Agreement Receivable Statement With Join In Virginia

Instant download

Description

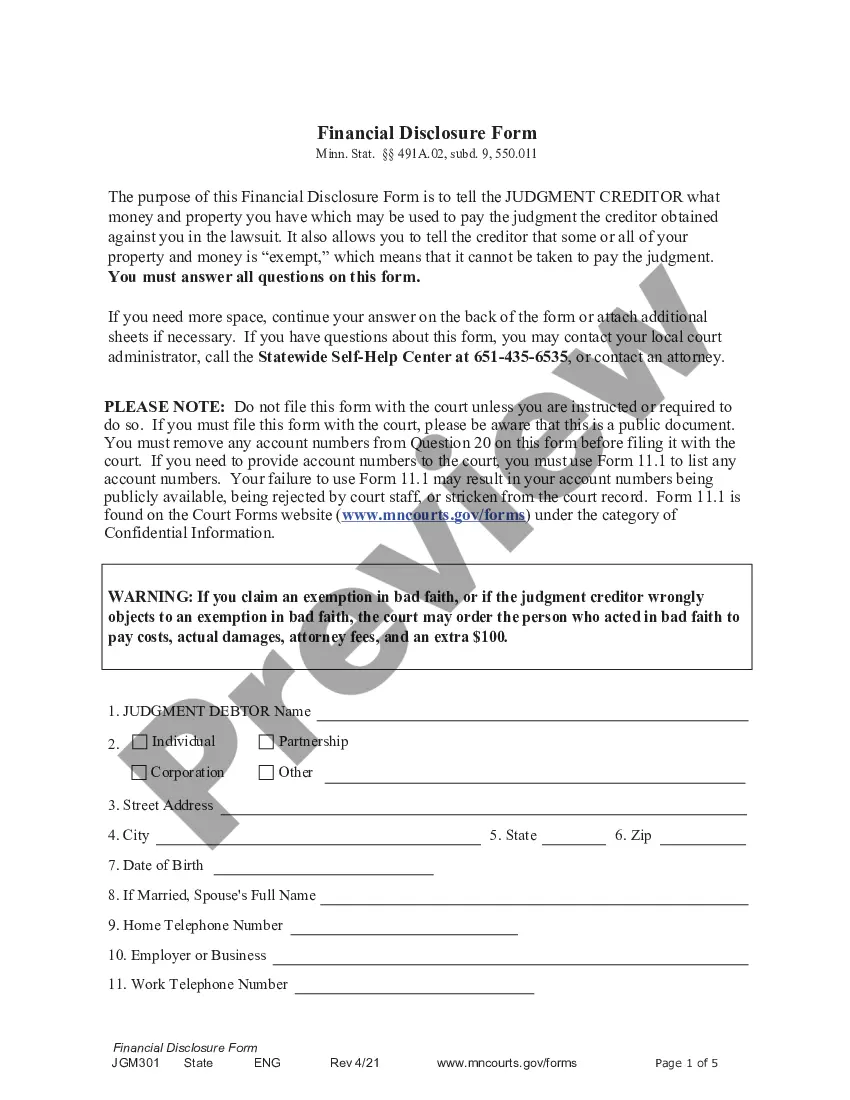

The Agreement receivable statement with join in Virginia outlines the terms and conditions under which one party (the Factor) purchases accounts receivable from another party (the Client). This form includes essential features such as the assignment of accounts receivable, credit approval processes, and the responsibilities of both parties regarding sales, delivery, and collection of receivables. The document facilitates commercial financing by enabling the Client to obtain funds based on their receivables, mitigating credit risks while outlining the obligations of both parties in case of disputes. For filling and editing, users should carefully complete the designated sections, including names, addresses, percentages, and crucial dates before signing. Specific use cases include scenarios where businesses seek immediate capital from their receivables or wish to offload credit risks associated with their customers. This agreement serves as a valuable tool for attorneys, partners, owners, associates, paralegals, and legal assistants whom assist clients in managing and securing financing through account receivables efficiently while ensuring legal protections are in place.

Free preview

Form popularity

FAQ

What Is an Example of an Accounts Receivable Journal Entry? If a restaurant supply company has sold $500 worth of utensils to Joe's Deli, the transaction will be recorded in the company's ledger as a $500 debit to assets as an accounts receivable. A corresponding journal entry will be made as a $500 credit to sales.

How Are Accounts Receivable Journal Entries Recorded? AR journal entries are recorded in the accounting system using a double-entry bookkeeping system. In this system, each transaction is recorded with two journal entries, one debiting one account and one crediting another account.