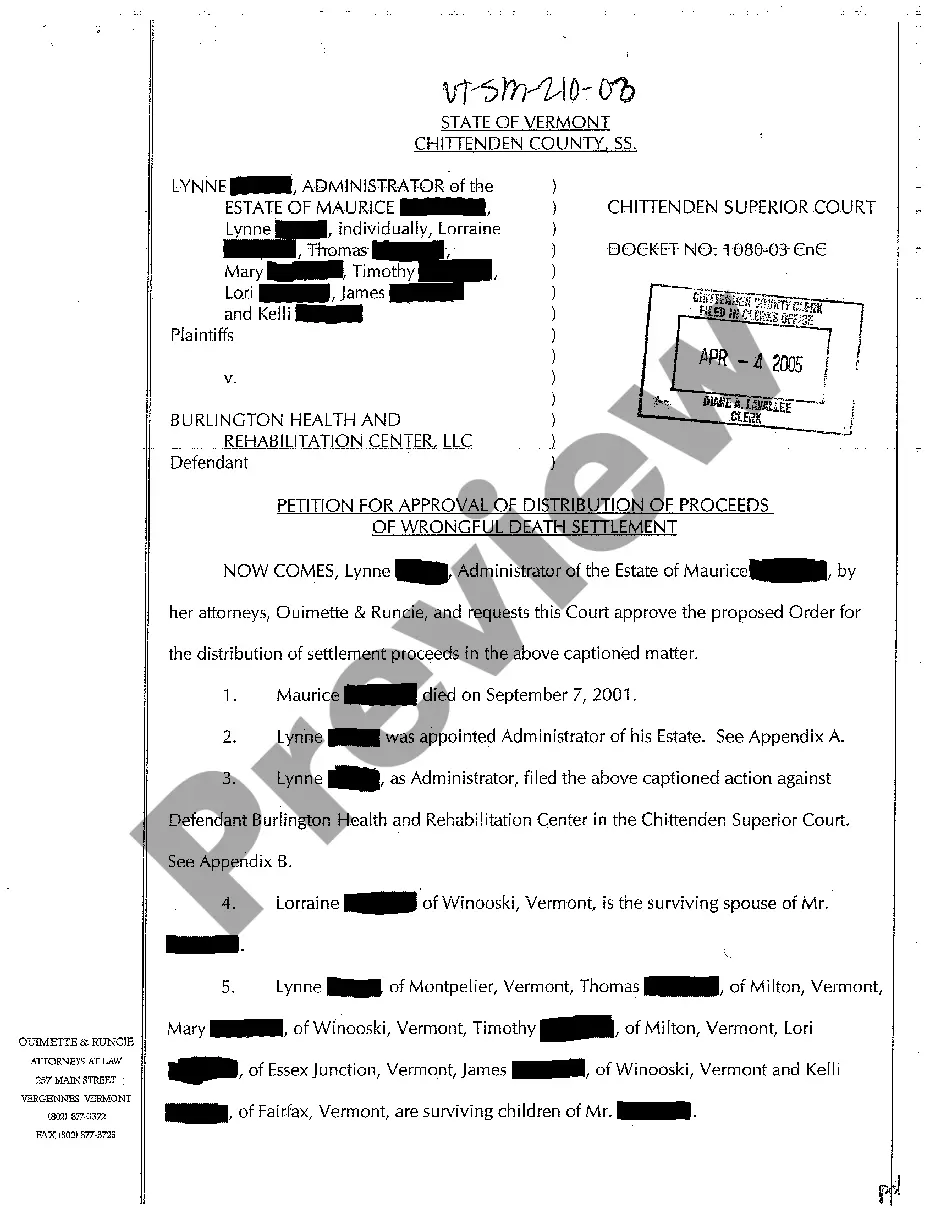

Settling an estate starts with finding and collecting information about any estate planning documents the deceased persona, referred to as the decedent had. These documents appoint someone to handle the estate, care for minor or disabled dependents, identify estate assets and where they are located.

In Minnesota, if a decedent has less than $75,000 of assets and no real estate, they may bypass the probate process. If a trust is involved, there will be a trustee or trustees. The trust must go through an administrative phase, the process for closing out the trust.

In Minnesota, creditors have 1 year from the decedent's death to file a claim against the estate, or 4 months from the initial publication of the creditor notice, whichever comes earlier (this 4-month period changes to 28 days from date of individual notification in the case where the creditor was entitled to ...

If your personal property exceeds $75,000 or you own real estate in your name alone, your estate must be probated.

Non-Probate Assets bank or brokerage accounts that are held jointly or with a payable-on-death beneficiary designation to a surviving person; investment or retirement accounts or insurance policies that have a designated beneficiary other than the decedent that survives the decedent; or. property held in a trust.

If your personal property exceeds $75,000 or you own real estate in your name alone, your estate must be probated.

First and foremost, there are a number of asset types that typically do not pass through probate. This includes life insurance policies, bank accounts, and investment or retirement accounts that require you to name a beneficiary.