Form Assignment Accounts With No Fees In Philadelphia

Description

Form popularity

FAQ

Starting 2025, all Pennsylvania corporations, nonprofits, non-professional LLCs, and LPs will need to file an Annual Report with the Pennsylvania Department of State, Bureau of Corporations and Charitable Organizations. It costs $7 for for-profit companies, $0 for nonprofits.

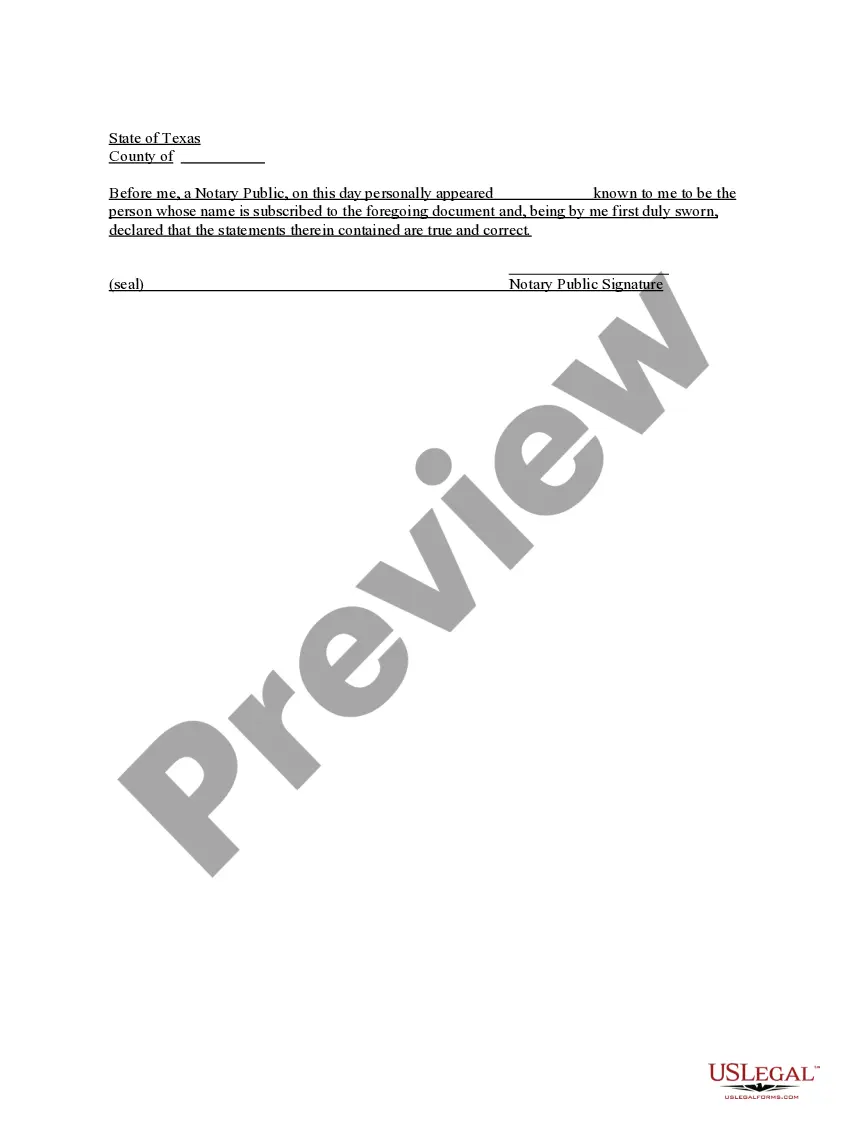

How to Write an Assignment Agreement Step 1 – List the Assignor's and Assignee's Details. Step 2 – Provide Original Contract Information. Step 3 – State the Consideration. Step 4 – Provide Any Terms and Conditions. Step 5 – Obtain Signatures.

A properly recorded deed can take anywhere from 14 days to 90 days. That may seem like a long time, but your local government office goes over every little detail on the deed to make sure the property is correct and there are no errors.