Employee Form Fillable Withholding Tax In Maricopa

Description

Form popularity

FAQ

The employee can submit a Form A-4 for a minimum withholding of 0.8% of the amount withheld for state income tax. An employee required to have 0.8% deducted may elect to increase this rate to 1.3%, 1.8%, 2.7%, 3.6%, 4.2%, or 5.1% by submitting a Form A-4.

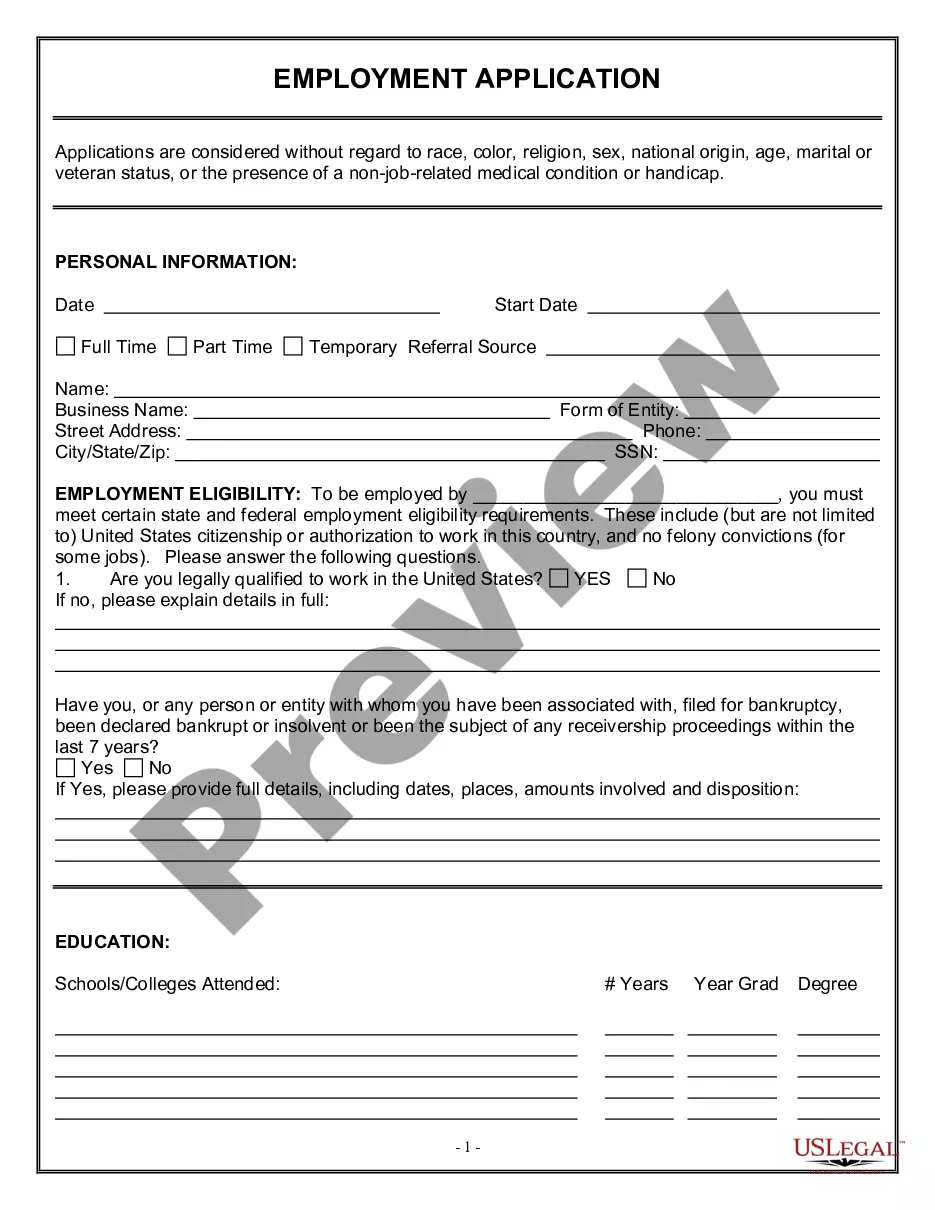

Employees typically complete W-4 forms before they start a new job. They provide employers with the necessary personal information (such as marital or dependent status) to determine the proper amount of tax deductions and withholdings.

Here's how to complete the form: Step 1: Provide Your Personal Information. Step 2: Specify Multiple Jobs or a Working Spouse. Multiple Jobs Worksheet. Step 3: Claim Dependents. Step 4: Make Additional Adjustments. Step 5: Sign and Date Your W-4.

Form I-9, Employment Eligibility Verification PDF. Form W-4, Employee's Withholding Certificate. Form W-4P, Withholding Certificate for Pension or Annuity Payments. Form W-9, Request for Taxpayer Identification Number and Certification.

If you have an Arizona tax liability when you file your return or if at any time during the current year conditions change so that you expect to have a tax liability, you should promptly file a new Form A-4 and choose a withholding percentage that applies to you.

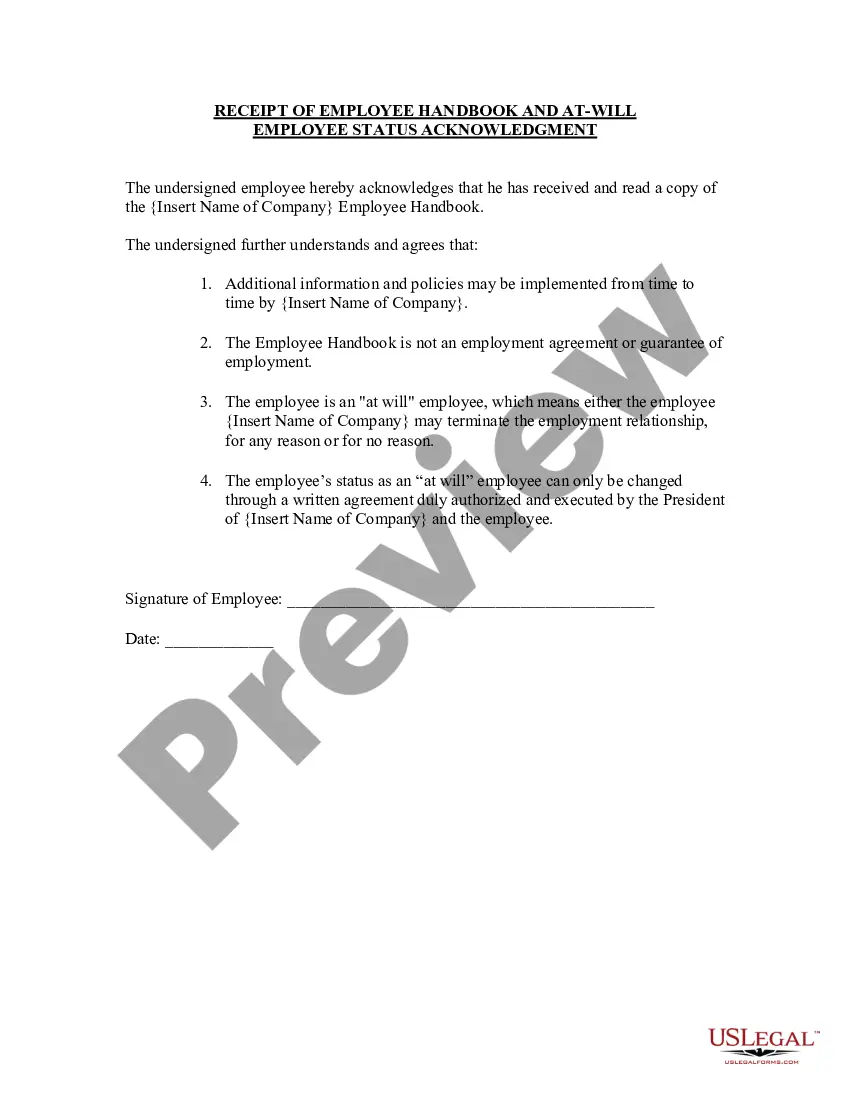

Individuals classified as employees do not fill out a W-9 form. Independent contractors and freelancers fill out W-9s before they begin working with a business. Upon hire, employees are asked to fill out Form W-4.

Wages and other payments to employees are reported on Form W-2, while payments to independent contractors are reported on Form 1099-NEC.

Withholding Percentage Options Keep in mind for tax year 2023 and beyond, the tax rate for Arizona taxable income is 2.5%.

Individuals may withhold Arizona income tax be withheld on their payments from a pension, annuity, or a distribution from a retirement account. The individual must complete Arizona Form A-4P and provide the completed form to the payor of their pension, annuity, or to their retirement account administrator.

Generally, you want about 90% of your estimated income taxes withheld and sent to the government.12 This ensures that you never fall behind on income taxes (something that can result in heavy penalties) and that you are not overtaxed throughout the year.