Master Sales Agreement With Down Payment In Wake

Description

Form popularity

FAQ

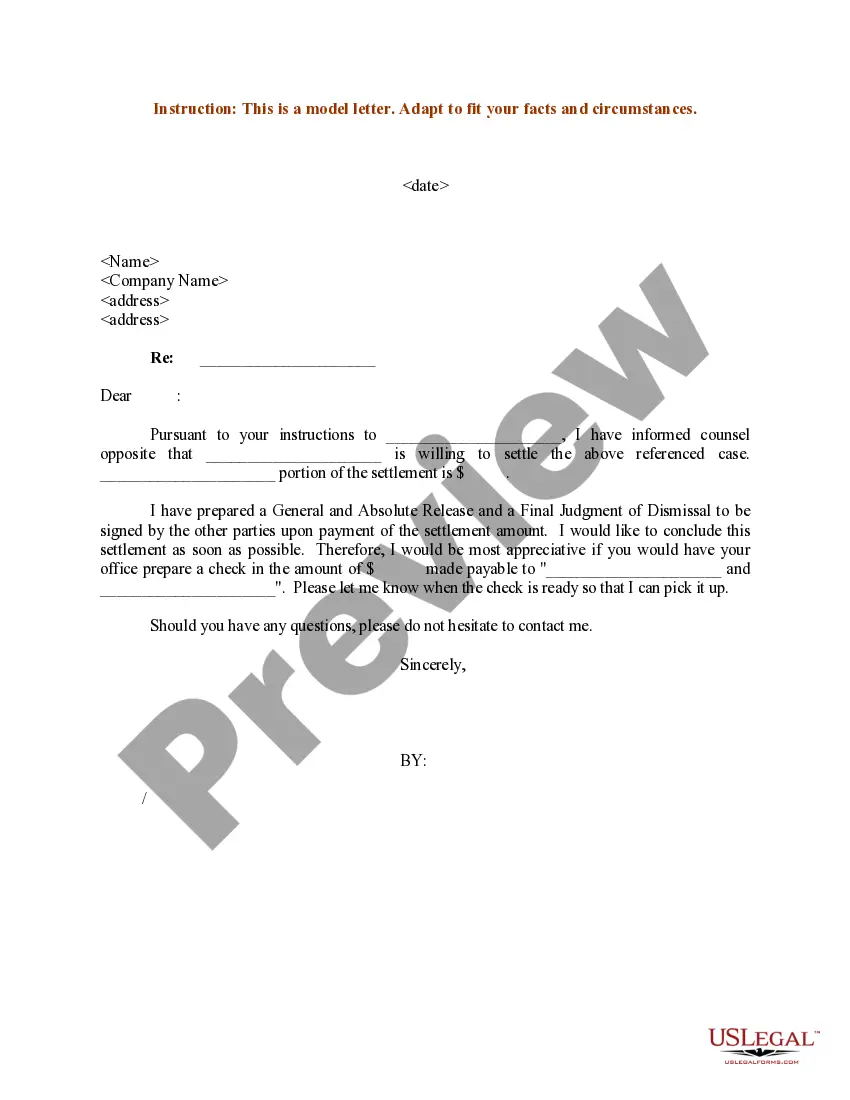

How to write a contract agreement in 7 steps. Determine the type of contract required. Confirm the necessary parties. Choose someone to draft the contract. Write the contract with the proper formatting. Review the written contract with a lawyer. Send the contract agreement for review or revisions.

A comprehensive guide on how to draft a contract Know your parties. Agree on the terms. Set clear boundaries. Spell out the consequences. Specify how you will resolve disputes. Cover confidentiality. Check the legality of the contract. Open it up to negotiation.

Below are four critical topics you and your lawyer should consider when drafting your company's buy-sell agreement. Identify the Parties Involved. Agree on the Trigger Events. Agree on a Valuation Method. Set Realistic Expectations and Frequently Review the Agreement Terms.

How to write an agreement letter Title your document. Provide your personal information and the date. Include the recipient's information. Address the recipient and write your introductory paragraph. Write a detailed body. Conclude your letter with a paragraph, closing remarks, and a signature. Sign your letter.

Ing to Boundy (2012), typically, a written contract will include: Date of agreement. Names of parties to the agreement. Preliminary clauses. Defined terms. Main contract clauses. Schedules/appendices and signature provisions (para. 5).

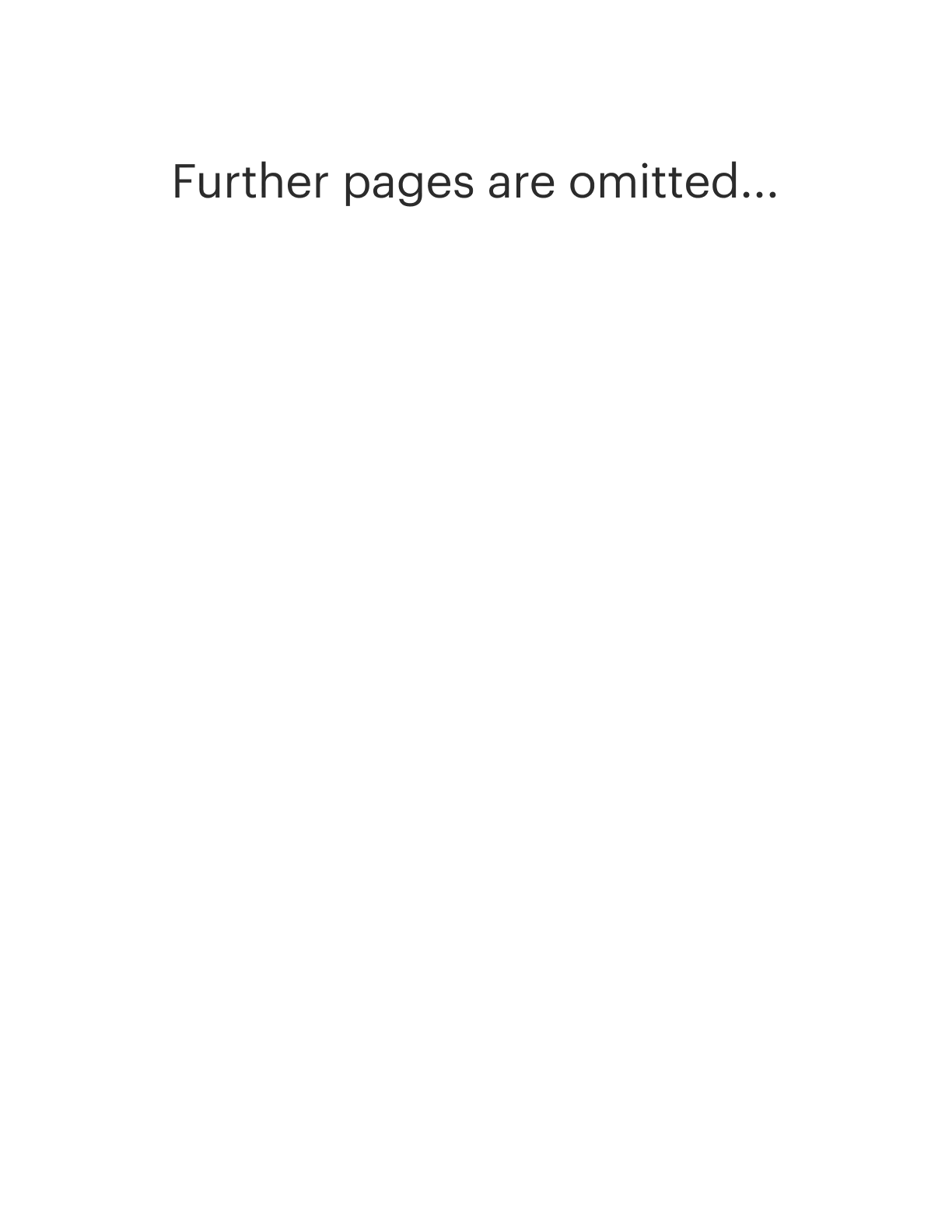

How do you write a contract for sale? Title the document appropriately. List all parties involved in the agreement. Detail the product or service, including all rights, warranties, and limitations. Specify the duration of the contract and any important deadlines.

Elements of a sales agreement Buyer and seller names and contact information. Description of goods, services, or property being purchased. Payment amount, dates, and method. Liability of each party in the case of loss, damage, or delivery failure. Ownership information, such as when ownership formally transfers to the buyer.

A down payment is an initial, up-front payment made during the confirmation of a sales transaction. Down payments reduce the risk for both parties (the seller and the buyer) as they indicate a mutual commitment to complete the sales transaction.