Employee Form Document For Work In Queens

Description

Form popularity

FAQ

This form should encompass areas such as personal information (name, address, date of birth), contact details, emergency contact information, employment history, educational background, and any relevant certifications or skills.

Those requesting employment or salary verification may access THE WORK NUMBER® online at using DOL's code: 10915. You may also contact the service directly via phone at: 1-800-367-5690.

Documents required for new employee: Proof of Identity: Typically, this involves a government-issued ID such as a passport or a national identity card. Proof of Eligibility to Work: Depending on the country, this could be a work permit, visa, or a document like the Social Security card in the USA.

Employee's eligibility to work in the United States All U.S. employers must properly complete Form I-9 for every individual they hire for employment in the United States. This includes citizens and noncitizens. Both employees and employers (or authorized representatives of the employer) must complete the form.

Both a W-2 and a W-4 tax form. These forms will come in handy for both you and your new hire when it's time to file income taxes with the IRS. A DE 4 California Payroll tax form. Issued by the Employment Development Department, this form helps employees calculate the correct state tax withholding from their paycheck.

“Every current and former employee, or his or her representative, has the right to inspect and receive a copy of the personnel records that the employer maintains relating to the employee's performance or to any grievance concerning the employee.” You must make your request in writing.

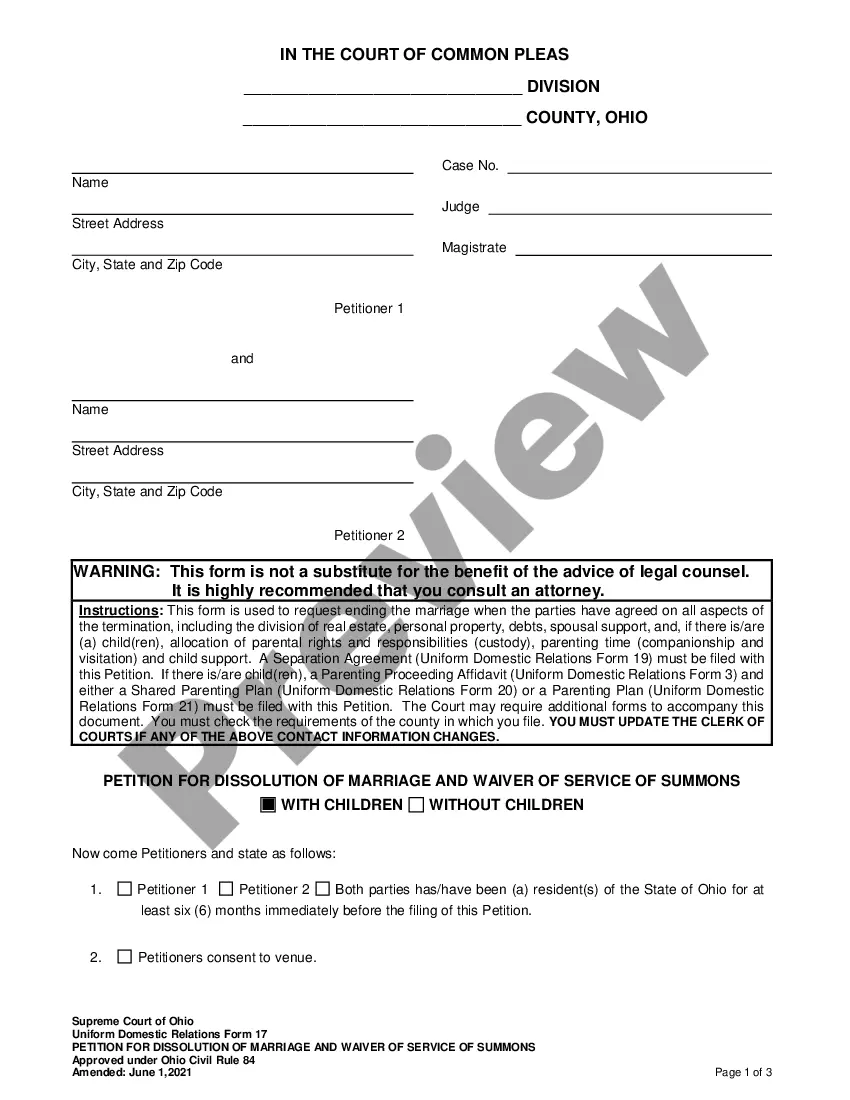

In New York, the new hire paperwork collection looks similar to that of other states: I-9 employment eligibility verification form (not required for volunteers, independent contractors, or unpaid interns) W-4 federal tax collection form. IT-2104 New York state tax withholding form.

It should include: Personal Information: Full name, address, contact details, marital status, and spouse's details. Job Information: Title, department, supervisor, work location, start date, and salary. Emergency Contact Information: Name, address, and contact details of the emergency contact.

Whenever you hire a new employee, you'll need to collect some key information, including: Personal details: Name, address, employee contact information, and emergency contact details. Employment information: Job title, department, start date, and salary.

When you fill the form: Be honest and critical. Analyze your failures and mention the reasons for it. Keep the words minimal. Identify weaknesses. Mention your achievements. Link achievements to the job description and the organization's goals. Set the goals for the next review period. Resolve conflicts and grievances.