Cancellation Form Fillable Withholding In Maryland

Description

Form popularity

FAQ

The Maryland Form MW 507, Employee's Maryland Withholding Exemption Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wages.

Families who can claim exemptions for themselves, their spouses, and their dependents are most likely to have 3-5 exemptions.

Overview of Maryland Taxes Gross Paycheck$4,742 Federal Income 14.83% $703 State Income 4.59% $218 Local Income 3.11% $147 FICA and State Insurance Taxes 7.65% $36323 more rows

You can call us at 800-492-5909 or 410-625-5555. online. This is the fastest and most secure method to update your Maryland state tax withholding. You can log into your account here: .

Closing a Withholding Account You can close your withholding account by calling 410-260-7980 from Central Maryland, or 1-800-638-2937 from elsewhere, Monday - Friday, a.m. - p.m. Please be ready to provide the following information: Name. Telephone Number.

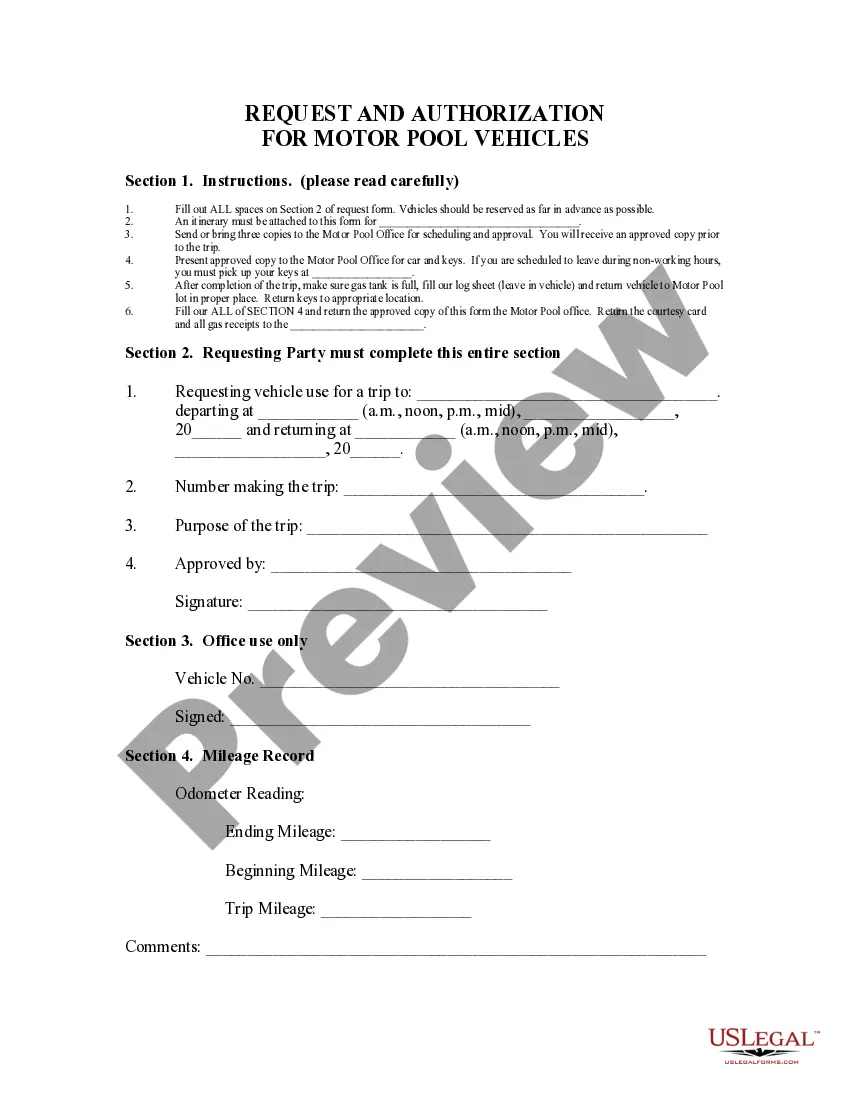

On the W-4 Form complete the following and write legibly. Section 1 – Payroll System – RG – Regular. Agency Code: 220100. Section 2 – Federal Taxes – Complete line 3; and then either line 5 or line 7. Section 3 – State Taxes -- Marital status and then line 1, or 3, or 4, or 5. Section 4 – Sign and date the form.

The Maryland Form MW 507, Employee's Maryland Withholding Exemption Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wages.

Exemptions and deductions. Personal exemptions: For tax year 2023, there have been no changes affecting personal exemptions on Maryland returns. The exemption amount of $3,200 begins to be phased out if the federal adjusted gross income (AGI) is more than $100,000 ($150,000 for joint taxpayers).

IRS form MW507 is the state of Maryland's Withholding Exemption Certificate. All Maryland residents or employees must complete form MW507 to ensure their employer withholds the correct amount from their paycheck.