Employee Form Document With Parameters In Minnesota

Description

Form popularity

FAQ

Official Records Act, Minnesota Statutes section 15.17 The Official Records Act requires government entities to, "make and preserve all records necessary to a full and accurate knowledge of their official activities." (Minn. Stat.

An employer can give out the following information only with a Release signed by you: written employee evaluations and your response to them, written disciplinary warnings and actions in the last 5 years, and. written reasons for why you left the job.

New employees need to fill out a Form I-9 to verify employment eligibility as well as a W-4 for income tax. In states with an income tax, it's necessary to fill out a second W-4.

All employer records must be open to inspection, audit, and verification at any reasonable time and as often as deemed necessary. Records must be kept for a minimum of four years.

Keep all records of employment taxes for at least four years after filing the 4th quarter for the year. These should be available for IRS review. Records should include: Your employer identification number.

In a perfect world… StateRecord retention period California 4 years Colorado 3 years Connecticut 7 years Delaware 3 years46 more rows •

All employer records must be open to inspection, audit, and verification at any reasonable time and as often as deemed necessary. Records must be kept for a minimum of four years.

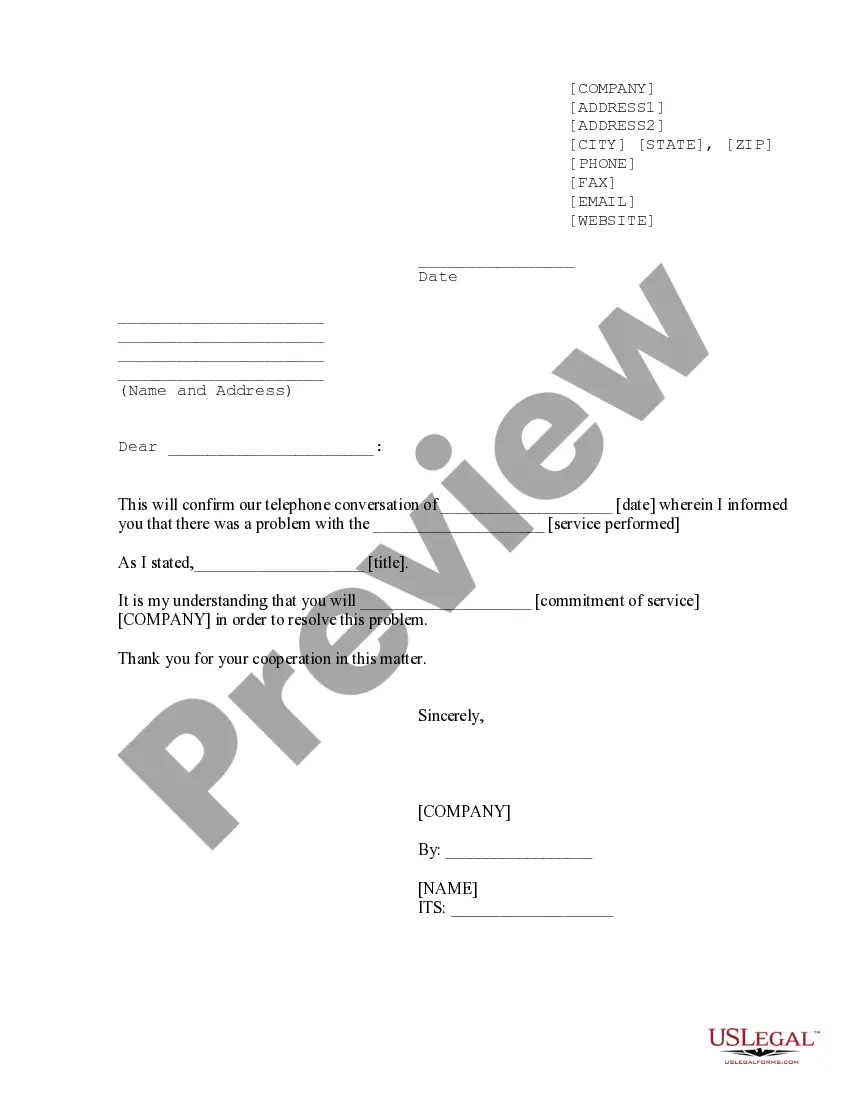

Here is what you need to include in an employee information form as a hiring manager: Employee information. Under this section, employees provide personal data to the company. Job information. Emergency contact details. Health information. Additional information. Standardize the form. Be clear. Order the forms logically.

The things to include in an employee's personnel file are: Job application, CV and cover letter. Education and past employment info. Role description. Job offer letter and employment contract. Emergency contact information. Training records. Payroll and benefits information (but not bank details) Performance appraisal forms.

Here's a snapshot of the items that can be included in a basic employee file: Job description. Job application and/or resume. Job offer. IRS Form W-4. Receipt or signed acknowledgment of employee handbook. Performance evaluations. Forms relating to employee benefits. Forms providing emergency contacts.