Factoring Agreement File With Irs In Travis

Category:

State:

Multi-State

County:

Travis

Control #:

US-00037DR

Format:

Word;

Rich Text

Instant download

Description

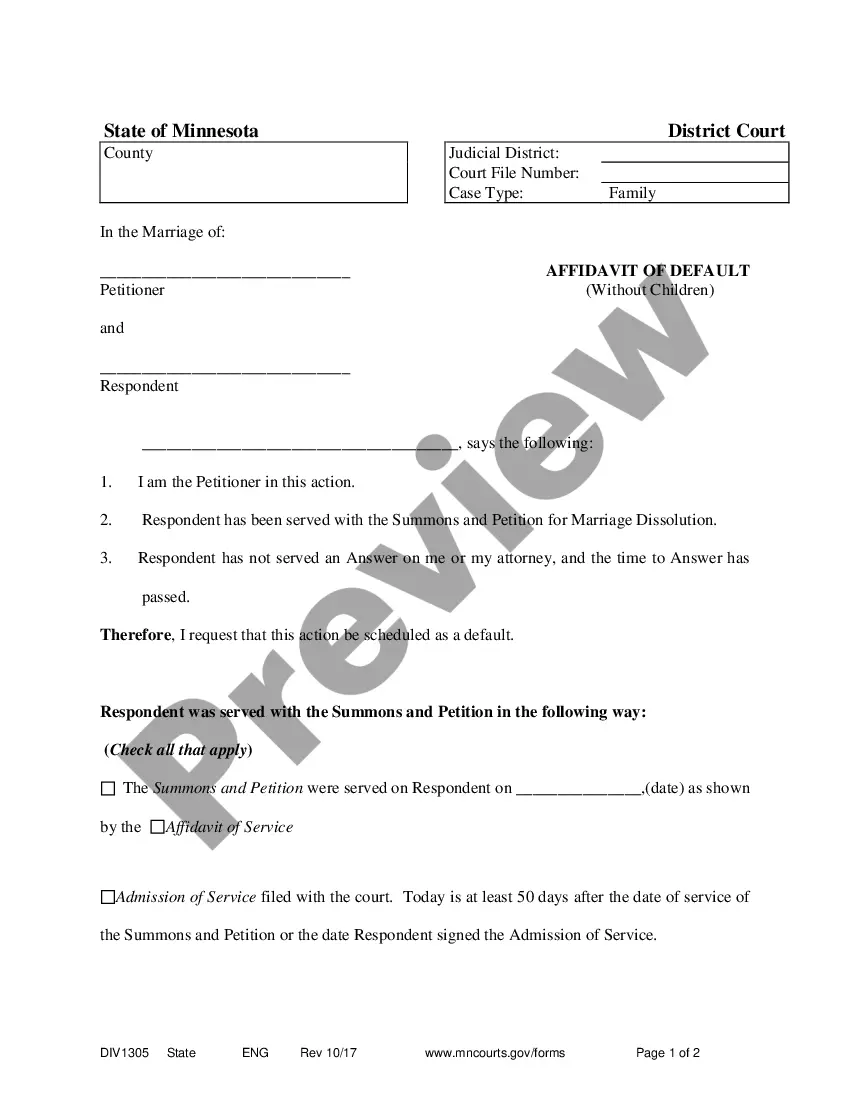

The Factoring Agreement file with IRS in Travis is a formal contract detailing the sale and purchase of accounts receivable between a factor and a client. This agreement serves as a framework for businesses seeking to obtain immediate funding by selling their receivables, which are debts owed by customers. Key features include the assignment of accounts receivable, credit approval processes, handling of merchandise sales, and stipulations regarding credit risks. The document outlines clear instructions for filling out and editing specific sections, ensuring both parties' responsibilities are well defined. It includes provisions for warranties of solvency, monthly profit and loss statements, and the handling of disputes through binding arbitration. Relevant for attorneys, partners, owners, associates, paralegals, and legal assistants, this agreement is pivotal for businesses looking to improve cash flow and manage receivables effectively. Legal professionals can also support clients in navigating the complexities of the agreement, ensuring compliance and protection of interests.

Free preview

Form popularity

FAQ

In most cases, no. Recourse and nonrecourse factored receivables are treated as regular income. The only difference is if a customer defaults on their debt, in which case that debt may be written off by whoever owns it.

Your reporting of factoring expenses as a deduction Commissions, set-up fees, and other factoring expenses are all tax deductible. But the reporting method differs depending on whether you retain the ownership of your receivables or end up selling them to a factoring company as described above.

In most cases, no. Recourse and nonrecourse factored receivables are treated as regular income.