Employee Form Document Withdrawal In Philadelphia

Description

Form popularity

FAQ

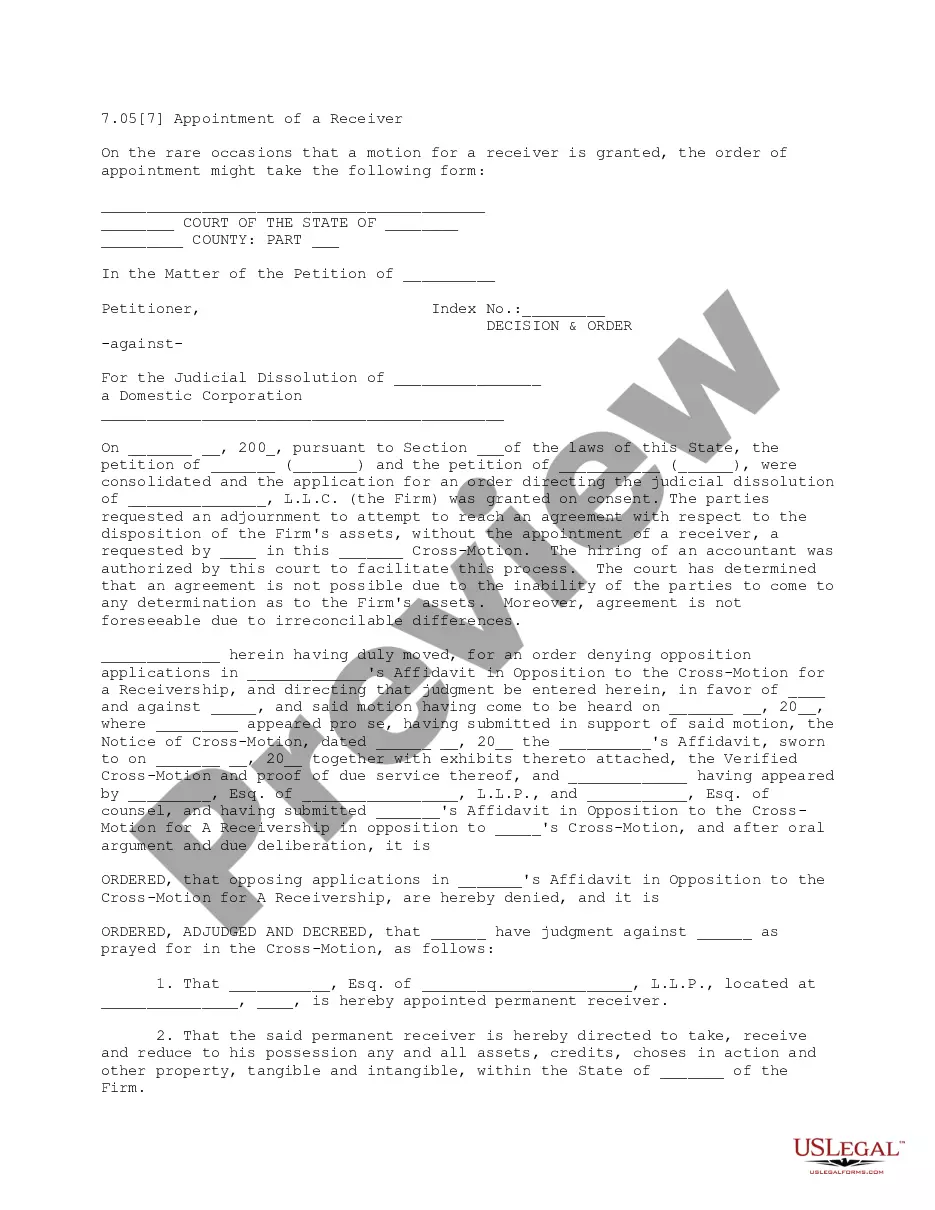

How do you dissolve an LLC in Pennsylvania? To dissolve your domestic LLC in Pennsylvania, you must provide the completed Certificate of Dissolution, Domestic Limited Liability Company form to the Department of State by mail, in person, or online.

To dissolve your corporation in Pennsylvania, you provide the completed Articles of Dissolution-Domestic (DSCB: 15-1977/5877) form to the Department of State, Corporation Bureau, by mail or in person. You may fax file if you have a customer deposit account with the Bureau.

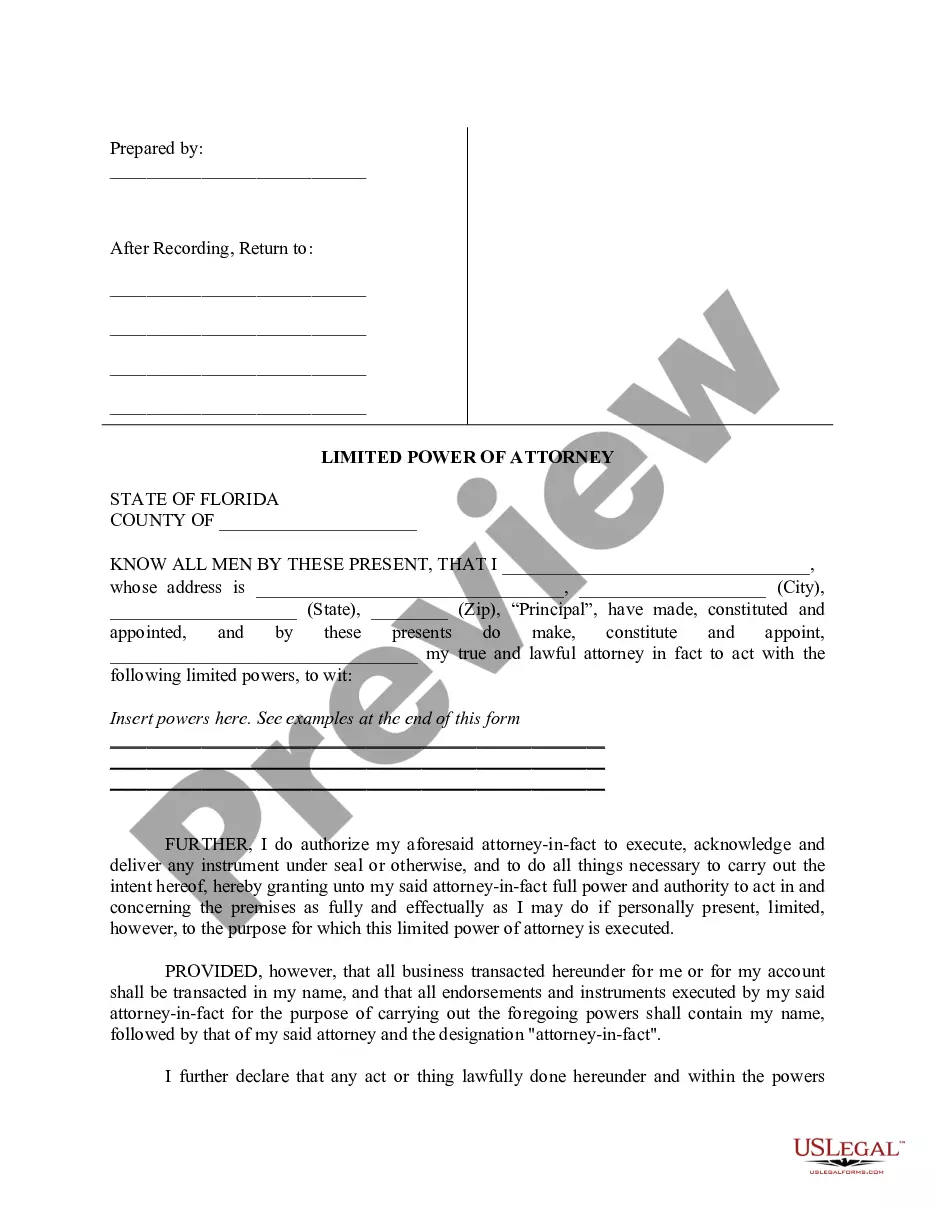

--A fictitious name registration under this chapter may be cancelled, or a party to such a registration may withdraw therefrom, by filing in the department an application for cancellation of fictitious name registration or an application for withdrawal from fictitious name registration, as the case may be, which shall ...

Any employee who has attained at least 10 years of credited service and attained the normal retirement age of their plan – Plans A and B – Age 50; Plan L – Age 55; Plan Y – Age 60.

Withdrawals are generally taxable but, unlike other retirement accounts, the 10% penalty tax does not apply to distributions prior to age 59½ (the penalty tax may apply to distributions of assets that were transferred to the 457(b) plan from other types of retirement accounts).

If you do not request a distribution or rollover, the following will automatically occur based on the balance in your account: More than $5,000 – retained in your PSERS DC Plan account. $1,000.01 to $5,000 – rolled over to a Voya IRA in your name, where it will retain its tax-deferred status.