Cancellation Agreement Form For Payment In North Carolina

Description

Form popularity

FAQ

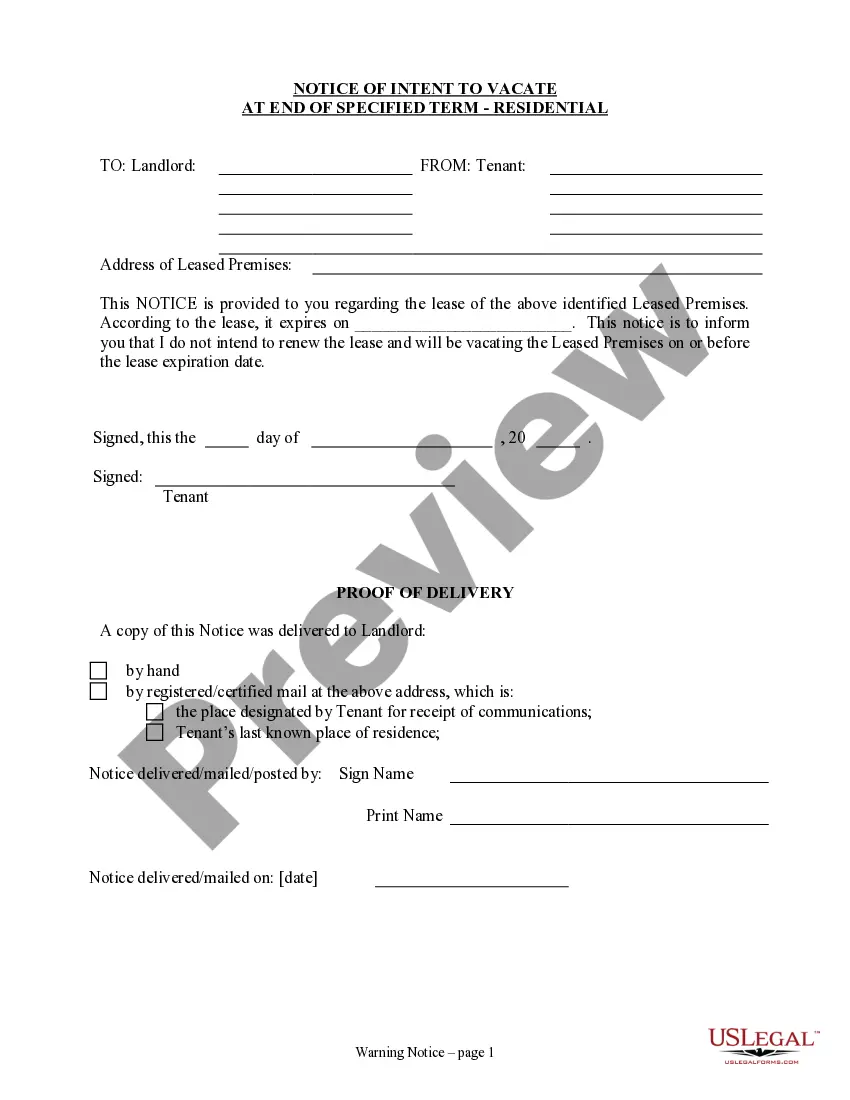

Writing the Cancellation Letter Clearly State the Purpose. Begin your cancellation letter by directly stating its purpose at the outset. Mention Details of the Contract or Service. Include a Request for Confirmation. Closing and Signature.

As a general rule, a contract is binding as soon as you sign it, and you do not have the right to cancel the contract. However, in some instances, North Carolina law, and sometimes federal law, gives you the right to cancel certain transactions even after you have signed a contract or agreement.

Writing--or hiring an attorney to write--a contract cancellation letter is the safest way to go. Even if the contract allows for a verbal termination notice, a notice in writing provides solid evidence of your decision, and it's always a good idea to have a written record.

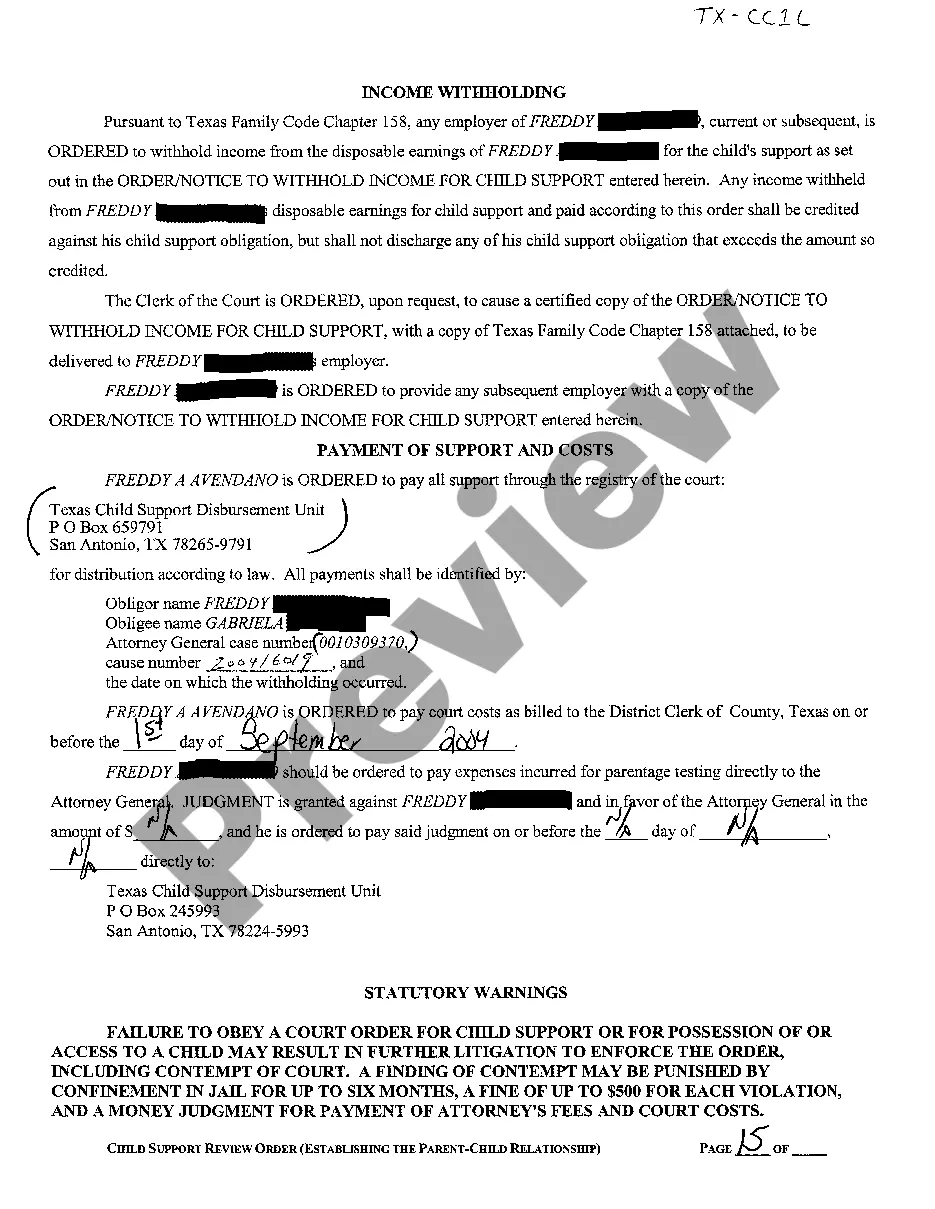

Cooling-off rule. Cooling-off Rule is a rule that allows you to cancel a contract within a few days (usually three days) after signing it. As explained by the Federal Trade Commission (FTC), the federal cooling-off rules gives the consumer three days to cancel certain sales for a full refund.

Cooling-off Rule is a rule that allows you to cancel a contract within a few days (usually three days) after signing it. As explained by the Federal Trade Commission (FTC), the federal cooling-off rules gives the consumer three days to cancel certain sales for a full refund.

The three-day period is called a "cooling off" period. You might use that law after hastily agreeing to have someone repave your driveway, deliver lawn fertilizer, or put a new roof on your house. You can cancel these contracts simply because you've changed your mind.

You have a right to change your mind. To cancel a sale, sign and date one copy of the cancellation form. Mail it to the address given for cancellations. Make sure the envelope is postmarked before midnight of the third business day after the contract date.

If you are refinancing a mortgage, you have until midnight of the third business day after the transaction to rescind (cancel) the mortgage contract. The right of rescission refers to the right of a consumer to cancel certain types of loans.

The 72-hour cancellation policy allows consumers a cooling-off period to cancel certain contracts without penalties. Federal and state laws, including the FTC Cooling-Off Rule, provide consumer protection for specific purchases, like home improvement loans and door-to-door sales.