Cancellation Template Email In Maryland

Description

Form popularity

FAQ

Once the LLC is dissolved, the members (or managers, if the LLC is manager-managed) must begin winding up its affairs. The LLC statutes broadly describe what has to be done. There are three main tasks: Discharging the LLC's debts, obligations, and other liabilities.

How long does it take to dissolve an LLC in Maryland? In addition to wondering how to dissolve an LLC in Maryland, you may wonder how long it takes. The process can take 8-10 weeks once the documentation is received by the State Department of Assessments and Taxation.

Closing a Sales and Use Tax Account You can close your sales and use tax account by calling 410-260-7980 from Central Maryland, or 1-800-638-2937 from elsewhere, Monday - Friday, a.m. - p.m.

To withdraw your foreign corporation or LLC from Maryland, you just have to file a termination or cancellation form with the Maryland State Department of Assessments and Taxation (SDAT). You can file documents with the SDAT by mail or in person.

Winding up an LLC in California can be a complex process. Seeking the guidance of an experienced California business lawyer can ensure compliance with laws and regulations, identify potential legal risks, and help draft and review necessary dissolution paperwork.

Maryland LLC Processing Time Online (6 weeks) Standard processing for online submissions takes 6 weeks to be approved. All online business filings are made on the Maryland Business Express website.

LLC ownership is personal property to its members. Therefore the operating agreement and Maryland state laws declare the necessary steps of membership removal. To remove a member from your LLC, a withdrawal notice, a unanimous vote, or a procedure depicted in the articles of organization may entail.

You can also close your withholding account by completing Form MW506FR, or by completing and resubmitting the Final Report Form in your withholding coupon booklet. Please be prepared to have your name, telephone number, account number, reason for closing the account, and closing date.

If you're closing your business and no longer plan to use your business name (Fictitious Business Name), you may submit a Statement of Abandonment of Use of Fictitious Business Name with the County Clerk.

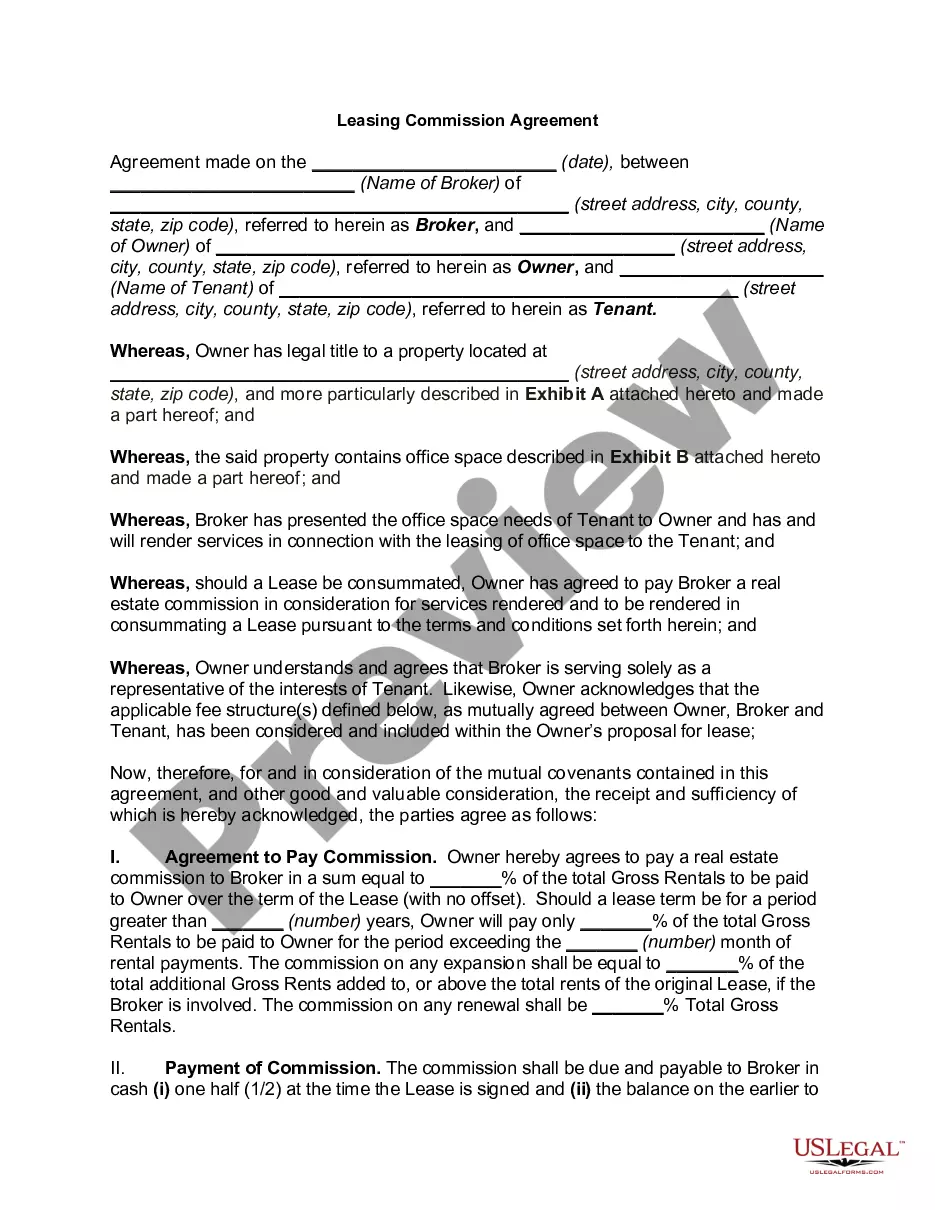

To dissolve a Maryland LLC, you'll need to file a document called Articles of Cancellation with the Maryland State Department of Assessments and Taxation (SDAT). To dissolve a Maryland corporation, you'll need to file Articles of Dissolution, which is basically the same thing, just specific to a corporate entity.