This form is a sample letter in Word format covering the subject matter of the title of the form.

Sample Irs Letter For Penalty Abatement In New York

Description

Form popularity

FAQ

The actual form to request the penalty abatement is Form 843.

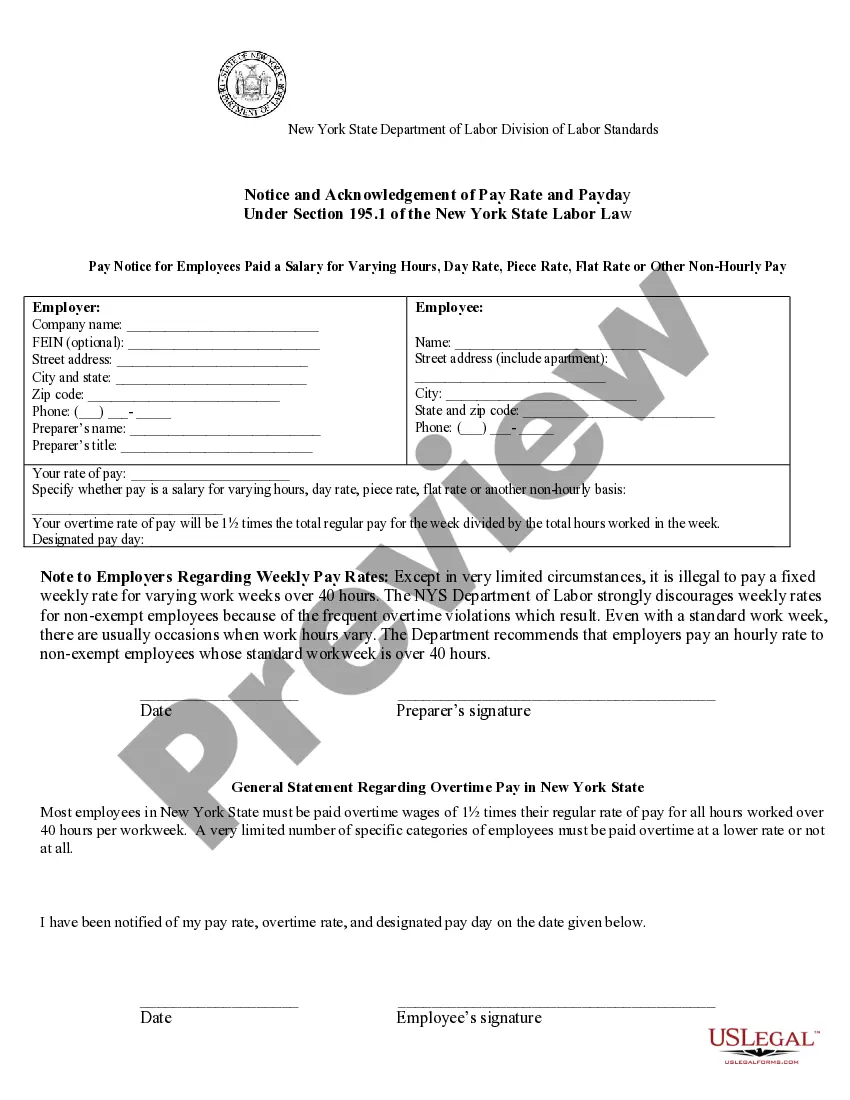

New York State Estimated Taxes To avoid a penalty for the underpayment of taxes to NYS, your payments must be made on time and the total amount of your New York State payment must be at least 90% of the amount of tax shown on your current income tax return or 100% of your last year's tax return.

Overview of reasonable cause As defined by the IRS, a tax penalty abatement is generally granted when the taxpayer exercises ordinary care and prudence, but nevertheless fails to comply with their obligations.

Under the NY Tax Law, a NYS offer in compromise is a program that allows a taxpayer to reduce the overall tax liability that is owed to New York State by offering a "reasonable amount." A reasonable offer in the eyes of New York State is based upon a two part test.

In the body of the letter, explain the reason for your request for penalty waiver. Be factual and provide specific details about your circumstances. If you are claiming reasonable cause, provide supporting evidence to back up your claim.

3) Reasonable cause relief is available for taxpayers who can demonstrate ordinary business care and prudence in meeting tax obligations but still failed to comply. 4) Penalty abatement requests can be submitted using Form 843 and may involve penalty negotiation with the Taxpayer Advocate Service (TAS) of the IRS.

time penalty abatement letter typically contains: Notice number and date (if applicable) Type of penalty and amount. Acknowledgment that the taxpayer fulfills the firsttime penalty abatement criteria. Optional: Explanation of the taxpayer's situation, circumstances and reasonable cause (review: IRM 20.1.

Steps Format a business letter. Add the IRS address. Include your personal information. Insert your salutation. Include a copy of the notice you received from the IRS. Identify the information you are providing. Close the letter on a friendly note. Identify any enclosures.

Look for the official IRS logo and letterhead, including the correct address and phone number. Dates should be recent, accurate, and accurately formatted (month spelled out), and they should include official IRS security or file numbers you can refer to for more information. A letter won't have this information.