Employee Form Fillable With Calculations In Florida

Description

Form popularity

FAQ

The following states have no income tax and don't require state W-4s: Alaska. Florida. Nevada.

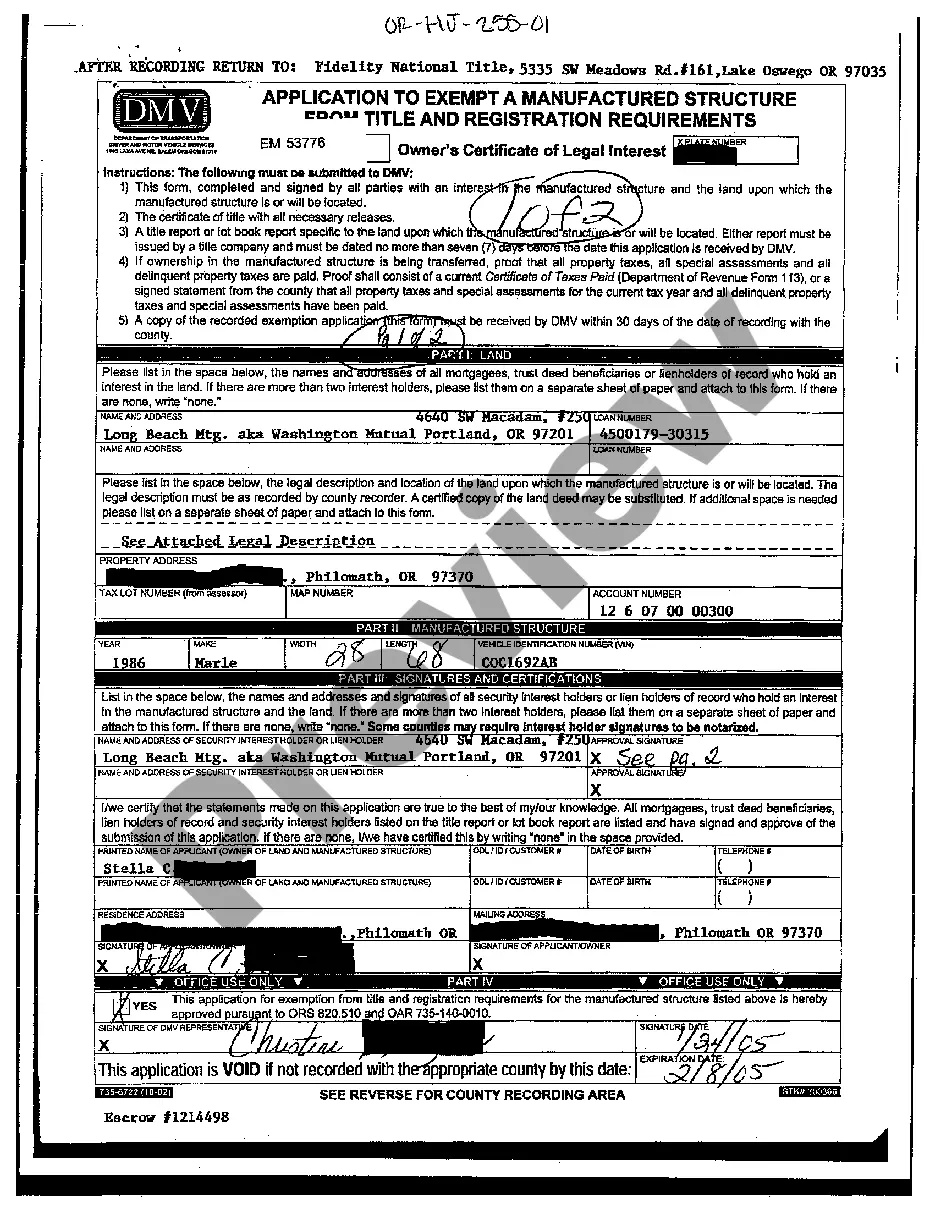

4 definition in further detail Failing to take the time to understand the 4 explained in plain terms could lead to confusion. A 4 is the IRS document that you complete for your employer to determine how much should be withheld from your paycheck for federal income taxes.

Employees will use the W-2 to complete their individual tax returns. Employees typically complete W-4 forms before they start a new job. They provide employers with the necessary personal information (such as marital or dependent status) to determine the proper amount of tax deductions and withholdings.

Form W-4 is used to gather employee information, while Form W-2 is provided at year-end so that employees can file their taxes. Both forms are relatively simple in most cases, but some circumstances, such as employee benefits or tips, might add complexity.

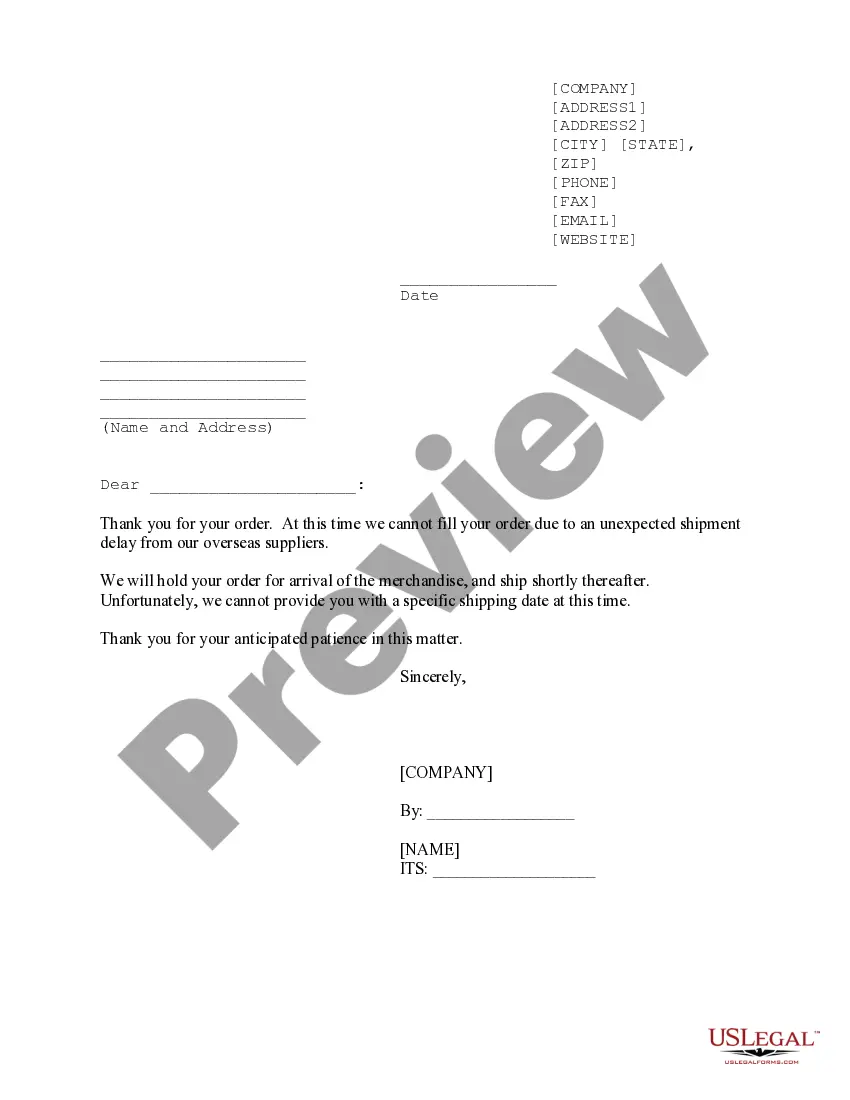

Florida New Hire Paperwork These forms are fairly consistent across other states and include: I-9 employee eligibility form. W-4 for federal tax purposes.

How to calculate payroll taxes: Key figures to think about Social Security tax formula: Employee Income × 6.2% = Social Security Tax. Medicare tax formula: Employee Income × 1.45% = Medicare Tax. FUTA tax formula: Employee Income × (FUTA Tax Rate – State Credit Reduction) = FUTA Tax.

Federal Income Tax is calculated based on an employee's W-4 Form. Employers withhold FIT using either a percentage method, tax bracket method, or alternative method. The percentage method is based on the graduated federal tax rates (0%, 10%, 12%, 22%, 24%, 32%, 35%, and 37%) for individuals.

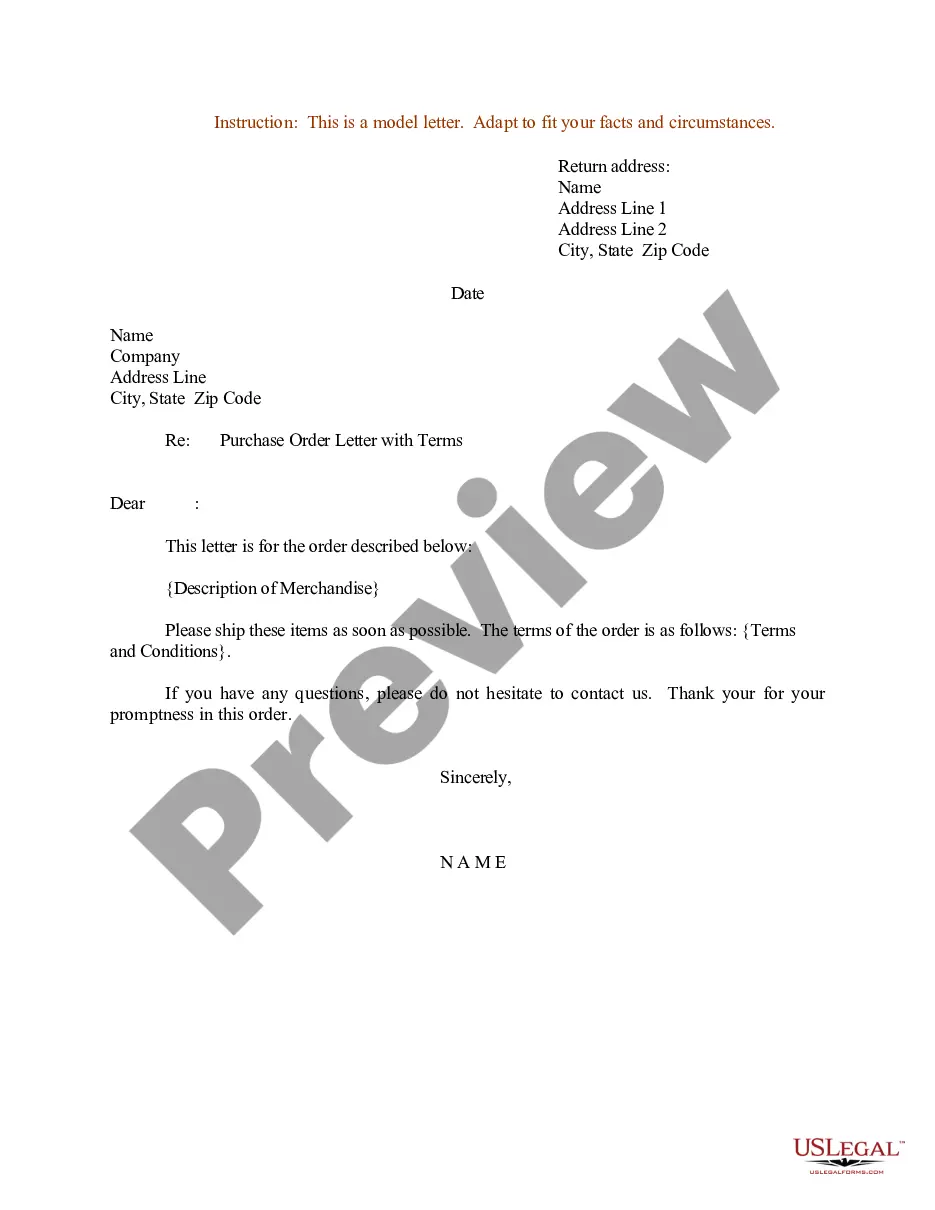

Here's how to complete the form: Step 1: Provide Your Personal Information. Step 2: Specify Multiple Jobs or a Working Spouse. Multiple Jobs Worksheet. Step 3: Claim Dependents. Step 4: Make Additional Adjustments. Step 5: Sign and Date Your W-4.