Factoring Agreement File With Irs In Pima

Description

Form popularity

FAQ

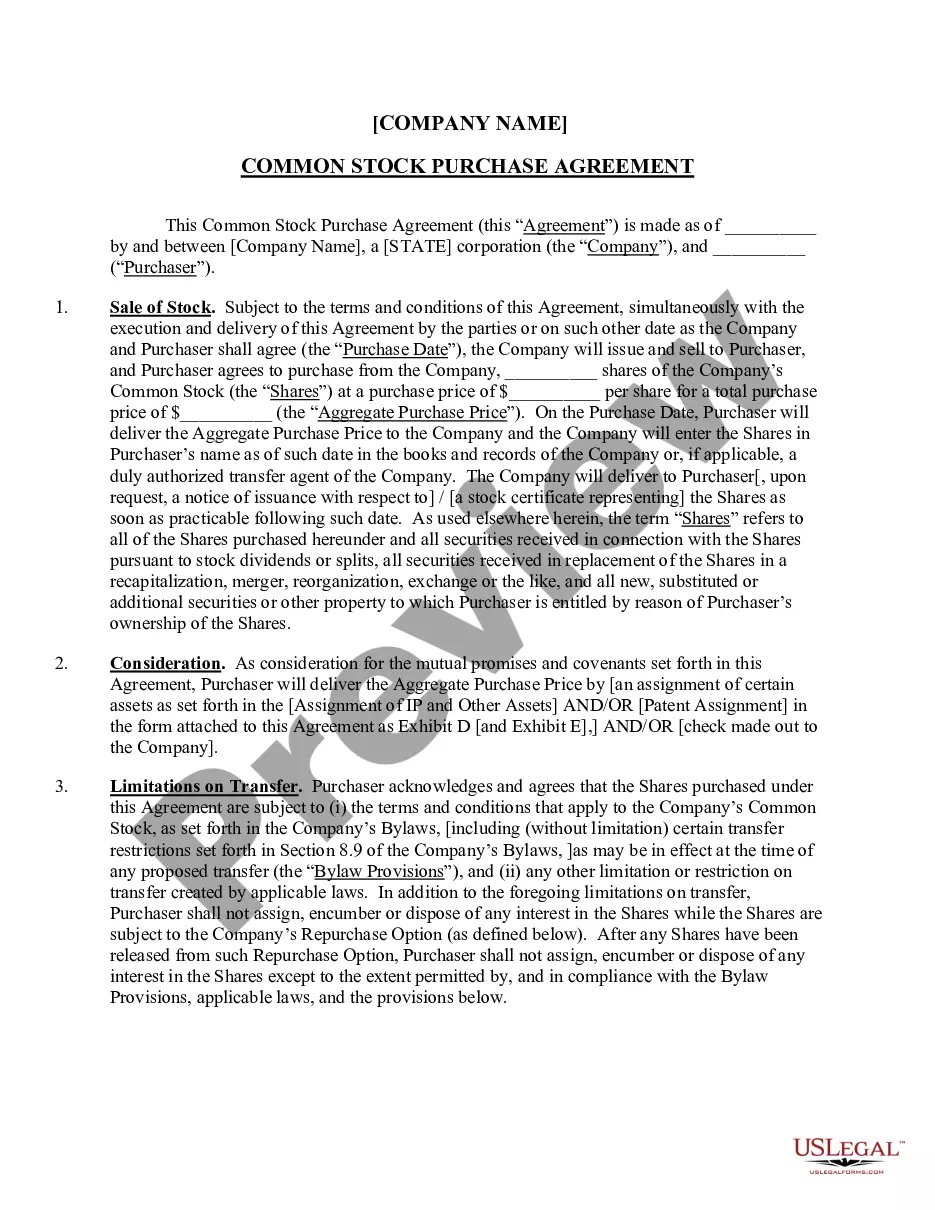

Factoring fees are generally treated as a business expense, making them tax-deductible. These fees can include service charges and interest. Documenting these fees properly is essential for ensuring that deductions are accurately reported on tax returns.

When the factoring company owns the accounts receivable, payment received on outstanding invoices is reported as income. However, when your business retains ownership of the accounts, payment from the factoring company is not taxable income.

Generally, recommerce businesses are not required to issue 1099s to factoring companies since these companies are not providing a service but purchasing receivables.

To be deductible, factoring fees must meet the IRS criteria of being ordinary and necessary expenses for the business. If the fees are deemed excessive or unnecessary, they may not be fully deductible.

Factoring fees are generally treated as a business expense, making them tax-deductible. These fees can include service charges and interest. Documenting these fees properly is essential for ensuring that deductions are accurately reported on tax returns.

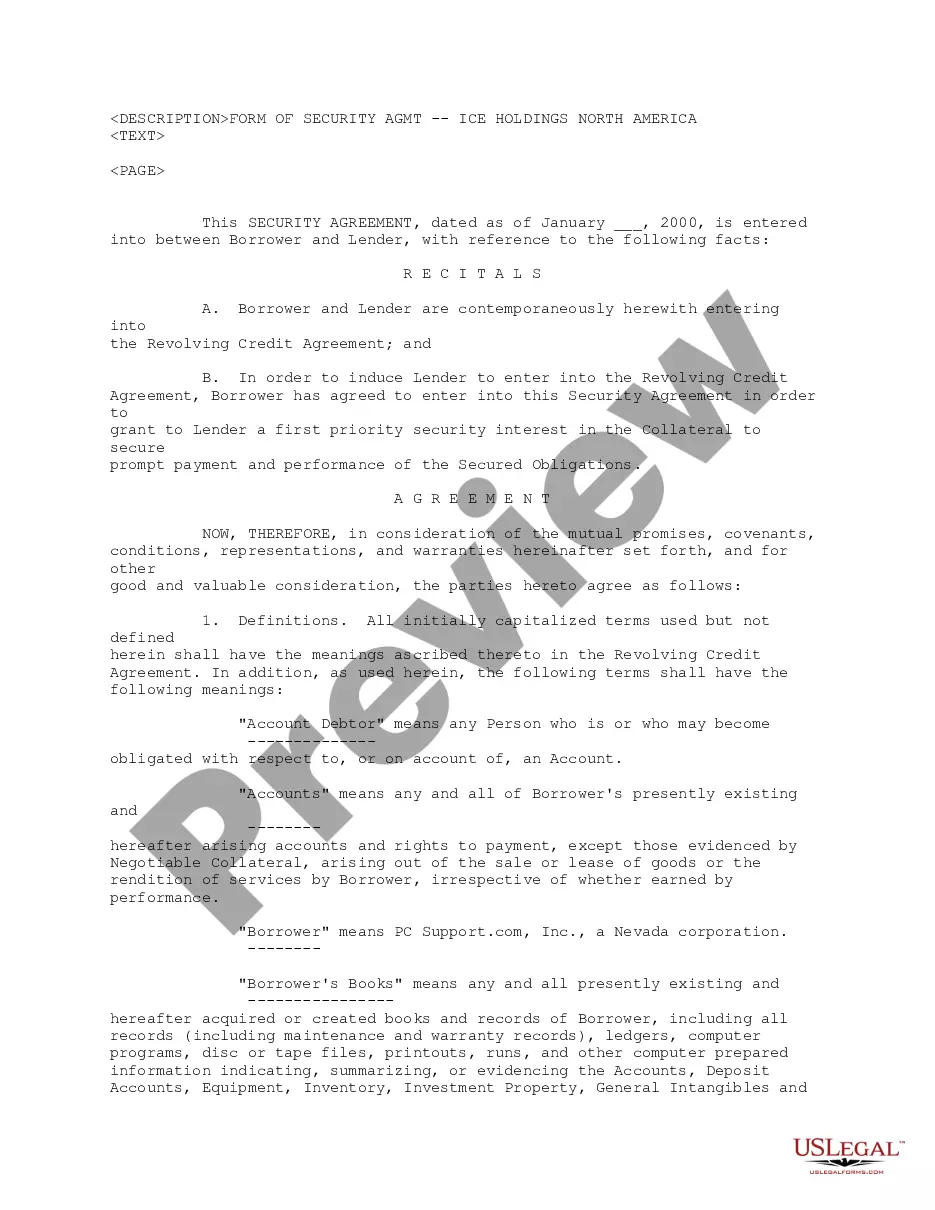

Assignment of receivables vs factoring While similar, the assignment of receivables is slightly different from factoring. Invoice factoring also involves assigning receivables to a third party, but in that case you essentially sell these assets rather than use them as collateral.

Assignment of accounts receivable is a method of debt financing whereby the lender takes over the borrowing company's receivables. This form of alternative financing is often seen as less desirable, as it can be quite costly to the borrower, with APRs as high as 100% annualized.

A Bank A/R Credit Line is Balance Sheet Driven. An A/R Factoring Company Buys Your Accounts Receivable. One of the main differences between invoice factoring (also known as A/R factoring) versus bank accounts receivable financing is that a line of credit (LOC) from a bank or asset-based lender is balance sheet driven.