Cancellation Form Fillable Withholding

Description

How to fill out Termination Or Cancellation Of Listing Agreement?

Creating legal documents from the ground up can occasionally be daunting.

Certain situations may require extensive research and significant financial investment.

If you’re looking for a more uncomplicated and economical way to produce the Cancellation Form Fillable Withholding or other documents without unnecessary hurdles, US Legal Forms is readily accessible.

Our online collection of more than 85,000 current legal forms covers nearly every aspect of your financial, legal, and personal concerns. With just a few clicks, you can promptly obtain state- and county-compliant documents carefully prepared by our legal professionals.

US Legal Forms prides itself on an impeccable reputation and over 25 years of expertise. Join us today and make form completion a simple and efficient process!

- Utilize our platform whenever you need dependable and trustworthy services to effortlessly find and download the Cancellation Form Fillable Withholding.

- If you’re familiar with our website and have created an account previously, simply Log In to your account, find the template, and download it right away or retrieve it later in the My documents section.

- Not registered yet? No worries. Setting it up and browsing the library requires minimal time.

- Before diving into downloading the Cancellation Form Fillable Withholding, consider these tips.

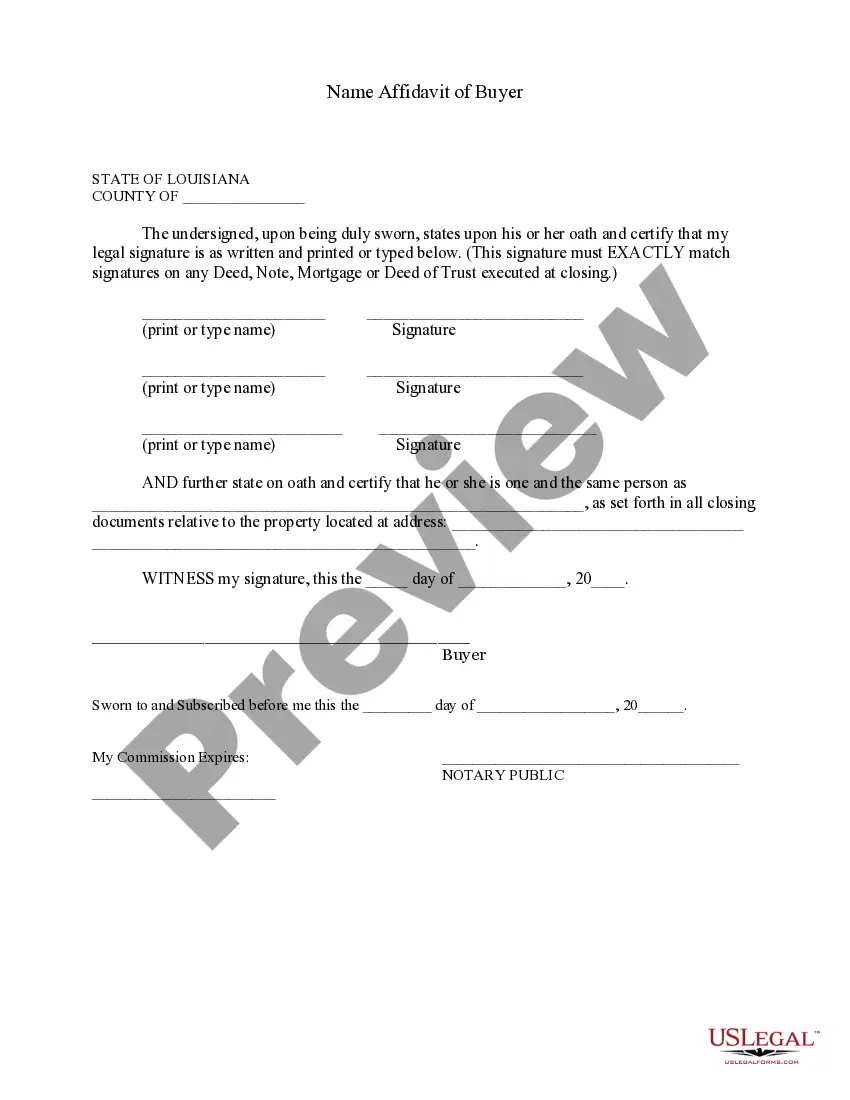

- Review the form preview and descriptions to ensure you’ve located the correct document.

Form popularity

FAQ

To cancel tax withholding, submit a new withholding form indicating your cancellation to your employer. Ensure all information is accurate for processing. Utilizing uslegalforms for a cancellation form fillable withholding simplifies this procedure and helps you avoid any errors.

To remove withholding tax, you typically need to submit a new withholding form that specifies your intention. This process can be streamlined using online resources. Consider uslegalforms as your source for a cancellation form fillable withholding to facilitate your request.

Yes, you can opt out of having taxes withheld, but there are specific criteria to meet. You will need to submit the appropriate forms to your employer. The cancellation form fillable withholding provided by uslegalforms can assist you in managing this process smoothly.

To fill out a withholding form, start by gathering your personal information and determining your desired withholding amount. Follow the guidelines provided on the form, and use uslegalforms for a straightforward cancellation form fillable withholding to ensure accuracy.

Yes, you can complete form W-4V online. Many online platforms, including uslegalforms, offer an easy and efficient way to fill out the cancellation form fillable withholding, ensuring that your preferences are accurately submitted.

You can cancel your tax withholding by submitting a new withholding form to your employer. Be sure to indicate your decision clearly on the form. Using uslegalforms allows you to easily access a cancellation form fillable withholding to simplify this task.

To temporarily stop tax withholding, you need to notify your employer and submit the appropriate form. This often involves filling out a new W-4 or W-4V form. With the cancellation form fillable withholding, uslegalforms can help guide you through the process effectively.

Yes, you can change your tax withholding whenever necessary. To do this, you must submit a new withholding form to your employer, outlining your revised preferences. Consider using uslegalforms for a seamless experience in completing the cancellation form fillable withholding.

Yes, you can file a W-4V form online. Utilizing a Cancellation form fillable withholding available on our site allows you to submit your information efficiently. This form is designed for those who wish to specify income tax deductions. Filing online saves you time and ensures that your preferences are communicated promptly.

Filling out withholding forms involves providing specific information, such as your filing status and allowances. You can download a Cancellation form fillable withholding from our site, which simplifies the process. Ensure that all information is accurate to avoid issues with tax deductions. If you need help, our platform offers guidance to assist you in completing these forms correctly.